Job seekers remain engaged, as the labor market cools ever-so-slightly

Hourly Hiring Report 10/12/2022

Highlights

Overall, while hourly jobs are up 161% from February 2020's pre-pandemic numbers, we are seeing an 8% month-over-month drop and a 2% year-over-year decline.

The recently released September jobs report from the US Bureau of Labor Statistics (BLS) brings some welcome news to hiring managers.

While an impressive 263,000 new jobs were added in September, this was still below most estimates (roughly 275,000) and the eye-opening August figure (315,000). Looking at the big picture, total job openings decreased significantly, from 11.2 million in July to 10.1 million in August.

The takeaway? Fewer new jobs mean less competition for businesses looking to hire. And in turn, that means less pressure to raise wages beyond your means to attract workers. On a side note, average hourly earnings rose 0.3% in the month, which was expected, although that’s still 5% higher than in September of last year.

However, this positive news was slightly tempered by BLS jobs report figures that show labor participation moving slightly lower to 62.3% (from 62.4% in August). This resulted in 57,000 fewer job seekers overall. And perhaps more significant for those hiring hourly workers, the report shows that in September those who are holding part-time jobs for economic reasons saw a decline from 7% to 6.7%. This suggests workers may be less worried about the economy than before. For up-to-date intel on the current mindset of hourly workers, and tips on winning them over, you’ll find details in our Holiday Hiring Report 2022.

All said, it appears that the US government’s efforts to cool economic growth, and thus slow inflation, are beginning to pay dividends. We’ll keep an eye on this and more in the days and weeks to come.

Specifically for hourly hiring, job growth highlights include:

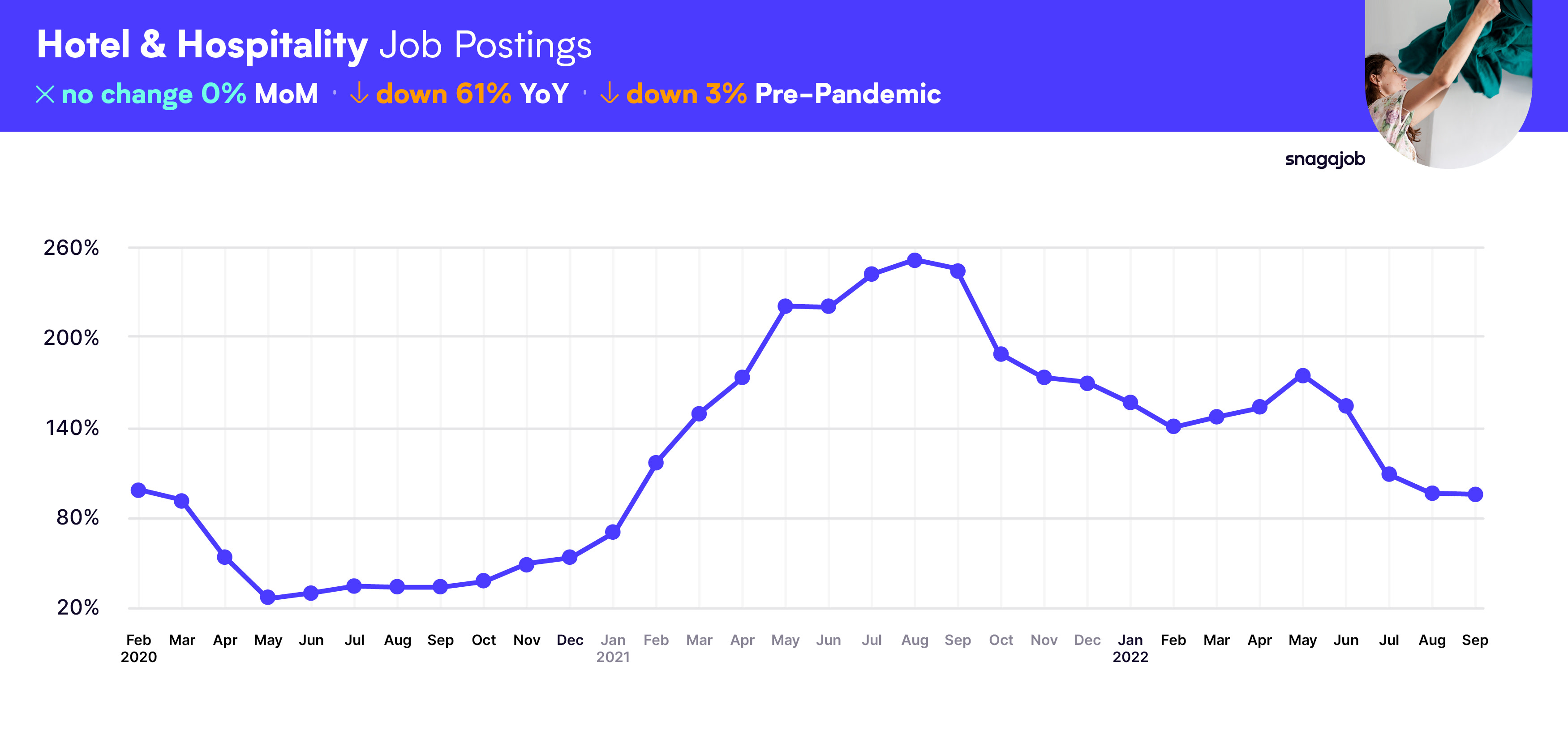

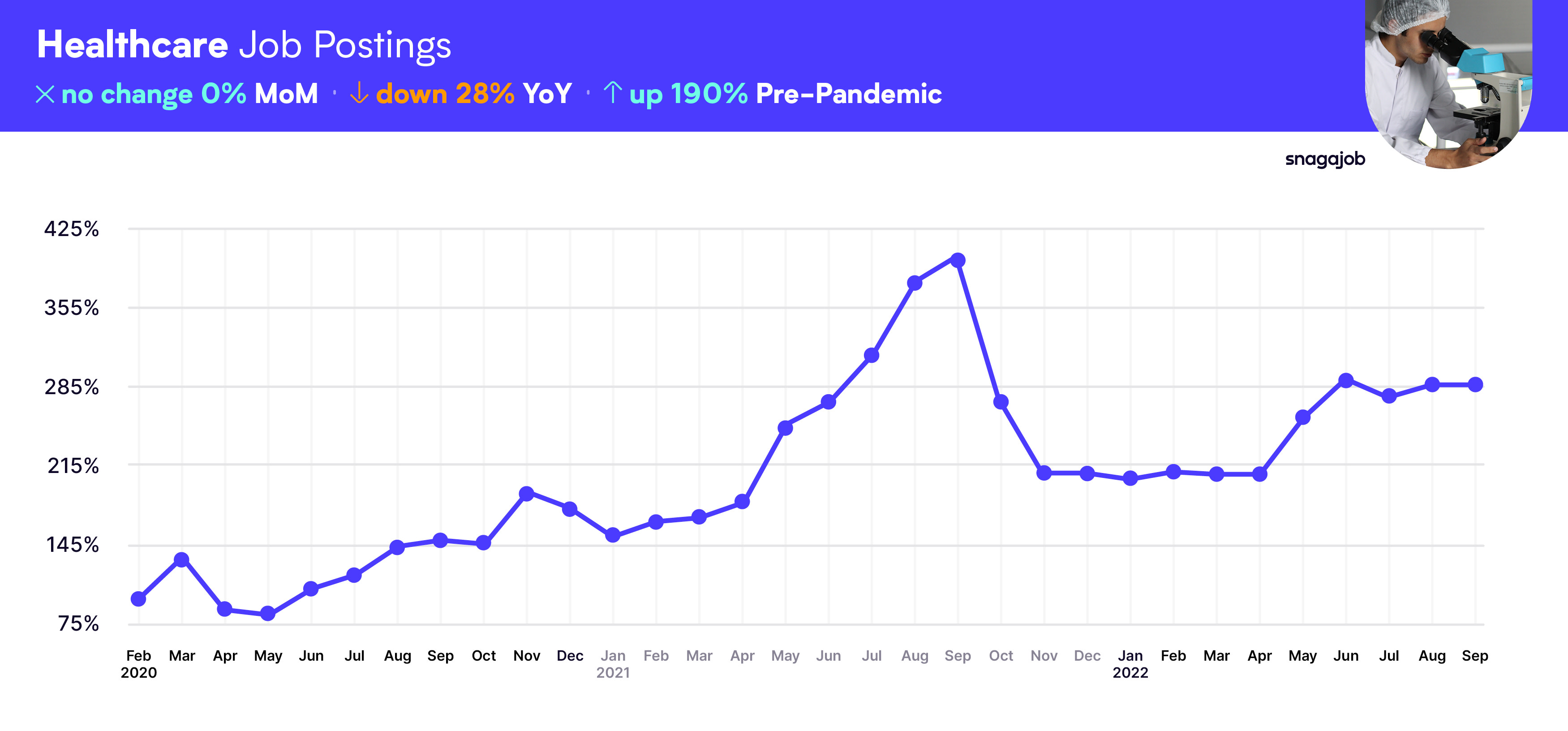

Both Healthcare and Hotel & Hospitality remained flat with 0% job growth during September, while all other sectors declined.

All job sector hiring is above pre-pandemic norms, except for Hotel & Hospitality which is down 3%.

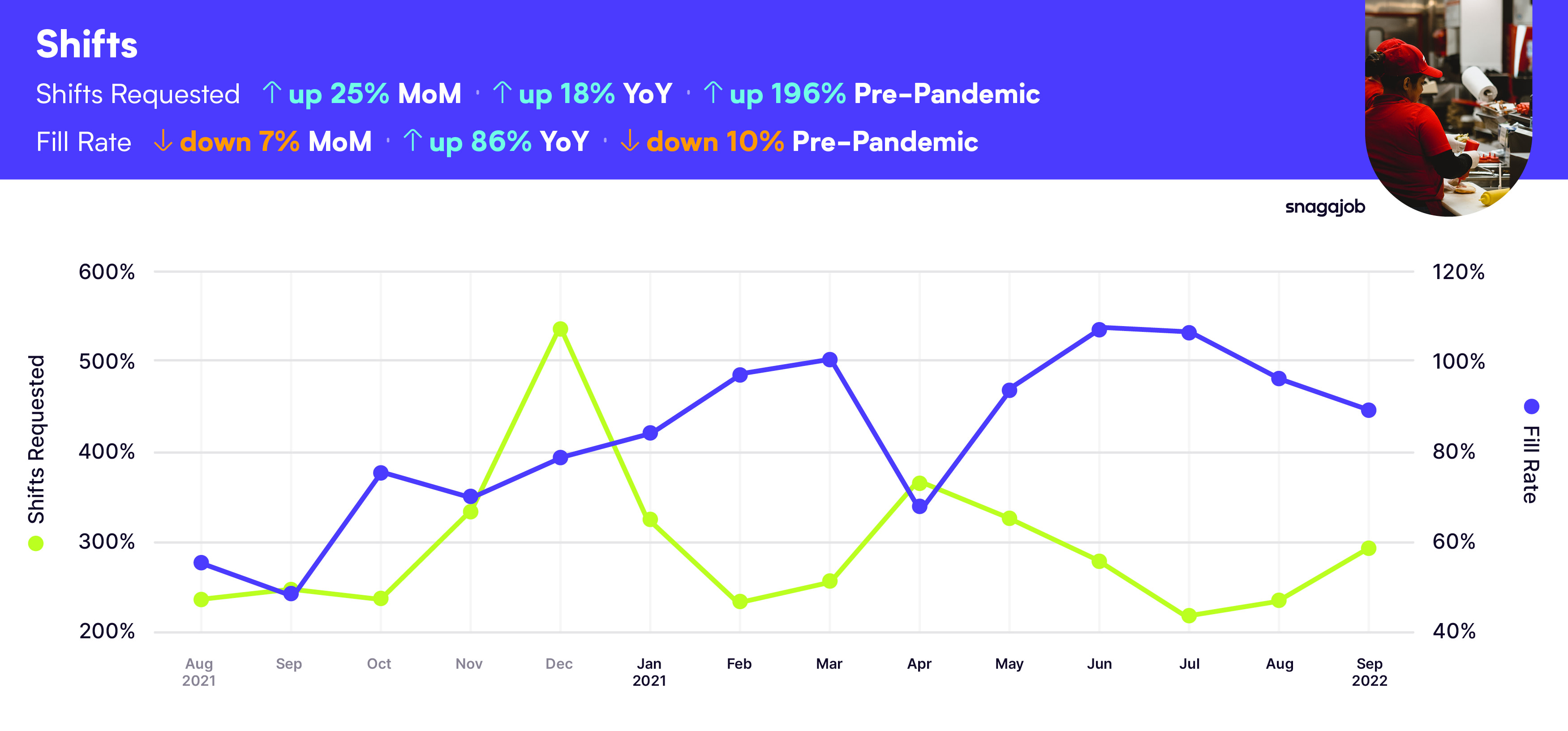

Shifts by Snagajob figures are up in most categories for the month and year, with special emphasis on

Shifts requests are up 18% year over year.

Shifts fill rates are up 86% year over year.

Jobs

All industry data is from 3/2/20-9/30/2022

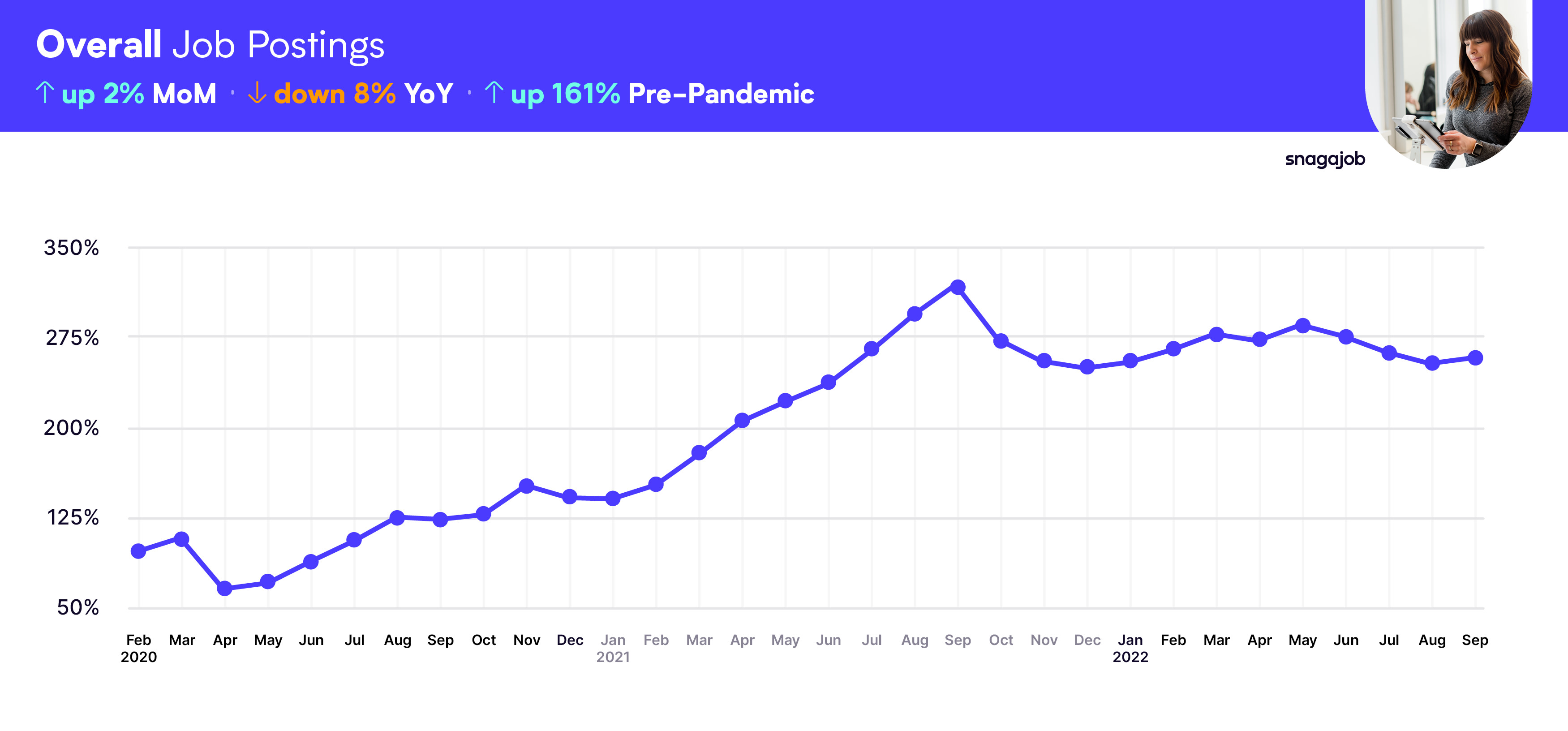

Here are the latest overall job numbers:

Overall, while hourly jobs are up 161% from February 2020's pre-pandemic numbers, we are seeing an 8% month-over-month drop and a 2% year-over-year decline.

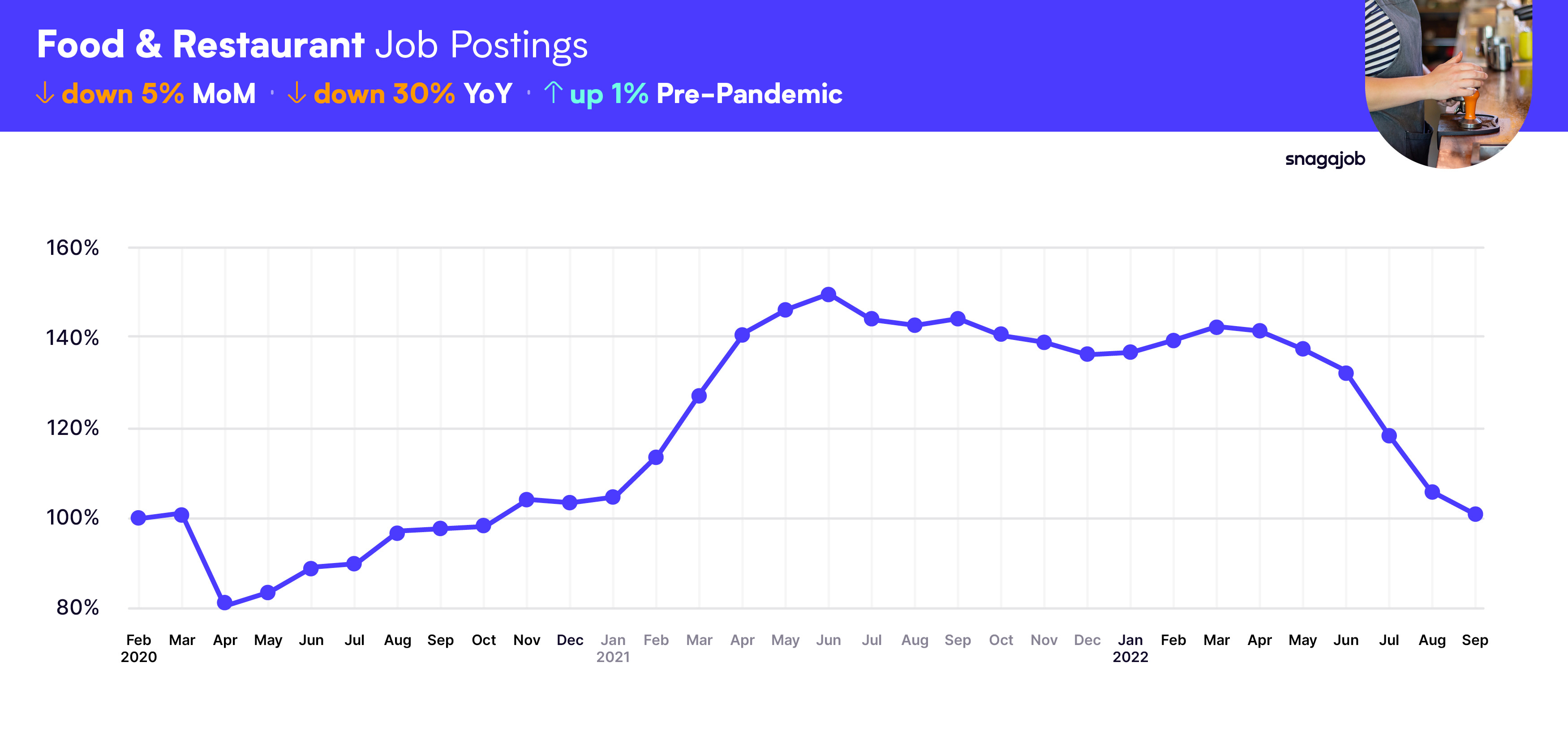

Here are the latest job numbers by industry and category:

Food & Restaurant jobs are up 1% compared to pre-pandemic norms, seeing a 5% month-over-month drop, and a 30% year-over-year decline.

Hotel & Hospitality jobs are down 3% compared to pre-pandemic norms, seeing a 0% month-over-month gain, and a 61% year-over-year decline.

Healthcare jobs are up 190% compared to pre-pandemic norms, seeing a 0% month-over-month gain, and a 28% year-over-year decline.

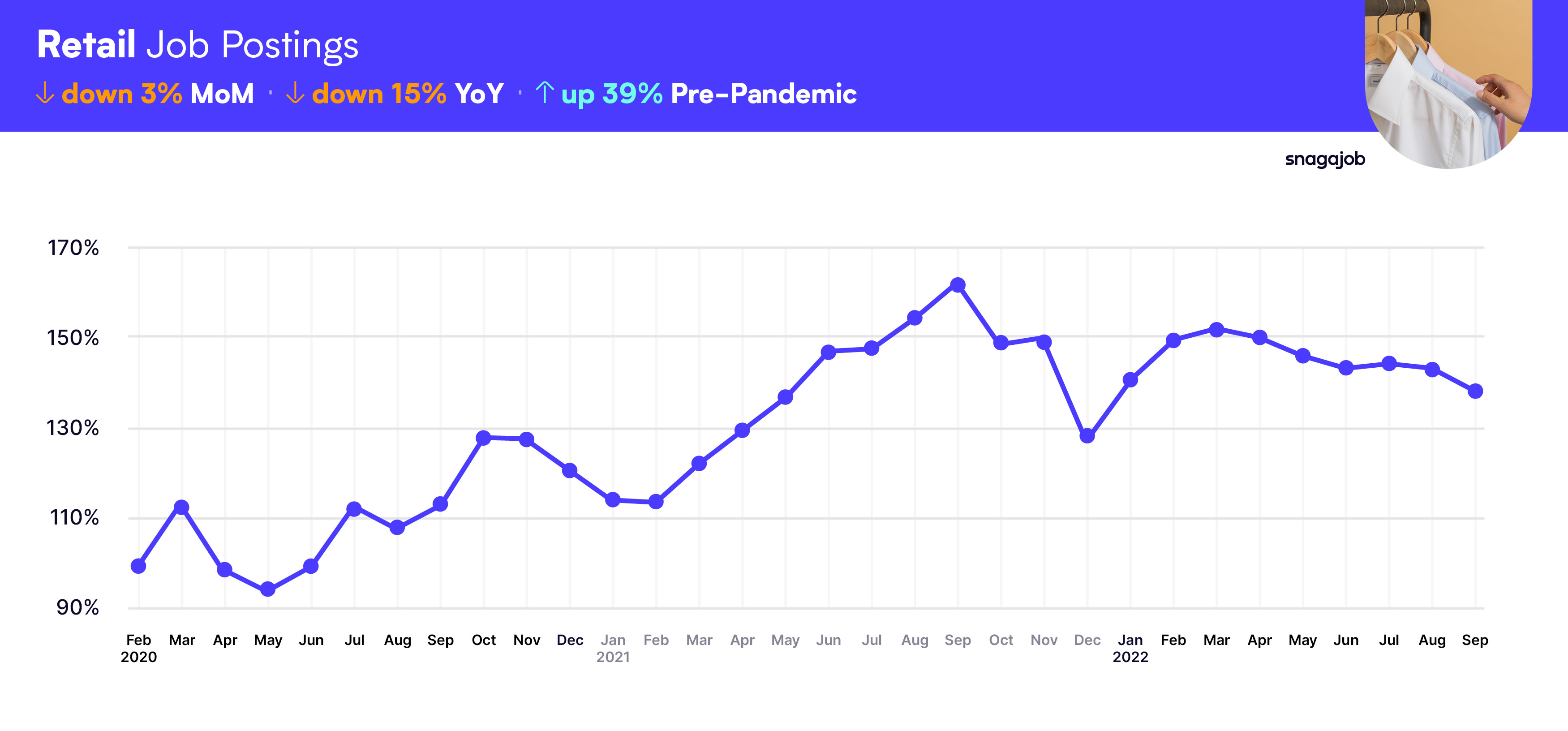

Retail jobs are up 39% compared to pre-pandemic norms, seeing a 3% month-over-month drop, and a 15% year-over-year decline.

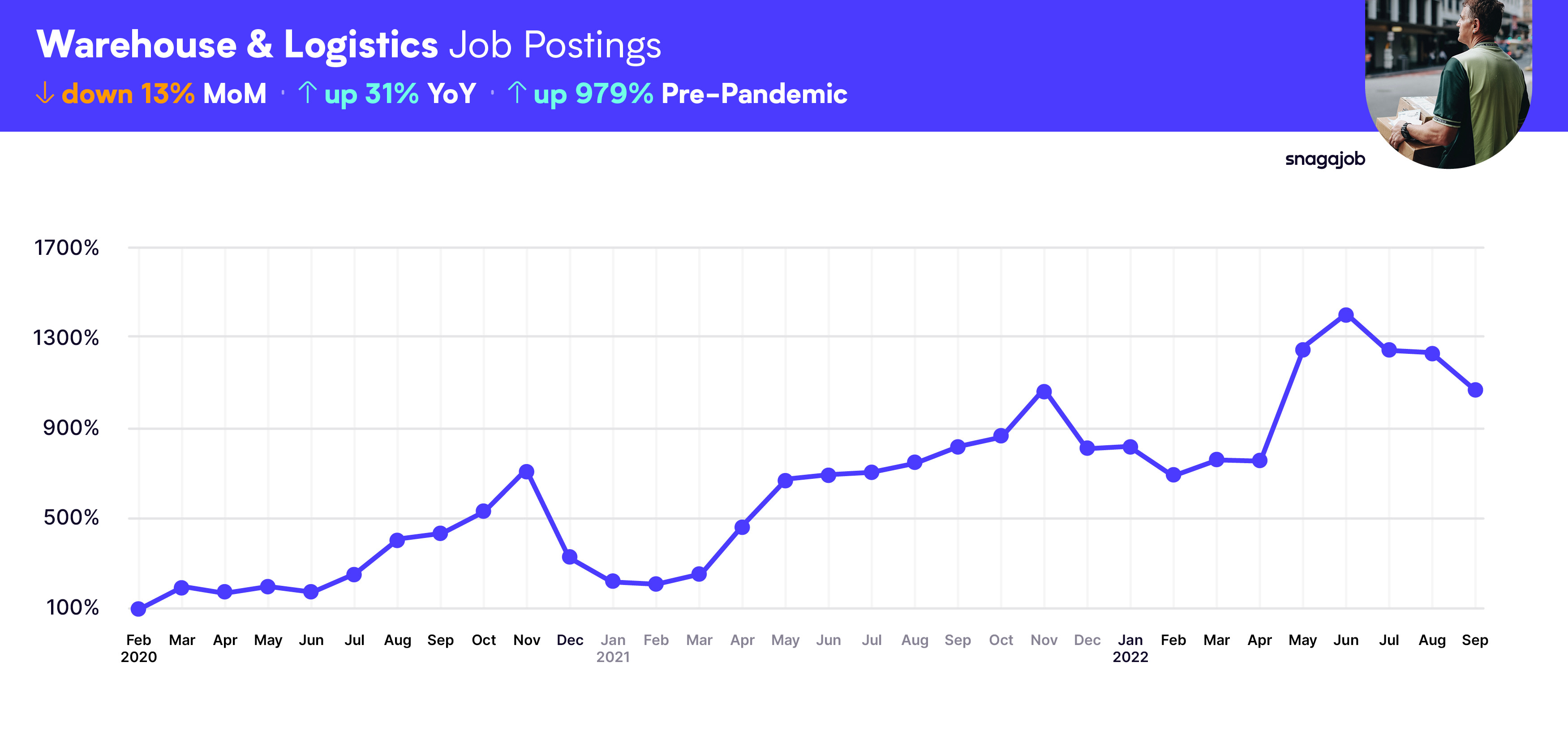

Warehouse & Logistics jobs are up 979% compared to pre-pandemic norms, seeing a 13% month-over-month decline, and a 31% year-over-year growth.

Shifts by Snagajob requested shifts are up 196% compared to pre-pandemic norms, seeing a 25% month-over-month gain, and an 18% year-over-year gain. Fill rates are down 10% compared to pre-pandemic norms, seeing a 7% month-over-month decline, and an 86% year-over-year growth.

The bottom line

We’ll continue to be your best resource for hourly job market insights as we collectively navigate towards our new normal and beyond.