The U.S. economy added 151,000 jobs in February

The U.S. economy added 151,000 jobs in February according to the latest jobs report from the Bureau of Labor Statistics (BLS) – more than the 125,000 jobs added in January.

Unemployment and Labor Force Participation

Following another month of job gains, the unemployment rate changed slightly from 4.0% to 4.1% in February due to a decline in the labor force. While cuts to jobs related to the Federal government have made headlines, the majority of those reductions are not yet reflected in the unemployment data. The number of unemployed individuals rose slightly to 7.1million while the labor force participation rate decreased little to 62.4%. With the drop in the participation rate, the labor supply is now the tightest it has been since January 2023. The number of people employed part-time for economic reasons increased significantly by 460,000 to 4.9 million (10%).

Industry-Specific Job Gains and Losses

While most sectors of the economy added jobs, job losses were concentrated in a few sectors–namely the Federal government (-10,000 jobs) and Leisure and Hospitality (-16,000 jobs). Healthcare continued to lead job gains, adding 52,000 positions in February, with widespread growth across hospitals, residential care facilities, and home health services. Financial Activities also saw a sizable increase of 21,000 jobs, especially in real estate and insurance related activities.

Other industries with significant changes included:

Construction: +19,000 jobs

Transportation and Warehousing: +17,800 jobs

Durable Goods Manufacturing: +11,000 jobs

Social Assistance: +11,000 jobs

General merchandise retailers: +10,300 jobs

Wholesale Trade: +8,800 jobs

Food and Beverage retailers: -15,000 jobs

Computer related services: -9,800 jobs

Other sectors, such as Information, Business Services, Mining and logging and Utilities, showed little change over the previous month.

Federal Government Policy Changes

As the jobs report shows, recent federal policy changes have resulted in federal government job losses, but those losses were more than offset by state and local government hiring in February. Despite all the headlines, hiring demand remains solid. The Federal government represents only a small piece of the broader economy. In February, it made up just 2% of non-farm payrolls, and just 12% of government jobs specifically.

The labor market remains stable, but employers should take note as additional Federal policy changes and DOGE-related cuts to the Federal government are enacted.

Revisions to Previous Data

While December data was revised up by 16,000, January jobs data was revised down by -18,000 jobs, indicating volatility in the labor market. Despite this, the upward revisions in late 2024 and solid hiring from the private sector in February provide reassurance in the employment market.

Earnings and Workweek Trends

Average hourly earnings increased by 4% year over year with average hourly earnings for Goods rising 4.2% and average hourly earnings for Services up 4.0% over 2024. Although hourly earnings rose over 2024 numbers, the 3-month annualized growth rate is the lowest it has been since April 2024 indicating less pressure on recent wage growth than we've seen in the past.

Snagajob Insights

As a leading indicator of future labor reports, the active job posting activity on Snagajob in February indicates that employers are looking to fill more jobs in the restaurant, retail, travel and hospitality industries heading into spring than they were just a month ago.

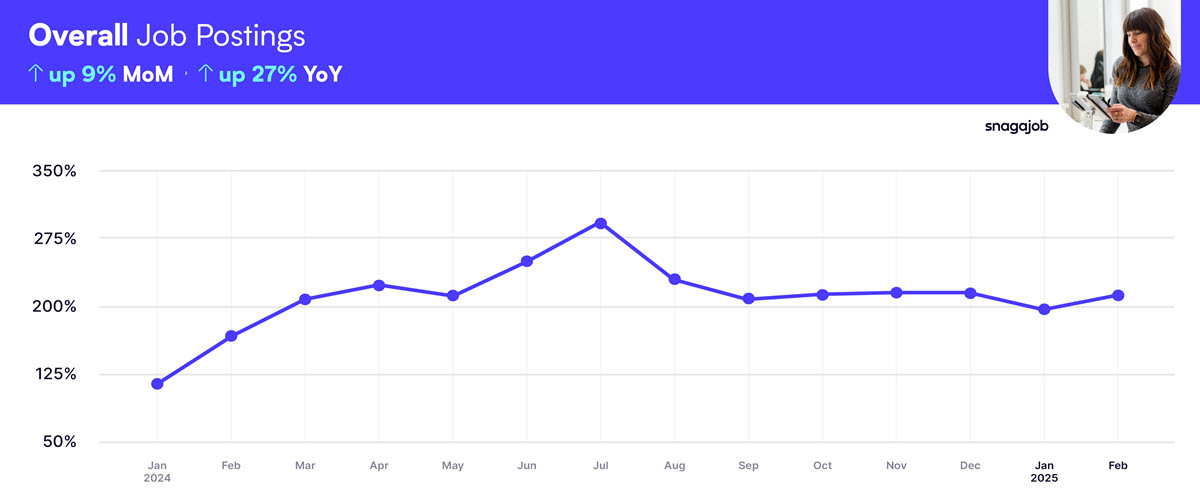

On Snagajob, overall job postings increased by 9% month-over-month and were up 27% year-over-year, indicating robust demand in the hourly job market. Sales and Marketing (+ 1,997%), along with Maintenance & Janitorial (+ 438%) and Accounting & Finance (+621%), experienced exponential growth over January.

Other notable changes in Snagajob postings included:

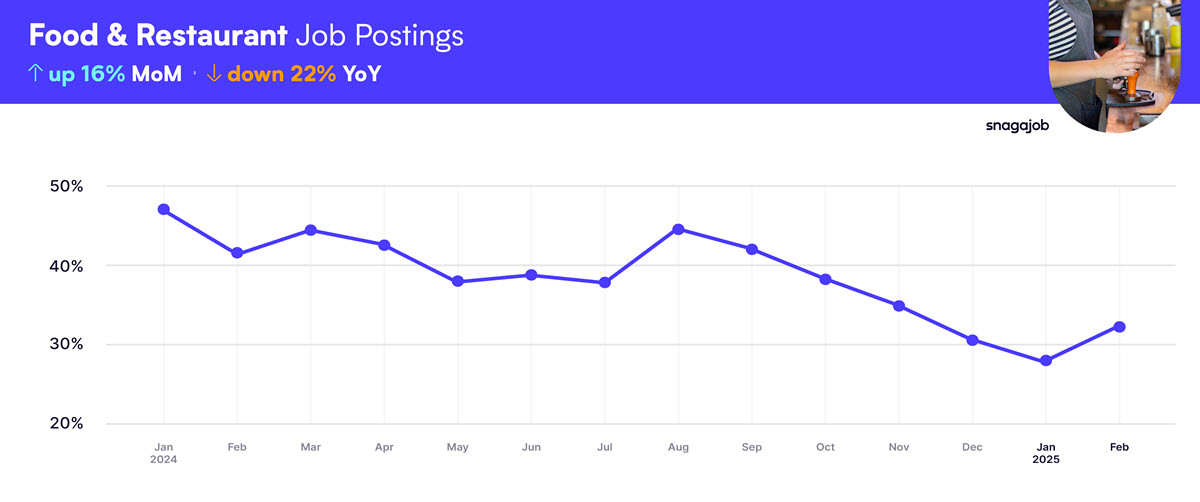

Food & Restaurant: +16%

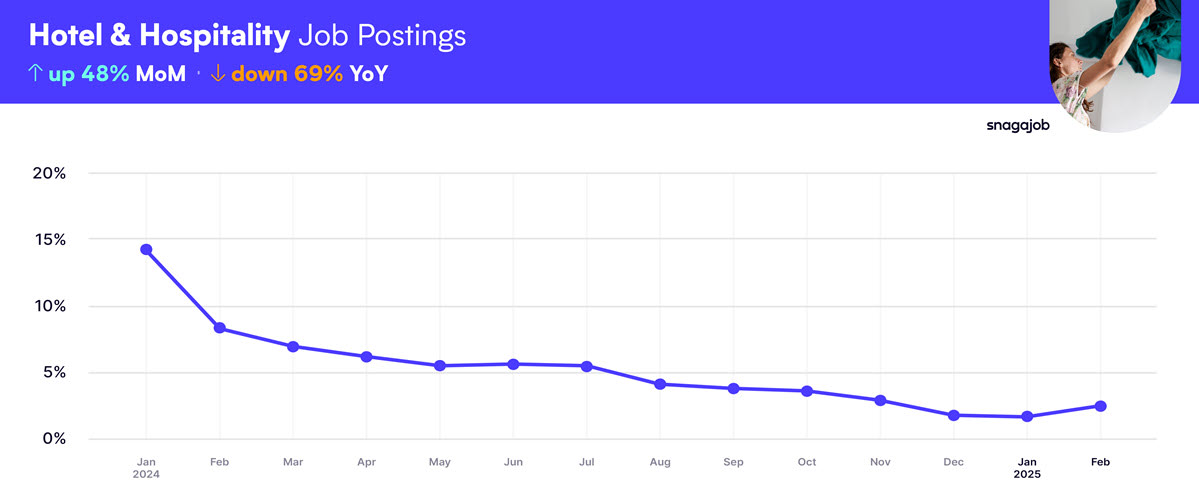

Hotel & Hospitality: +48%

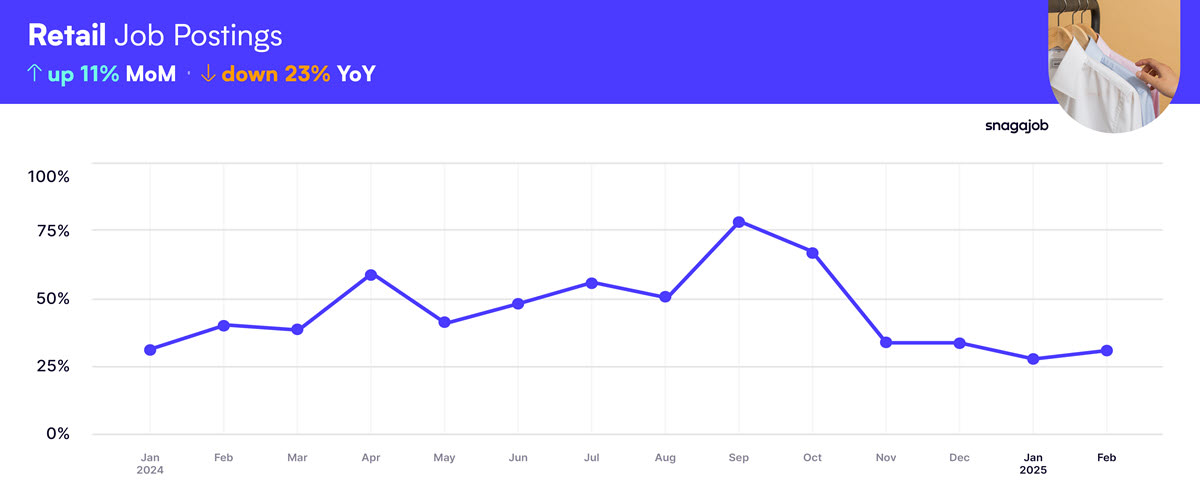

Retail: +11%

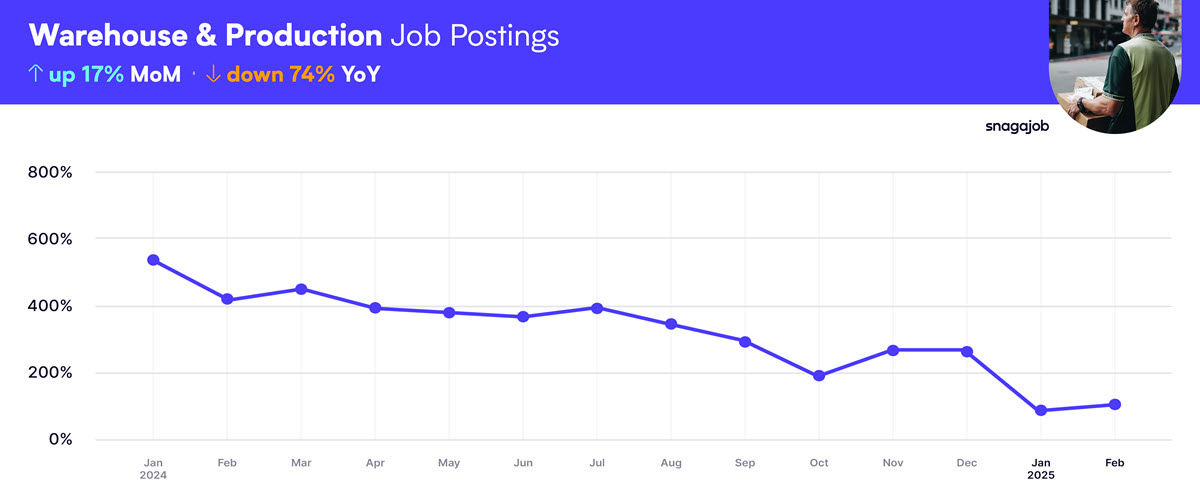

Warehouse & Production: +17%

Personal Care & Services: +21%

Customer Service: +120%

Transportation: +14%

Legal: +38%

Key Insights from External Sources

Seeking Alpha: "Firms reported solid hiring, offsetting federal government job losses, but households reported an increase in unemployment and part-time work due to weak economic conditions. At the same time, the labor supply tightened, and wage growth accelerated slightly."

Yahoo! Finance: "We know that over the next three to six months, we're going to see some of the disruptive effects in Washington start to show up in both the economy and in the labor market," Brusuelas said. "But for now, what this tells us is that we really only need to add about 100,000 to 150,000 jobs a month to keep employment stable. That's exactly what happened."

The New York Times: "Average hourly earnings for private-sector workers rose 0.3 percent over the month, or 4 percent since last year. That’s still strong wage growth, though a slower monthly pace than in January."

"With 151,000 jobs added in February, the data showed a pace of hiring moderate enough to temper fears about resurgent inflation, yet robust enough to avoid exacerbating worries about a slowing economy."

As the hourly expert, Snagajob is here to help with your hiring needs. Contact our team today to learn more about our solutions for enterprise, mid-size, and small businesses.

All industry data is from 1/1/2024-2/28/2025.

Here are the latest overall job numbers:

Overall hourly jobs are up 9% month over month, and up 27% year over year.

Here are the latest job numbers by industry and category:

Warehouse & Production jobs are up 17% month-over-month.

Food & Restaurant jobs are up 16% over the previous month.

Retail jobs are up 11% month-over-month.

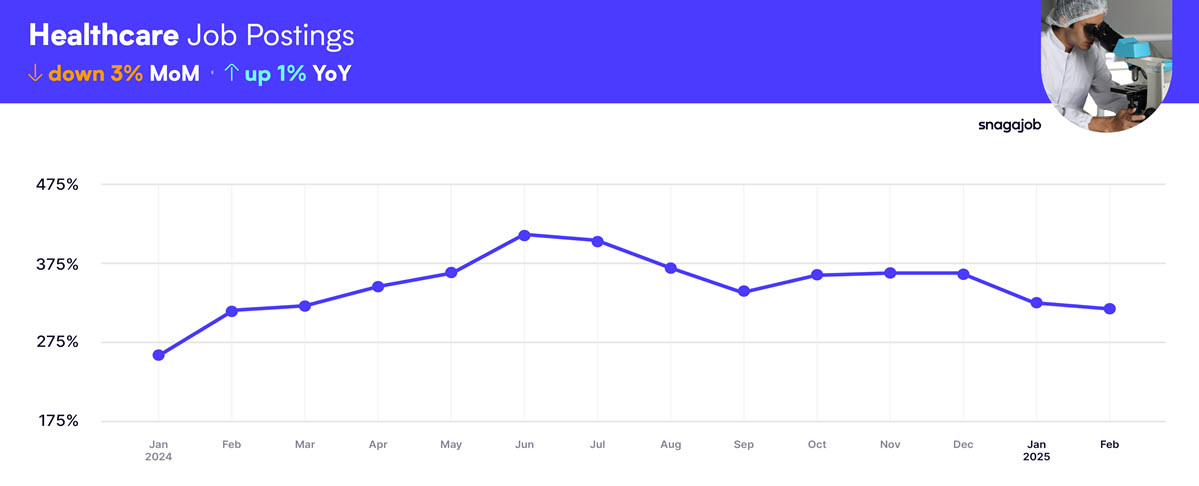

Healthcare jobs are down 3% month-over-month.

Hotel & Hospitality jobs are up 48% month-over-month.