Hiring Trends: Surprising jobs report and sector-by-sector analysis

Highlights

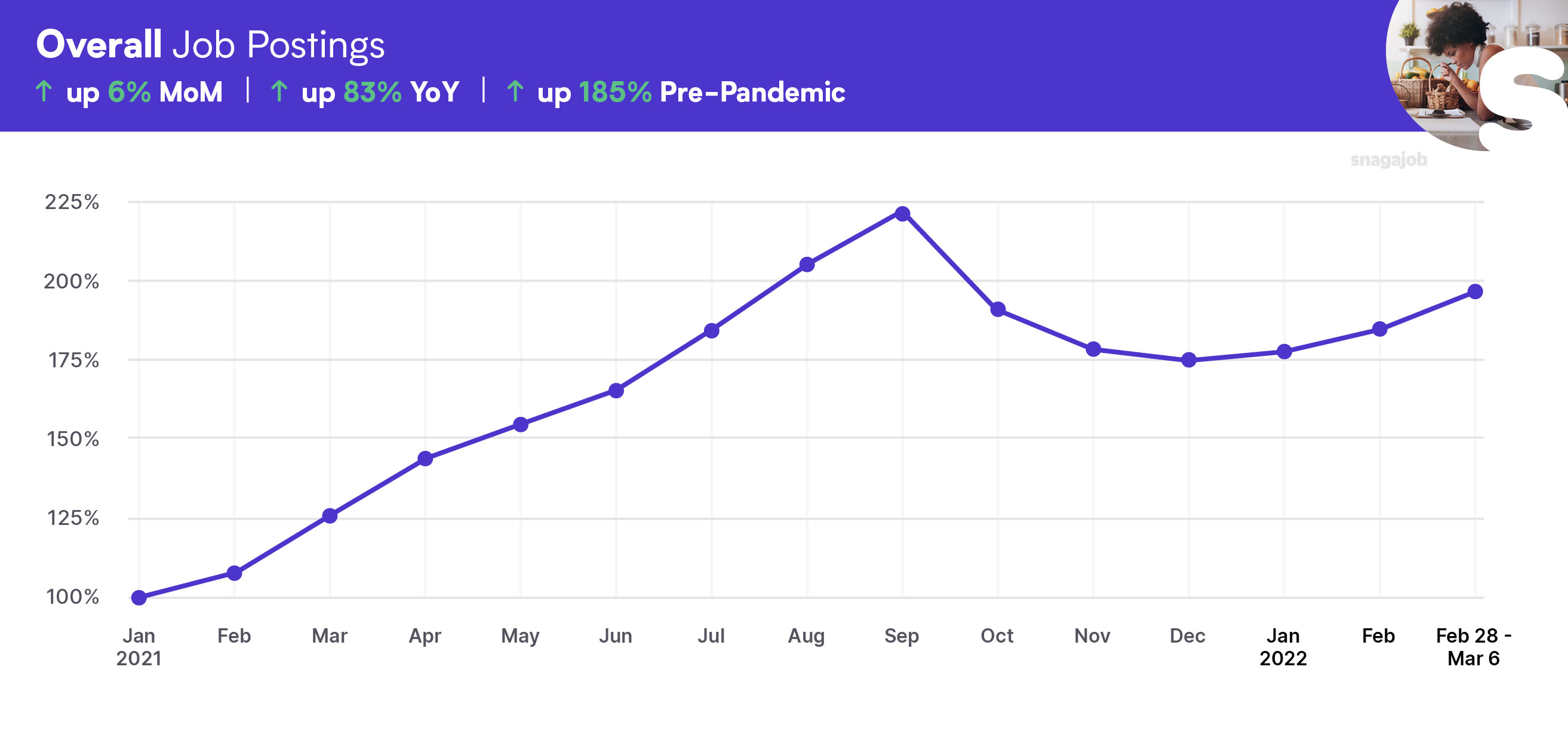

Overall, hourly jobs are up 185% compared to pre-pandemic norms, seeing a 6% month-over-month gain, and an 83% year-over-year growth. Google searches for hourly jobs are up 7% from this time last year.

The US economy added a surprising 678,000 jobs last month, according to the recent Bureau of Labor Statistics February jobs report. This figure blew past economist predictions of 440,000 new jobs. The report also cited a 3.8% unemployment rate, better than the 3.9% expected rate (and January’s 4% rate).

Specific highlights from the February jobs report include:

Since the pandemic began, the 678,000 jobs added in February was the largest monthly growth since July of 2021.

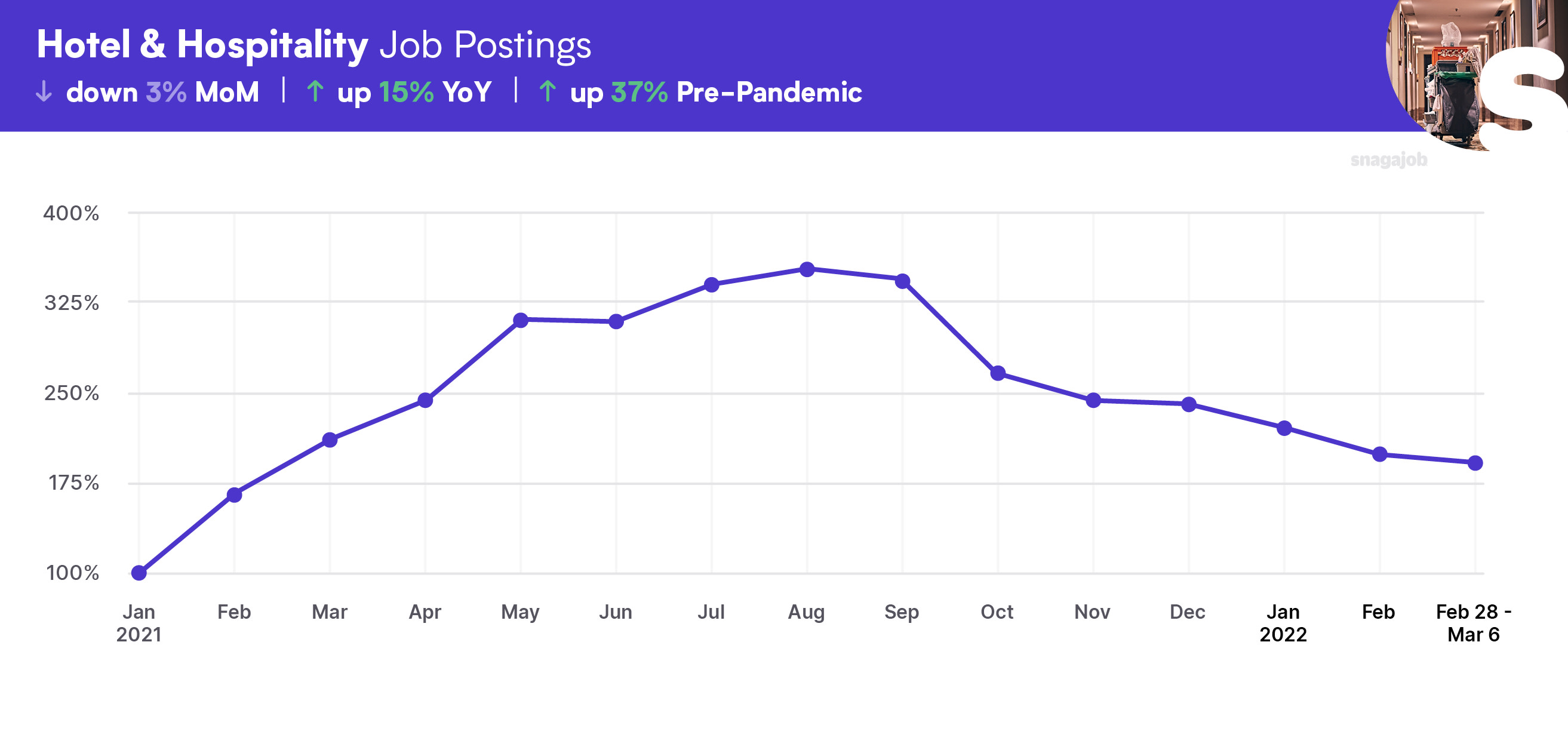

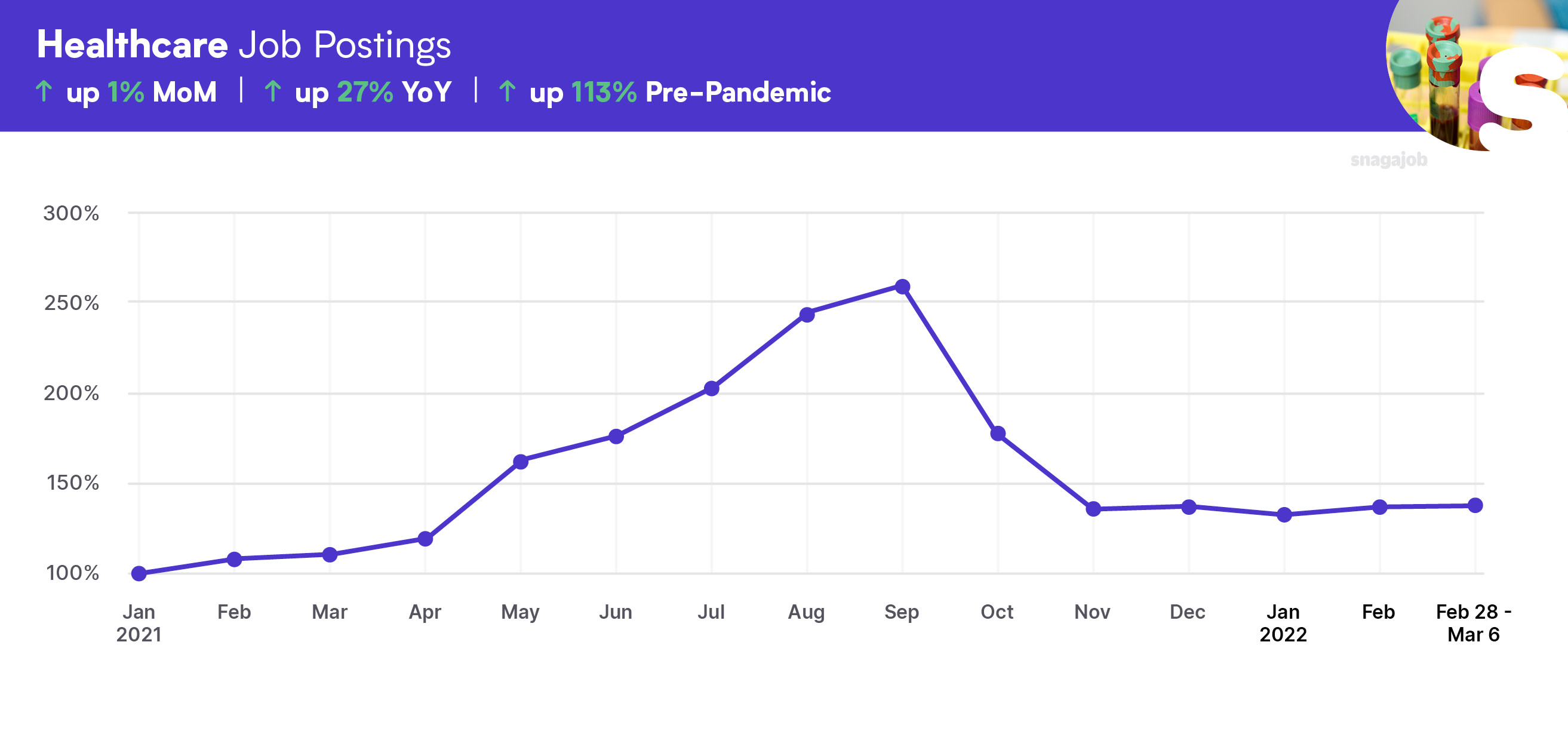

By sector, Hotel and Hospitality had the largest job gain at 179,000, while Healthcare added 94,000 jobs, and Retail 37,000.

The bulk of the hiring was among large companies (500+ employees), which added 552,000 jobs. Conversely, small companies (<50 employees) added 96,000 jobs.

In terms of hourly workers, Warehouse & Production saw the largest gain from last month (up 7%), while both Healthcare and Retail saw the slowest growth (up just 1% from January figures).

Big picture, by later this year, the US economy is on track to gain back the 22 million jobs lost during the pandemic, according to Moody’s Analytics chief economist, Mark Zandi. This was echoed by Kathy Jones, chief fixed income strategist at Charles Schwab. “Job growth is still quite healthy and strong. So things are really good,” she said. “As more people come back to work and participation picks up, the level of wage gains should start to subside a little bit.” Wage gains were flat for the month (although up 5.1% for the year), but once again well below economist predictions.

However, we’re not out of the woods yet, as we’re still short 1.14 million jobs from pre-pandemic numbers. With well over 10 million open jobs, that amounts to 1.7 open jobs per available worker. With summer hiring on the horizon, for the short-term at least, there will remain a very competitive market for employers hoping to staff up.

In other news, Moscow’s invasion of Ukraine continues to bring lingering economic uncertainty, especially with regards to raising the interest rate (which will have implications for workers and businesses). Although the US only gets 5% of its crude oil from Russia (according to the US Energy Information Administration), a worldwide ban on Russian energy imports could dramatically impact prices. "We think that a complete ban on Russian energy imports would cause the prices of crude oil and natural gas to surge," economists at Capital Economics said in a research report. This could add inflationary pressure, making heating homes and driving cars more expensive in the US.

While less impactful for hourly work, many US organizations continue to see a major slowdown in output from Ukraine workers as an estimated 85,000 to 100,000 computers in Ukraine are without internet access.

But one thing seems fairly certain: at least from a labor market viewpoint, the Omicron appears to have become minimal. Hiring managers have put the variant behind them, and are staffing up for anticipated growth in the summer.

An unexpectedly positive February jobs report is optimistic news, as the economy appears to be rebounding from the pandemic (and shows very little hindrance from the Omicron strain). However, the gap between open jobs and available workers remains significant, leaving businesses in a flux as summer hiring kicks into full gear. We’ll dive deeper into this issue in upcoming reports.

Jobs

All industry data is from 3/2/20-3/8/22

Here are the latest overall job numbers:

Overall jobs are up 185% compared to pre-pandemic norms, seeing a 6% month-over-month gain, and an 83% year-over-year growth. Google searches for hourly jobs are up 7% from this time last year.

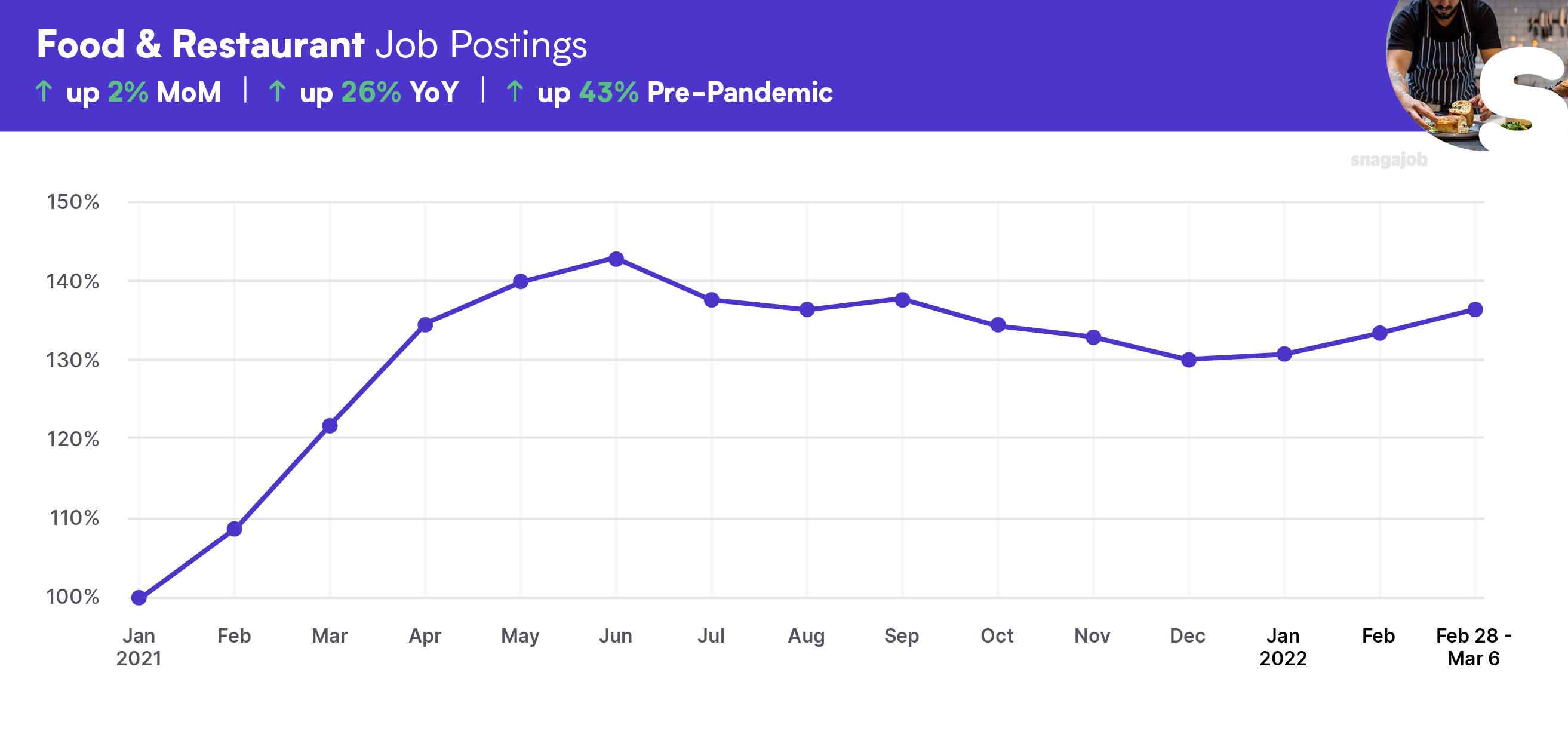

Here are the latest job numbers by industry:

Food & Restaurant jobs are up 43% compared to pre-pandemic norms, seeing a 2% month-over-month gain, and a 26% year-over-year growth.

Hotel & Hospitality jobs are up 37% compared to pre-pandemic norms, seeing a 3% month-over-month decline, and a 15% year-over-year gain.

Healthcare jobs are up 113% compared to pre-pandemic norms, seeing a 1% month-over-month gain, and a 27% year-over-year gain.

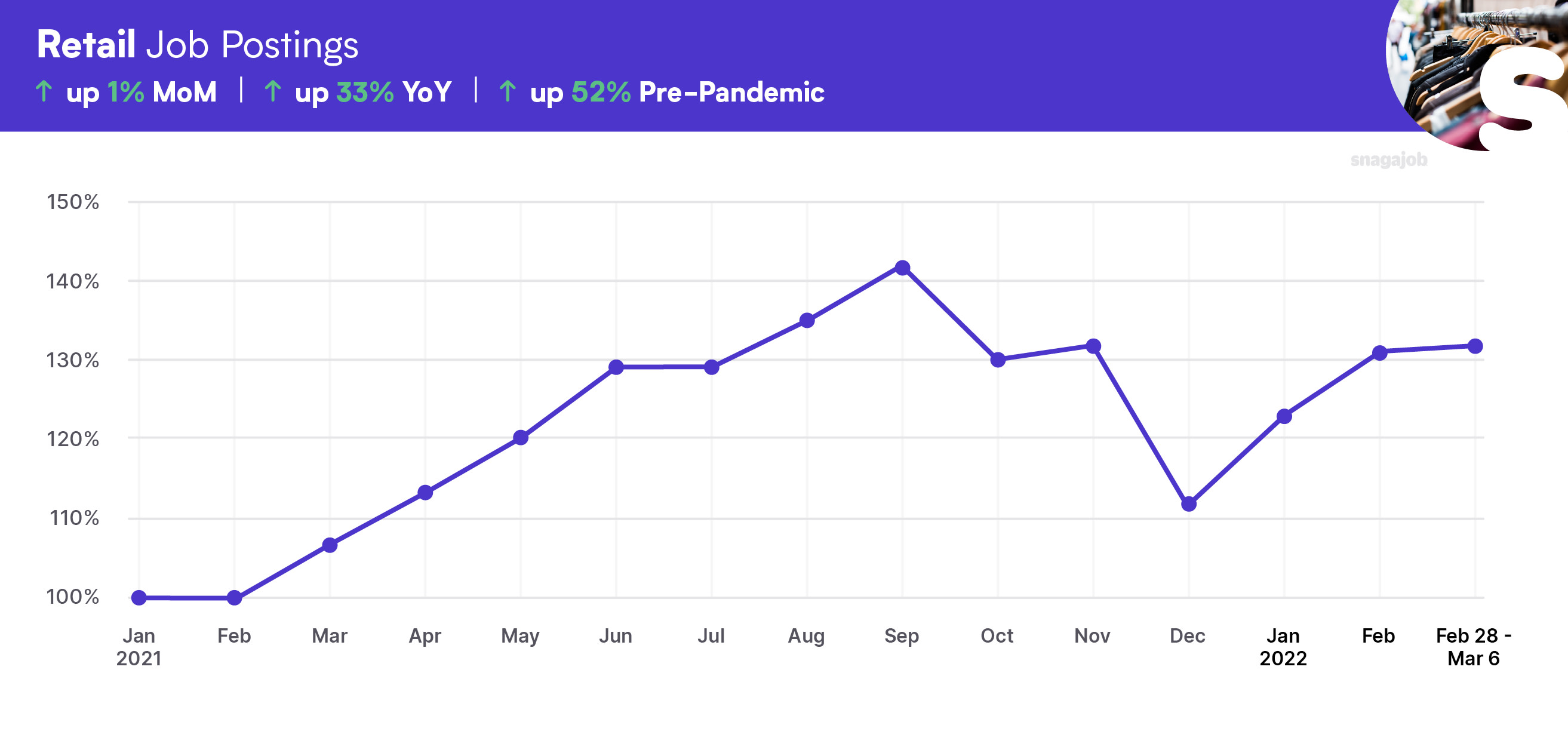

Retail jobs are up 52% compared to pre-pandemic norms, seeing a 1% month-over-month gain, and a 33% year-over-year growth.

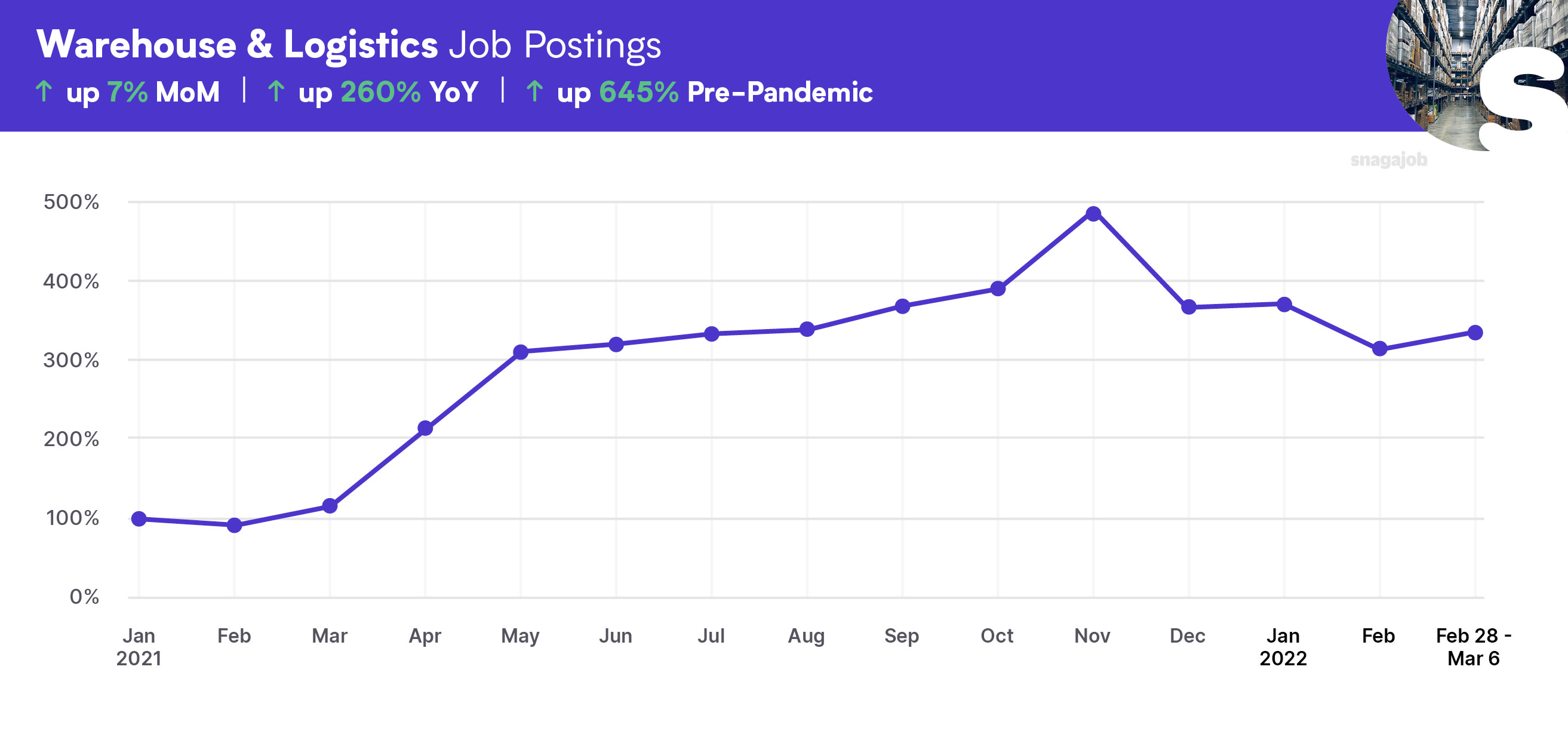

Warehouse & Production jobs are up 645% compared to pre-pandemic norms, seeing a 7% month-over-month gain, and a 260% year-over-year growth.

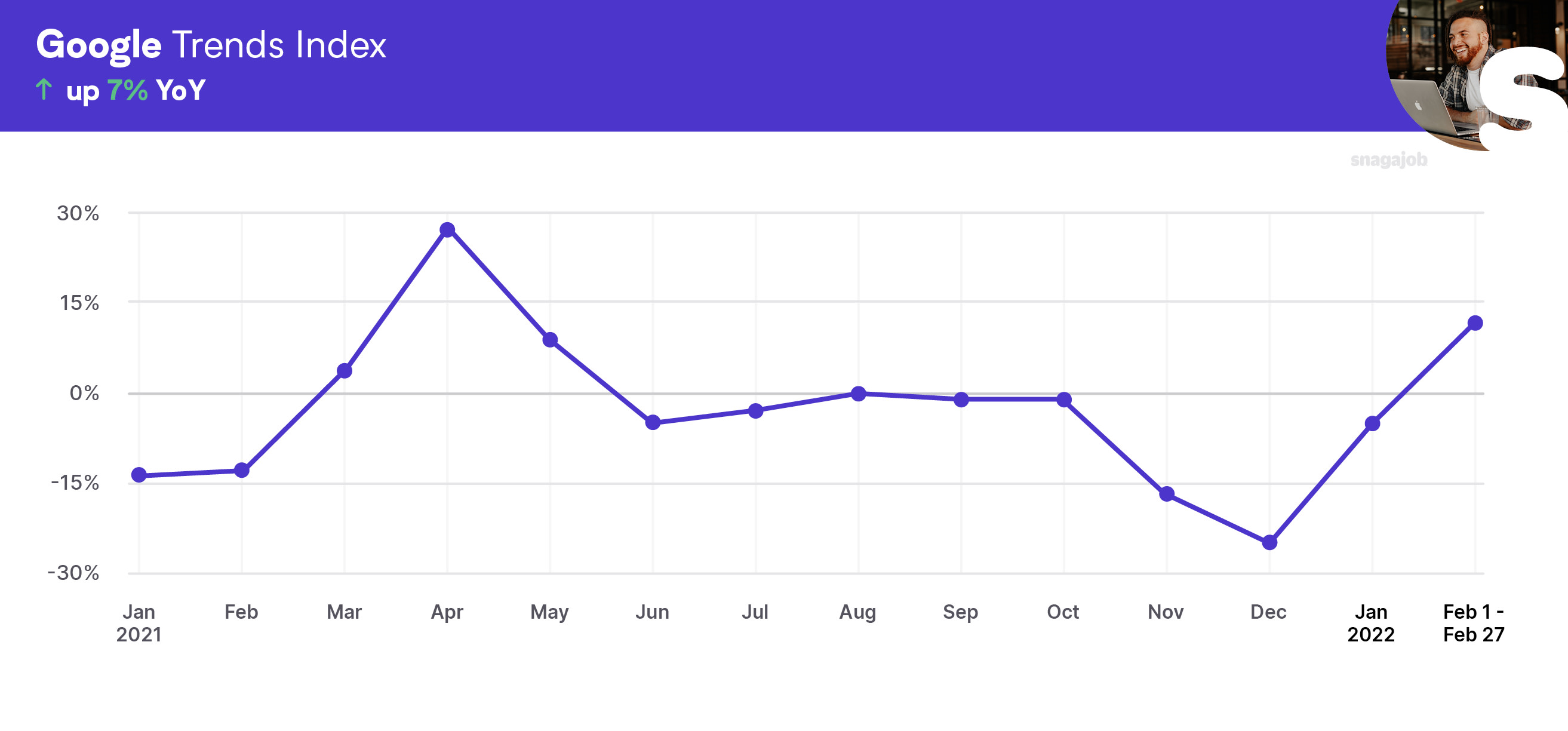

Workers

Google searches for hourly jobs are up 7% year over year.

The bottom line

We’ll continue to be your best resource for hourly job market insights as we collectively navigate towards our new normal and beyond.