US job hiring recovery continues, but new factors come into play

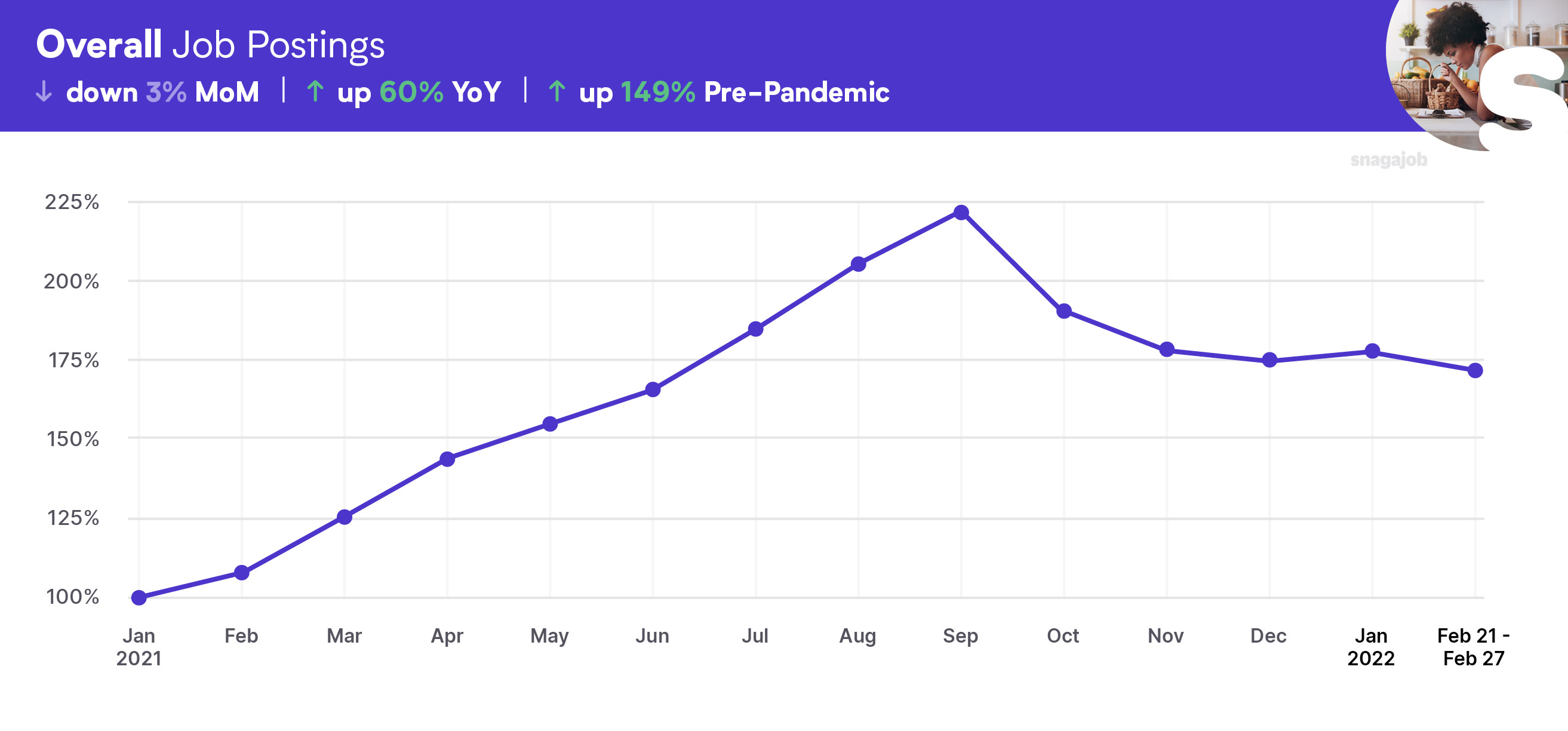

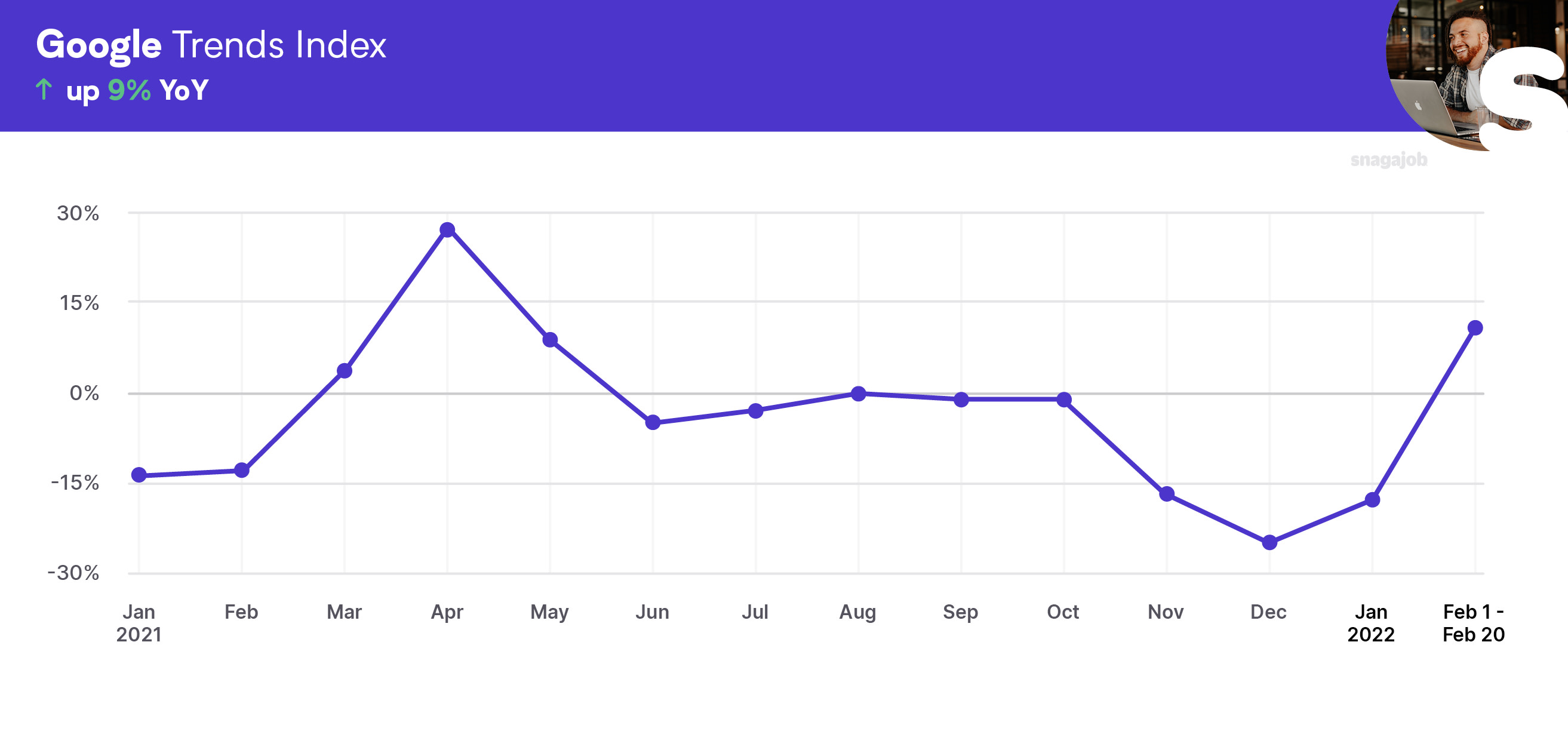

Overall, hourly jobs are up 149% compared to pre-pandemic norms, seeing a 3% month-over-month decline and a 60% year-over-year gain. Google searches for hourly jobs are up 9% from this time last year.

While perhaps not considered a direct correlation to US hourly hiring news, Moscow’s attack on Ukraine makes things more complicated for the Fed who is determining how to curb soaring price levels—without stunting economic growth—as they move towards hiking the federal interest rate.

A favorable labor market for workers is a great thing for U.S. households, but the extensive job openings have also contributed to inflation. Average hourly earnings grew by 5.7% year-over-year.

In anticipation of February’s jobs report from the Bureau of Labor Statistics—expected on Friday—many economic forecasters are making predictions. February’s figures will likely reflect continued momentum in the labor market’s recovery, with economists surveyed by Bloomberg estimating 400,000 jobs were added during the month.

Additional highlights from this week’s US labor market news include:

The jobs recovery continues on the upswing, with jobless claims (those filing for unemployment two weeks in a row) dropping to below 1.5 million in mid-February. Not only was it lower than predicted by economists, but it was also at the lowest level since June of 1973.

Overall statistics dating back to 2003 suggest that states with smaller-sized businesses tend to have faster job growth, higher pay, and larger pay raises. In the past 9 years, states with smaller businesses grew by 19% while states with larger businesses grew by only 12%.

A majority of private and public workers report not having access to paid family leave (gathered from Bureau of Labor Statistics data). Figures from last year show that only 23% of private industry workers have access to paid family leave, while state and local government employees report an even lower 26% rate. Despite employees now offering greater benefits to induce hesitant workers, these figures remain largely unchanged from 2008.

Many companies, however, are revising hiring tactics to attract workers in today’s challenging job market. For example, Target recently announced they’ll increase hourly wages for store and distribution center workers to as high as $24 an hour in the most competitive markets such as New York. Their minimum wage for any position is $15 per hour.

While the latest news regarding the US jobs recovery is optimistic (Omicron’s impact is fading and more and more companies are offering more benefits to entice workers off the sidelines), there still remains a large gap between workers and jobs. This week’s February Jobs Report will provide greater insights and we’ll gradually get a better picture of how inflation, wage increases, and the invasion of Ukraine will impact our labor market.

Jobs

All industry data is from 3/2/20-3/02/22

Here are the latest overall job numbers:

Overall jobs are up 149% compared to pre-pandemic norms, seeing a 3% month-over-month decline, and a 60% year-over-year growth. Google searches for hourly jobs are up 9% from this time last year.

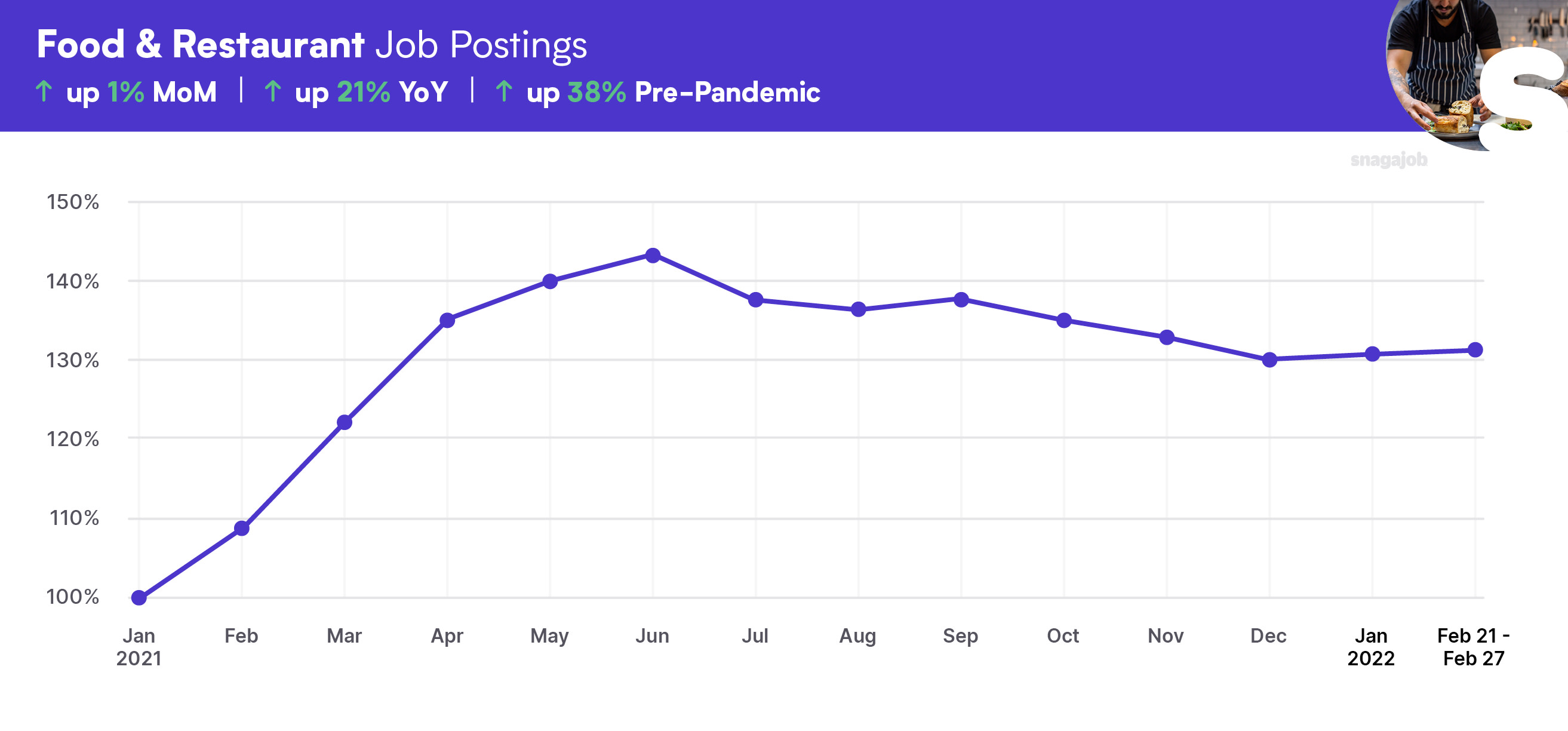

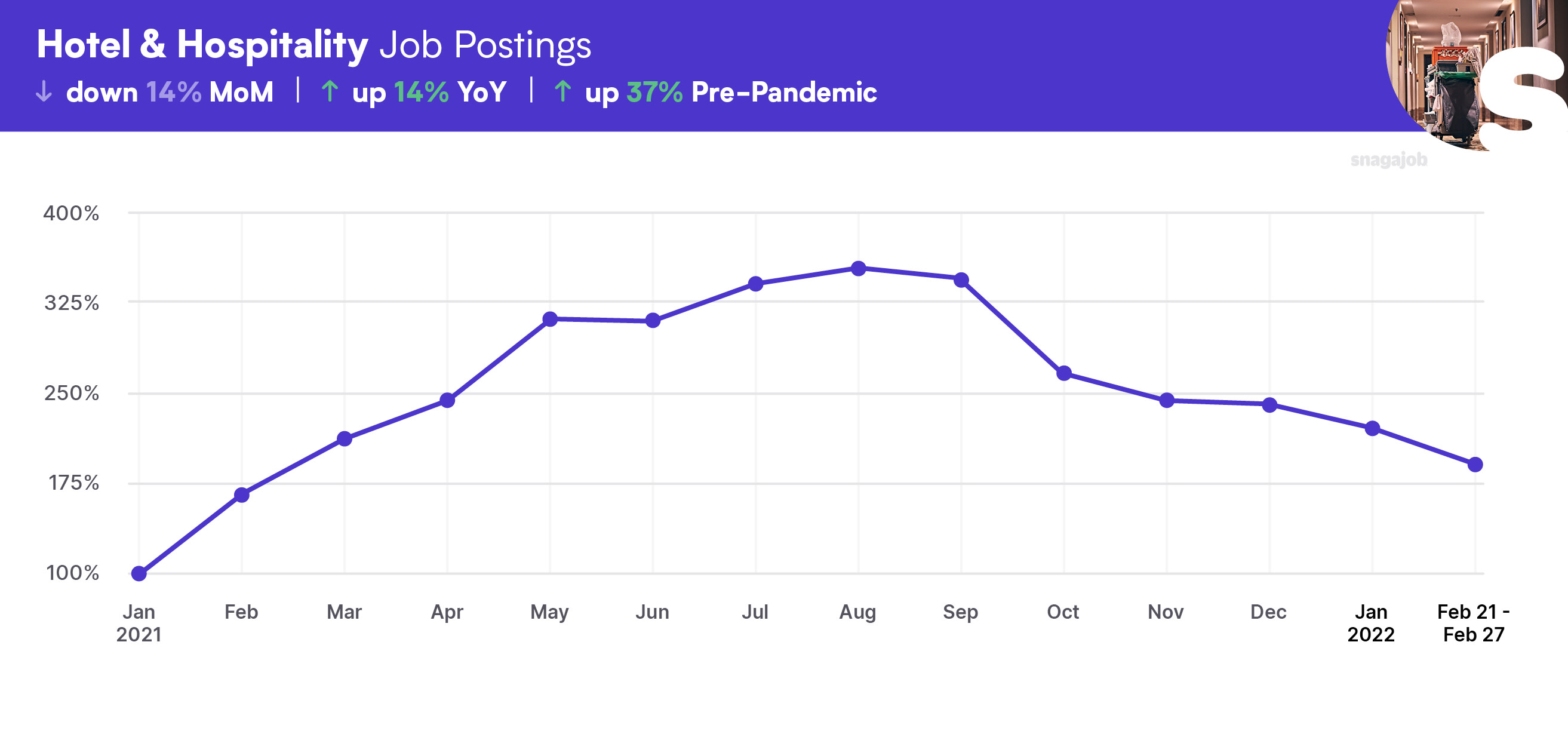

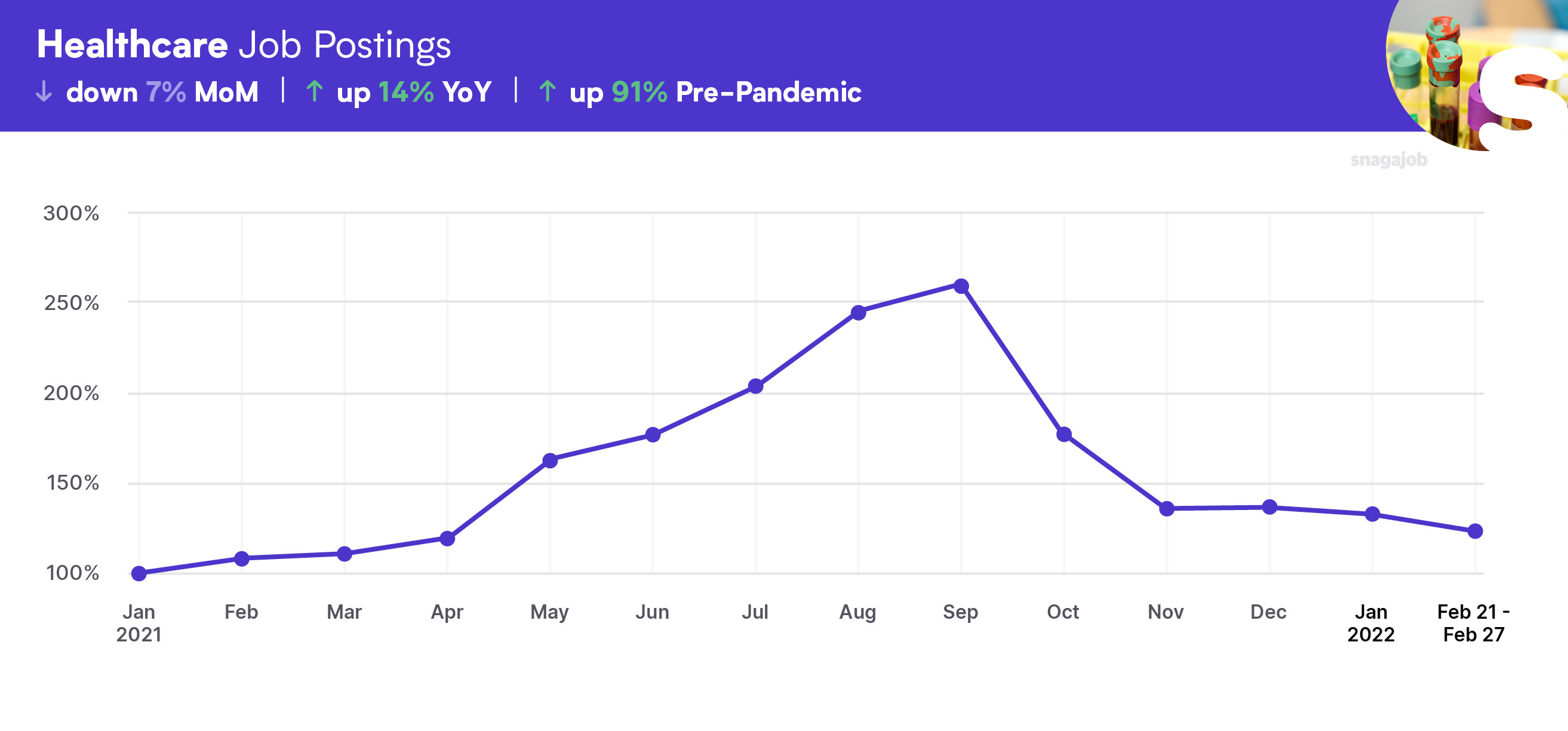

Here are the latest job numbers by industry:

Food & Restaurant jobs are up 38% compared to pre-pandemic norms, seeing a 1% month-over-month gain, and a 21% year-over-year growth.

Hotel & Hospitality jobs are up 37% compared to pre-pandemic norms, seeing a 14% month-over-month decline, and a 14% year-over-year gain.

Healthcare jobs are up 91% compared to pre-pandemic norms, seeing a 7% month-over-month decline, and a 14% year-over-year growth.

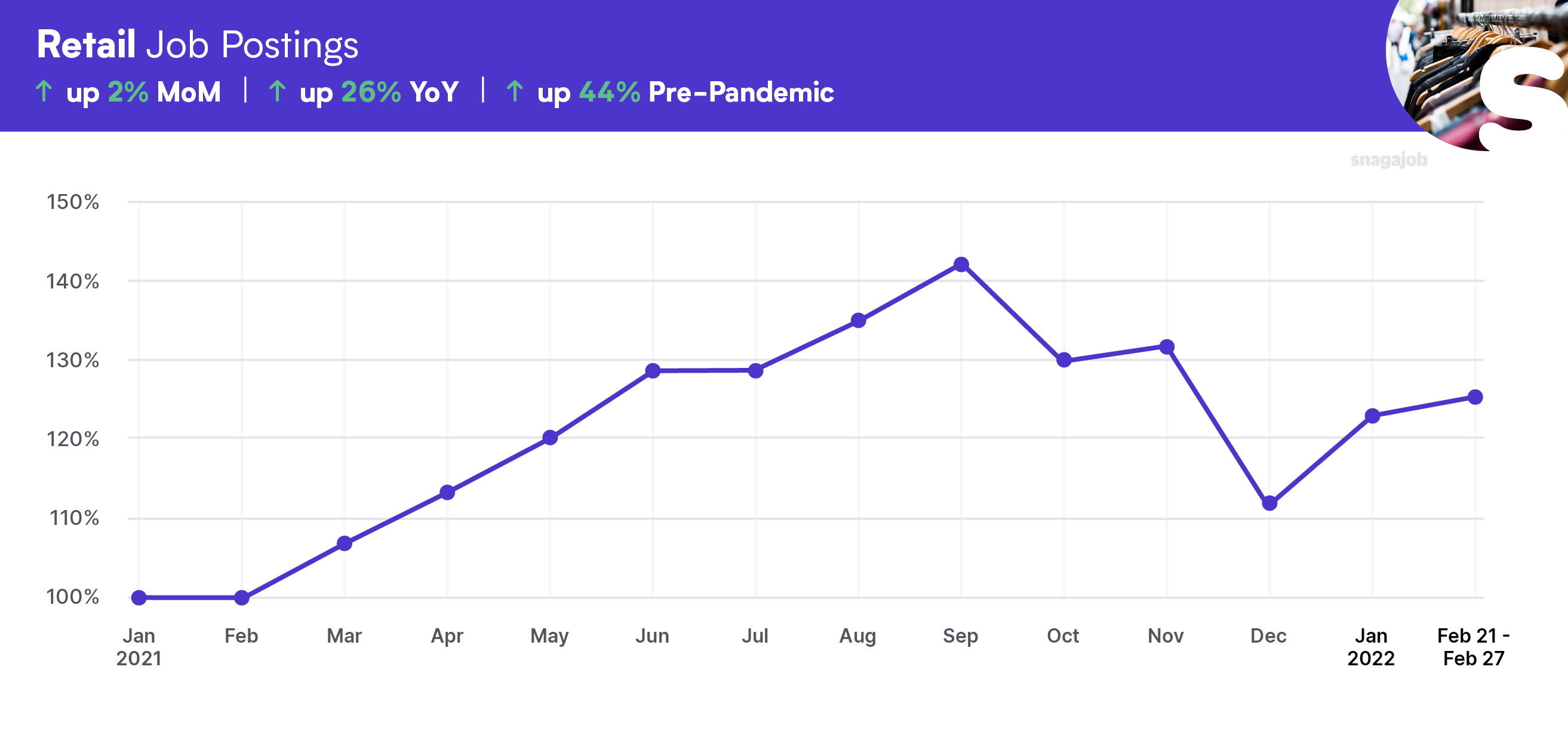

Retail jobs are up 44% compared to pre-pandemic norms, seeing a 2% month-over-month growth, and a 26% year-over-year gain.

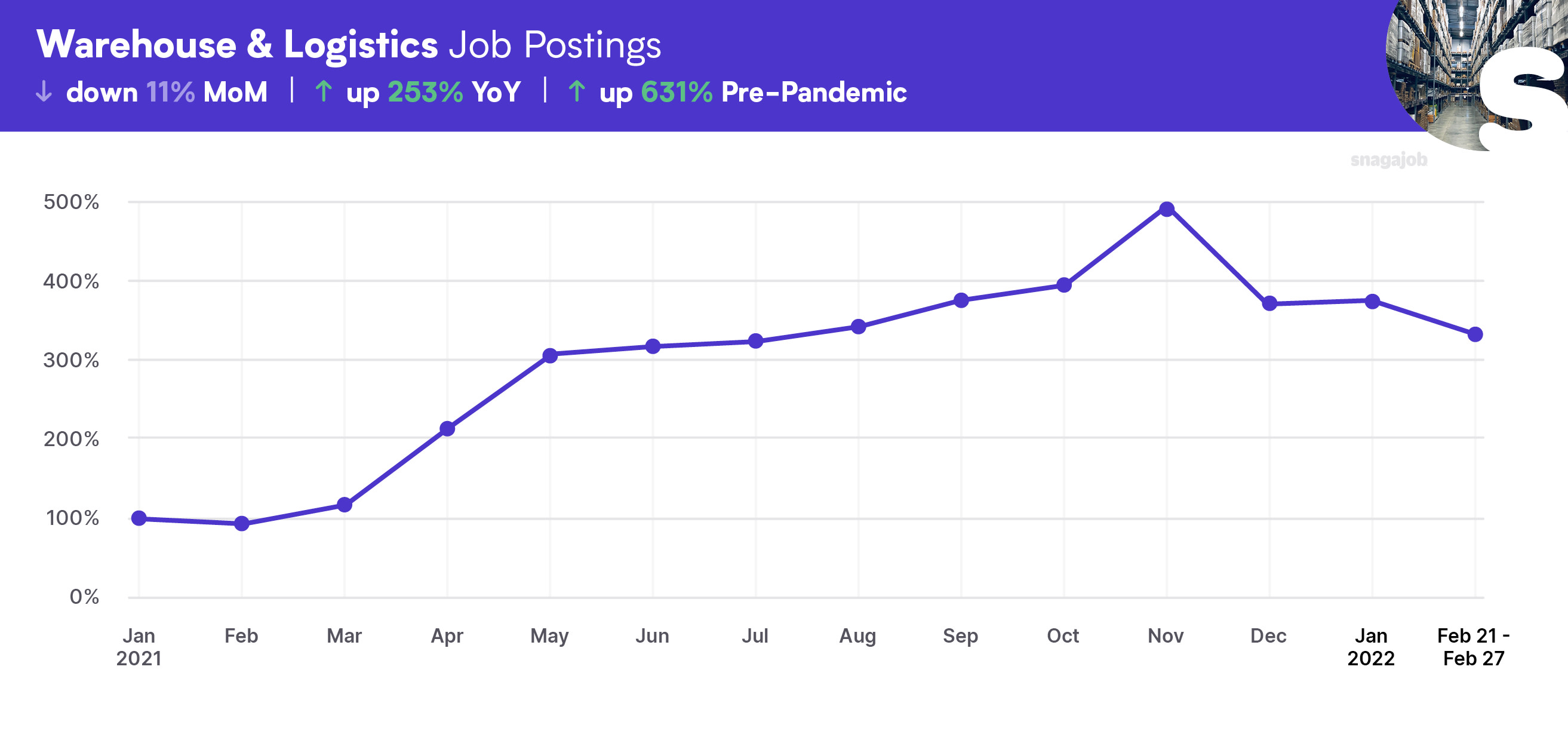

Warehouse & Production jobs are up 631% compared to pre-pandemic norms, seeing an 11% month-over-month decline, and a 253% year-over-year gain.

Workers

Google searches for hourly jobs are up 9% year-over-year.

The bottom line

We’ll continue to be your best resource for hourly job market insights as we collectively navigate towards our new normal and beyond.