Reduced tech-sector hiring may slow summer wage increases

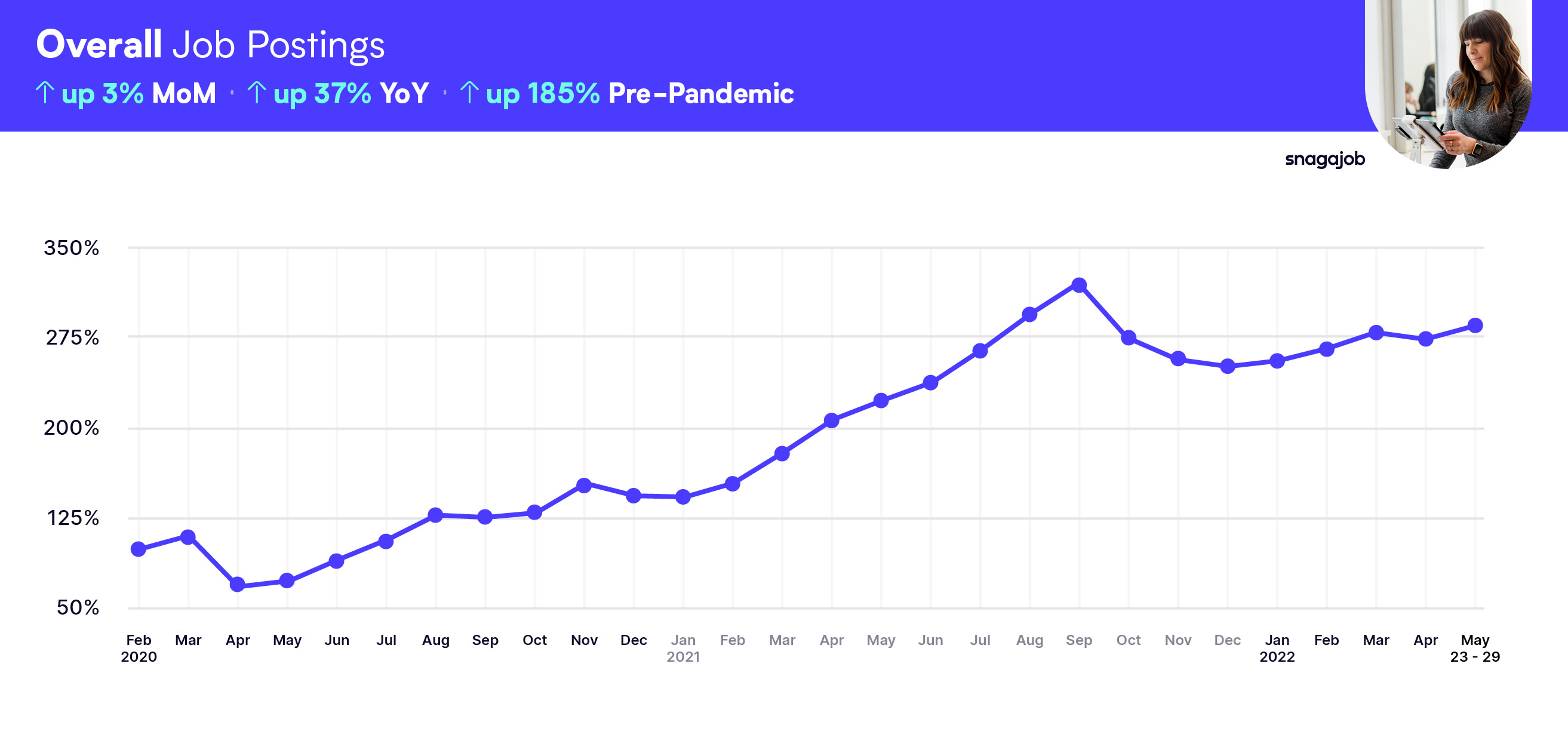

Overall, hourly jobs are up 184% compared to pre-pandemic norms, seeing a 3% month-over-month gain, and a 37% year-over-year growth. Google searches for hourly jobs are down 15% from this time last year.

Businesses are keeping a close eye on this week’s upcoming jobs report from the Department of Labor. Indications are that although job gains per month will continueーestimated to be just slightly under 400,000 new jobs added for Mayーthis would still represent the slowest job growth since April of 2021.

Despite signs of a full jobs recovery by summer’s end, the labor market remains fluid. In fact, there appears to be a fork in the road for hiring managers.

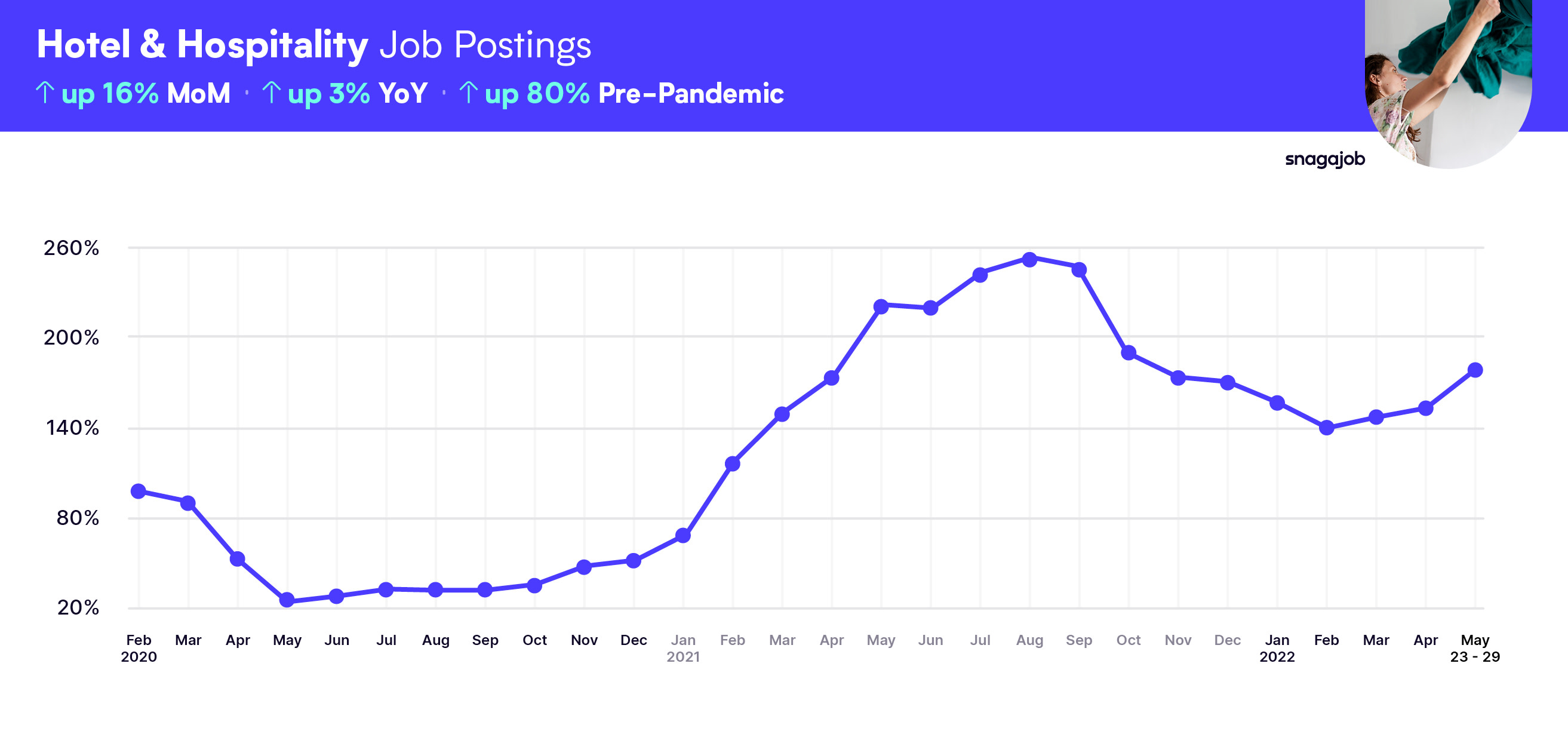

As discussed in our Summer 2022 Hourly Hiring Report, with two jobs available for every worker, many businesses are scrambling to find summer help-including key summer travel and entertainment-focused sectors like hotels, hospitality, and restaurants. Hiring managers are resorting to previously unthinkable measures to hire enough people A prime example is the city of Phoenix, which is offering $2,500 signing bonuses for lifeguards and still can’t fill the demand.

Yet it’s the opposite story for many well-known tech companies. They’re increasingly pulling back the reins on hiring, even laying off workers. “We will treat hiring as a privilege and be deliberate about when and where we add headcount,” noted Uber CEO Dara Khosrowshahi. The same can be said for many tech companies from Microsoft and Meta to Twitter.

This emerging divergence in the jobs market may keep wages from continuing to rise so quickly, as the number of available jobs recedes.

But, these staffing challenges may affect the overall economy as well, as the June-through-August summer season traditionally creates about 10% of the US gross domestic product (thanks to the 30 million workers who help serve the millions of Americans on break from work and school).

To better understand today’s shifting labor market, and for a discussion on ways to solve your staffing challenges, browse The Impact of Today’s Job Market on Summer Hiring.

Jobs

All industry data is from 3/2/20-5/31/22

Here are the latest overall job numbers:

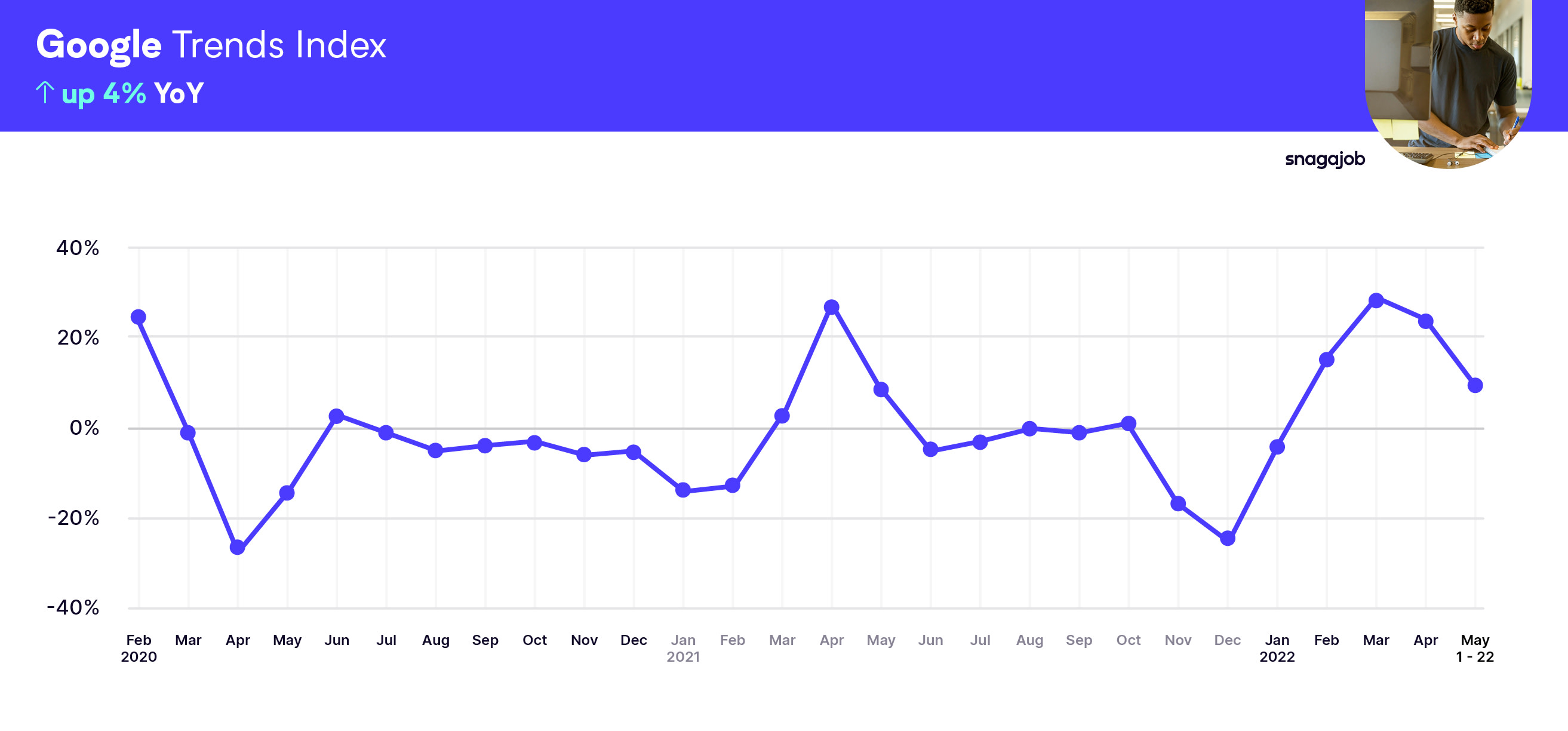

Overall hourly jobs are up 184% compared to pre-pandemic norms, seeing a 3% month-over-month gain, and a 37% year-over-year growth. Google searches for hourly jobs are up 4% from this time last year.

Here are the latest job numbers by industry:

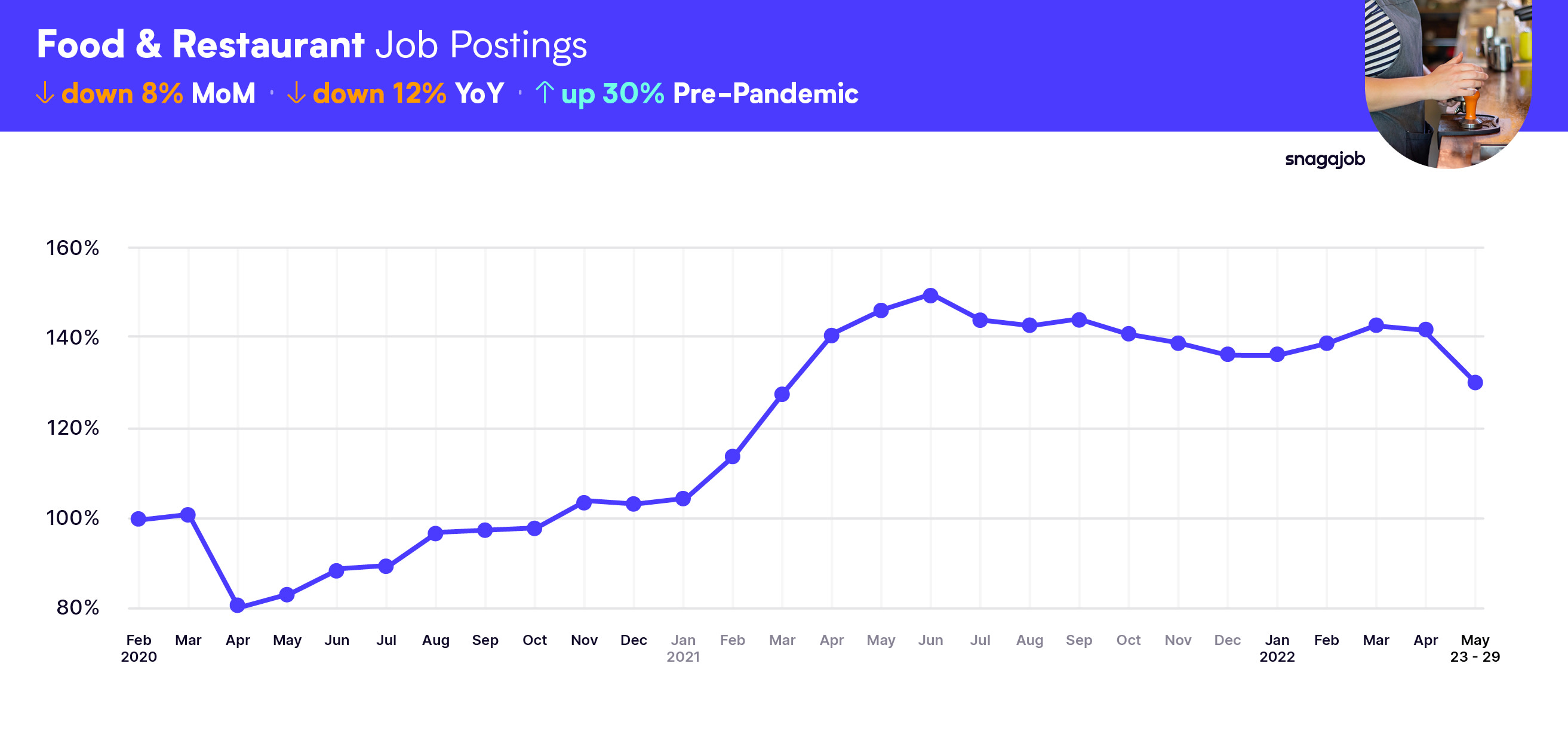

Food & Restaurant jobs are up 30% compared to pre-pandemic norms, seeing an 8% month-over-month drop, and a 12% year-over-year decline.

Hotel & Hospitality jobs are up 80% compared to pre-pandemic norms, seeing a 16% month-over-month gain, and a 3% year-over-year growth.

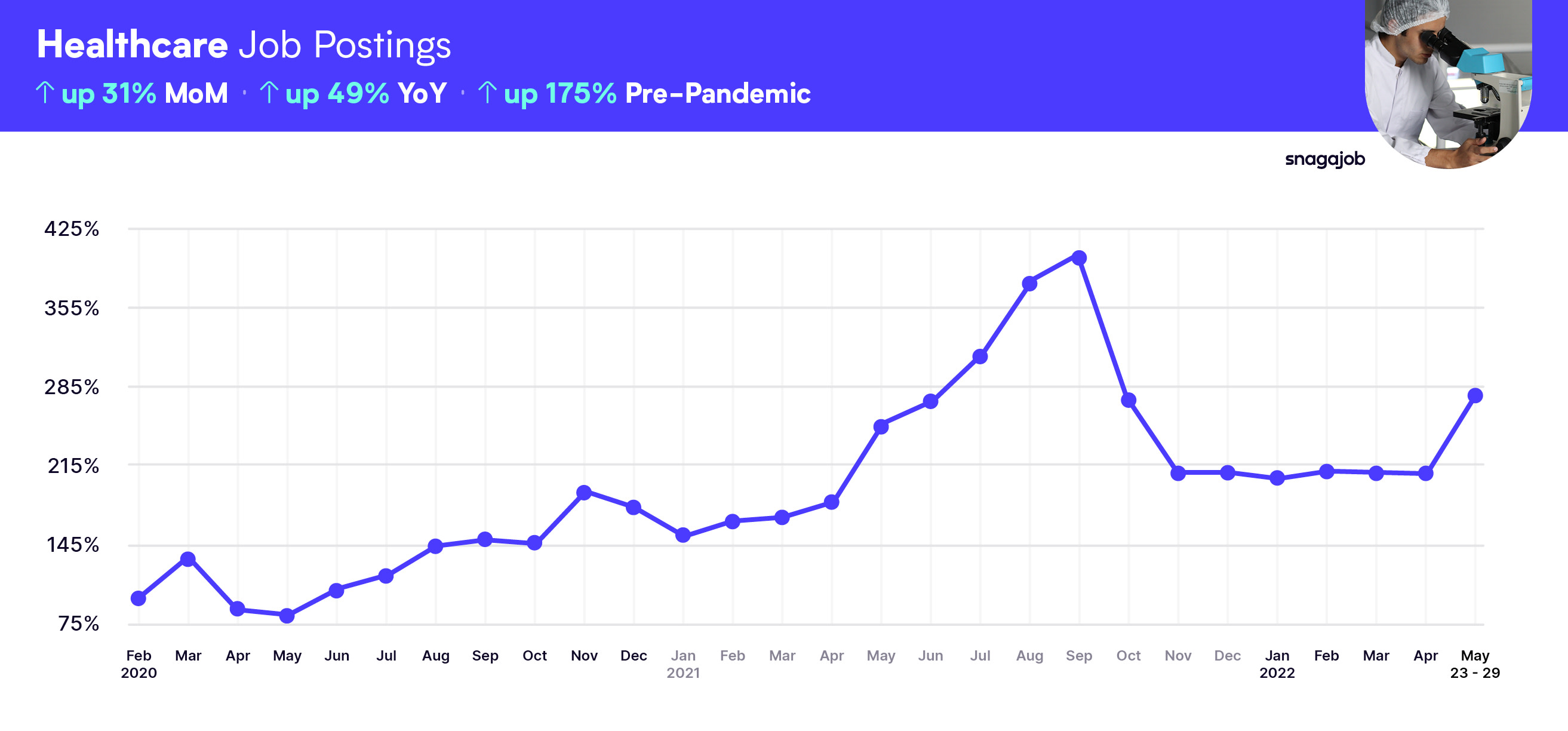

Healthcare jobs are up 175% compared to pre-pandemic norms, seeing a 31% month-over-month gain, and a 49% year-over-year growth.

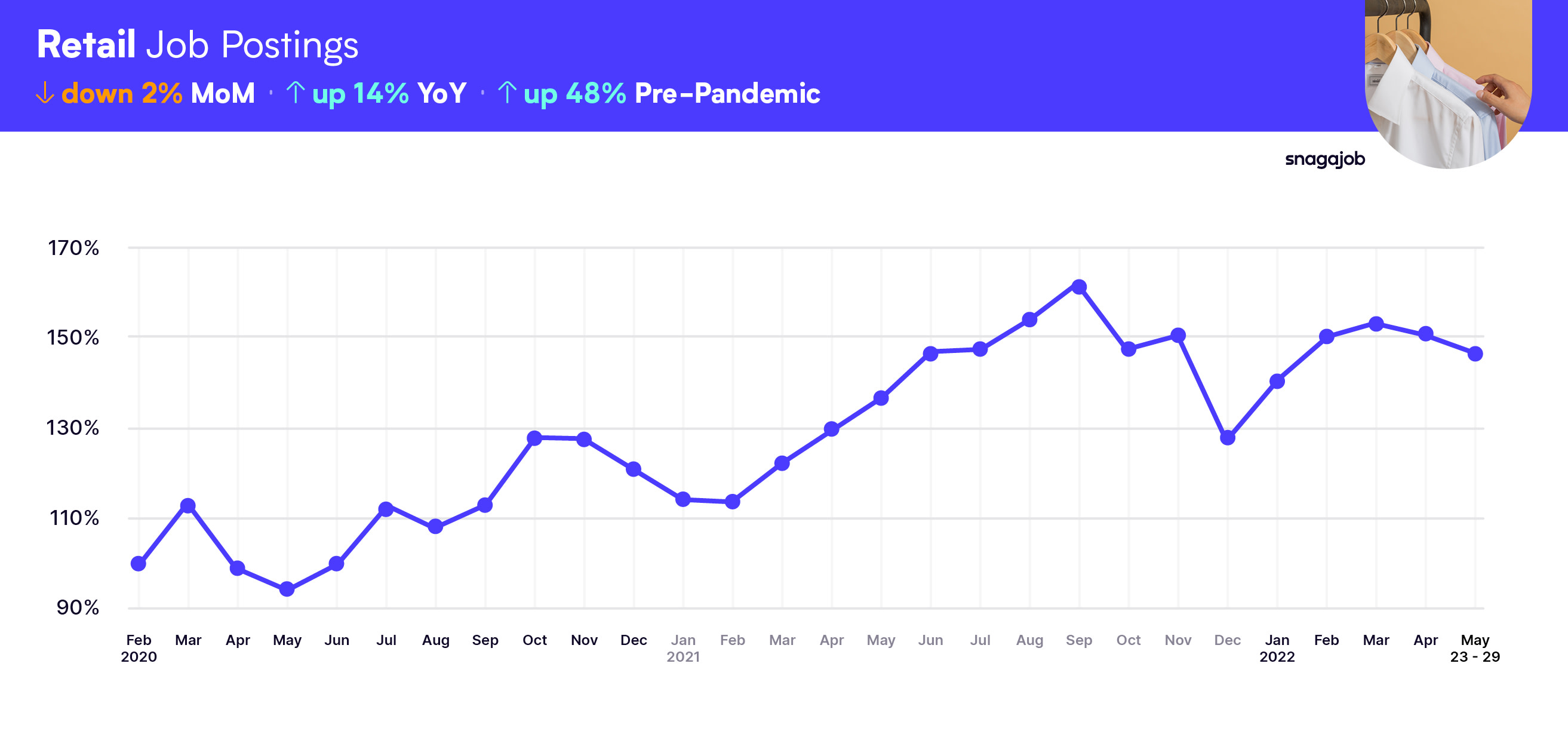

Retail jobs are up 48% compared to pre-pandemic norms, seeing a 2% month-over-month decline, and a 14% year-over-year growth.

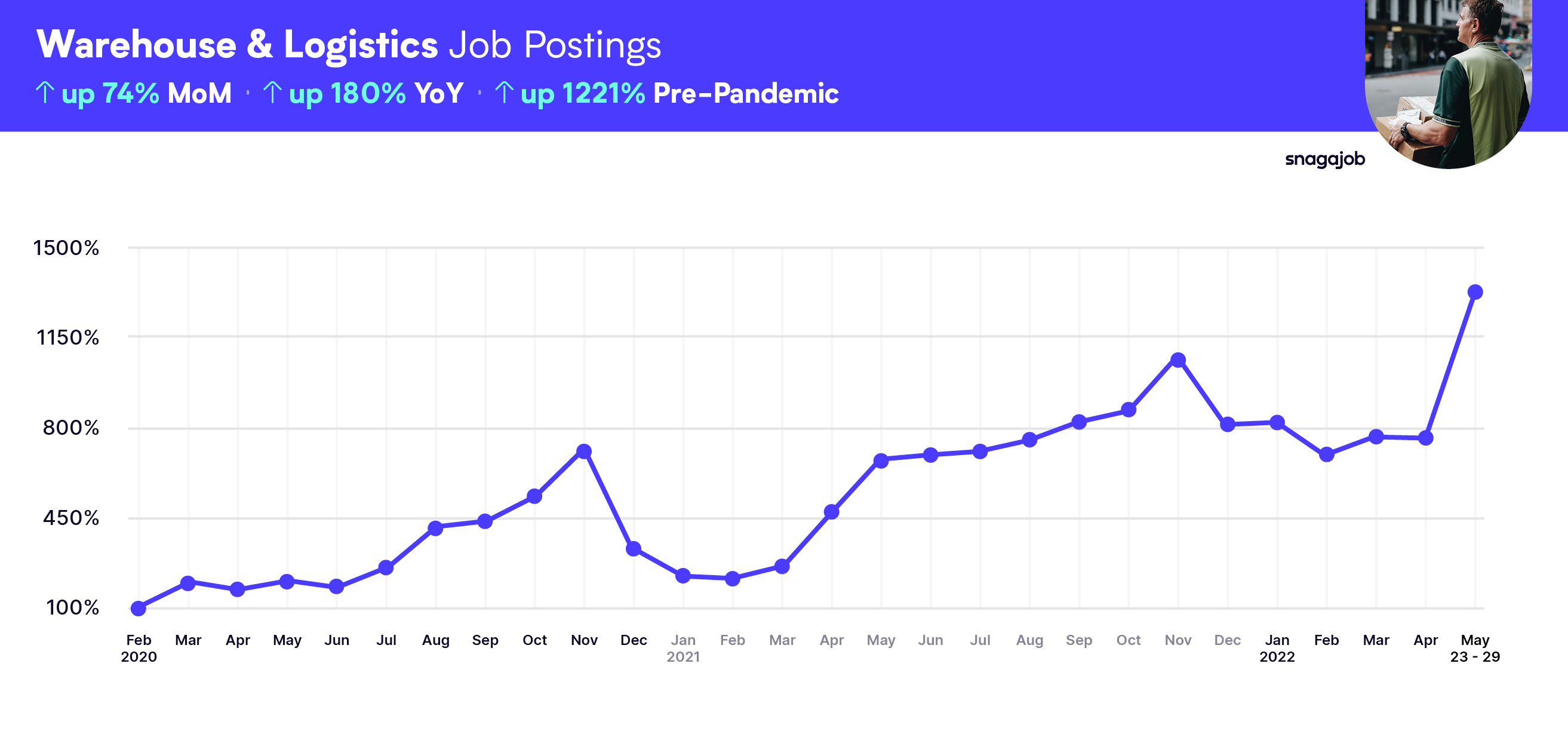

Warehouse & Production jobs are up 1221% compared to pre-pandemic norms, seeing a 74% month-over-month gain, and a 180% year-over-year growth.

Workers

Google searches for hourly jobs are up 4% year-over-year.

The bottom line

We’ll continue to be your best resource for hourly job market insights as we collectively navigate towards our new normal and beyond.

Got one minute? Help improve this report. Share your feedback by answering five quick questions.