Weekly Hourly Hiring Report 1/12/22

Highlights

Overall, hourly jobs are flat with a 0% change from pre-pandemic norms in March of 2020. Yet these jobs are down 10% month-over-month, although up 6% over January 2021.

The start of 2022 has been marked by a record wave of the Omicron variant, causing millions of people to miss work. This has left many understaffed employers scrambling to manage their businesses. Reduced hours, canceled flights, and empty grocery shelves are just a few tell-tale signs of how this is playing out amid an already tight labor market.

US employers added 199,000 jobs in December, lower than the 422,000 expected (and compared to 249,000 in November), according to the Bureau of Labor Statistics.

The leisure and hospitality job sector rose the most in December, adding 53,000 jobs.

Unemployment fell to 3.9%, down from 4.2% the previous month

At face value, these numbers look strong. So, why are employers still feeling the strain, and struggling to fill open roles?

According to Stephen Juneau, U.S. Economist for Bank of America Securities, Omicron will probably impact the labor market by reducing both the supply of labor and the demand for labor. It will also have a major “quarantine effect,” with a significant jump in people absent from work but still employed. This could result in a constrained supply that affects businesses, yet doesn't impact stats that draw the biggest headlines. Bank of America estimates there will be more than 4 million US workers under quarantine at the peak of the Omicron wave.

In positive news, wages rose 0.6% in December (4.7% year over year), suggesting that the tight competition for workers has prompted many businesses to pay higher salaries to attract employees. However, higher wages do impact inflation, which has led the government to curtail stimulus efforts and to most likely raise interest rates for the first time since 2018.

While Omicron continues to throw us curve balls, it’s important to note that we’ll eventually put these setbacks behind us. As we continue to make progress, the momentum will build as we work together to align the needs of hourly workers and employers.

Jobs

All industry data is from 3/2/20-12/6/21

Here are the latest job numbers by industry:

Quick service restaurant (QSR) jobs are down 31% compared to pre-pandemic norms, seeing a 2% month-over-month decline, and a 4% year-over-year decline.

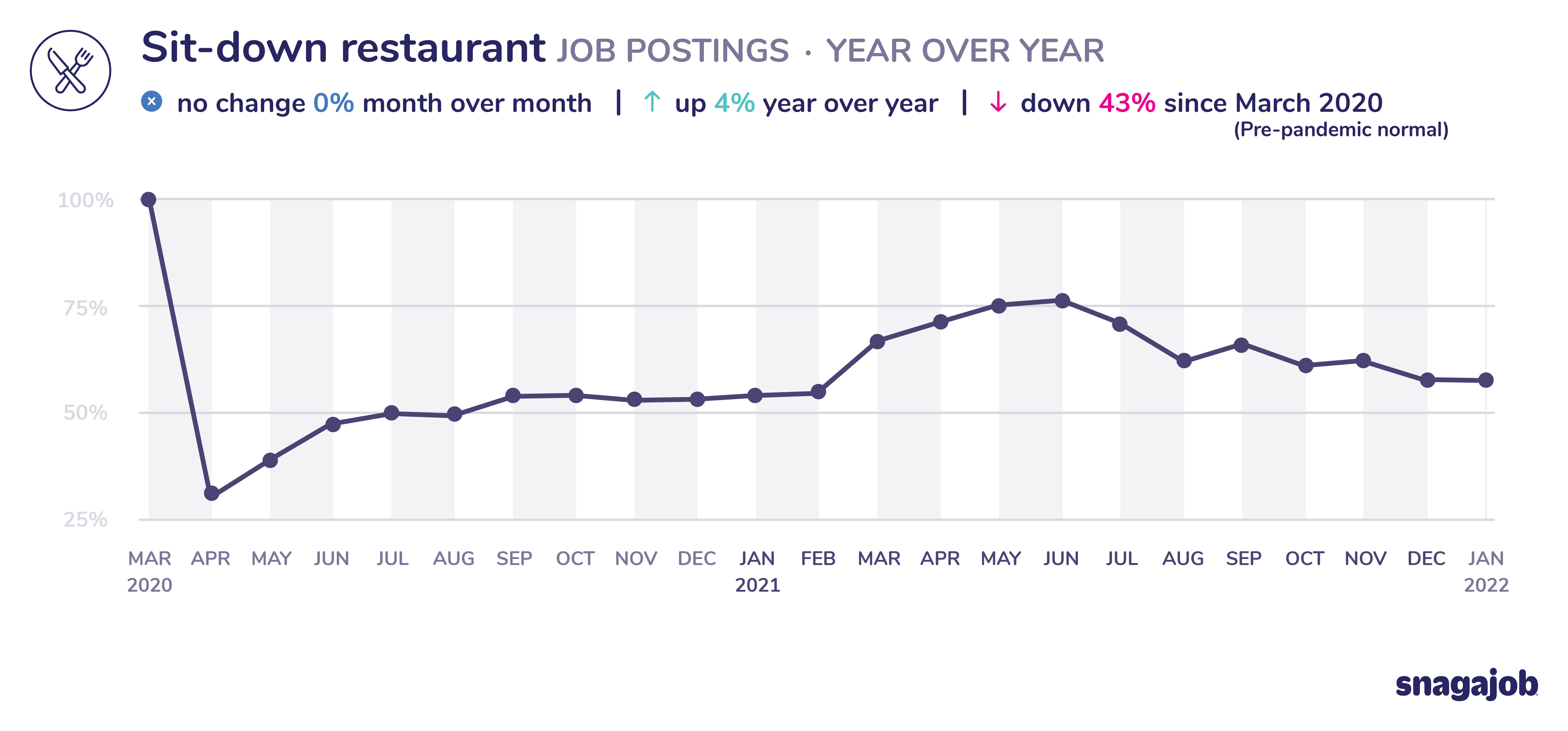

Sit-down restaurant jobs are down 43% compared to pre-pandemic norms, flat at 0% month-over-month, and seeing a 4% year-over-year growth.

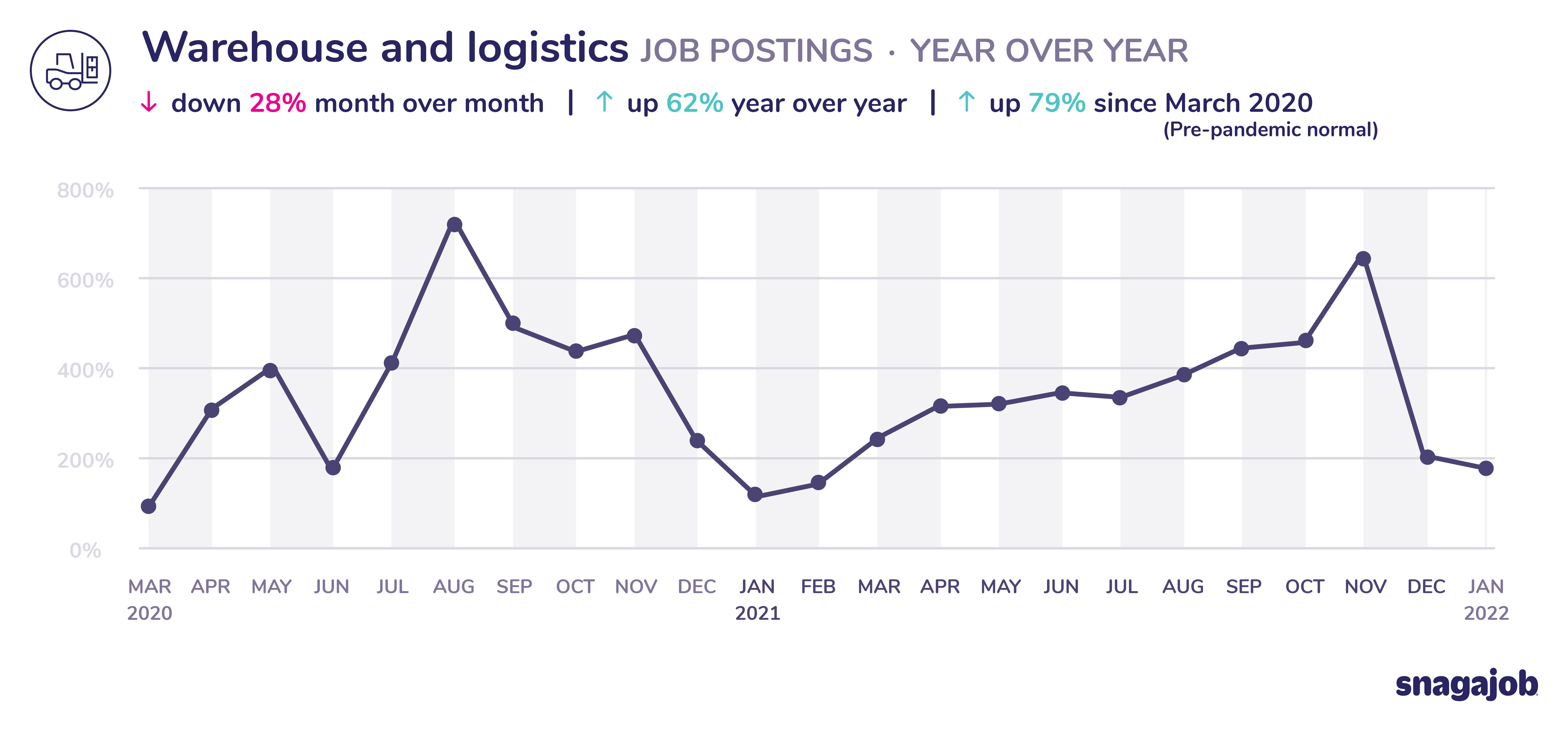

Warehouse and logistics jobs are up 79% compared to pre-pandemic norms, seeing a 28% month-over-month decline, and 62% year-over-year growth.

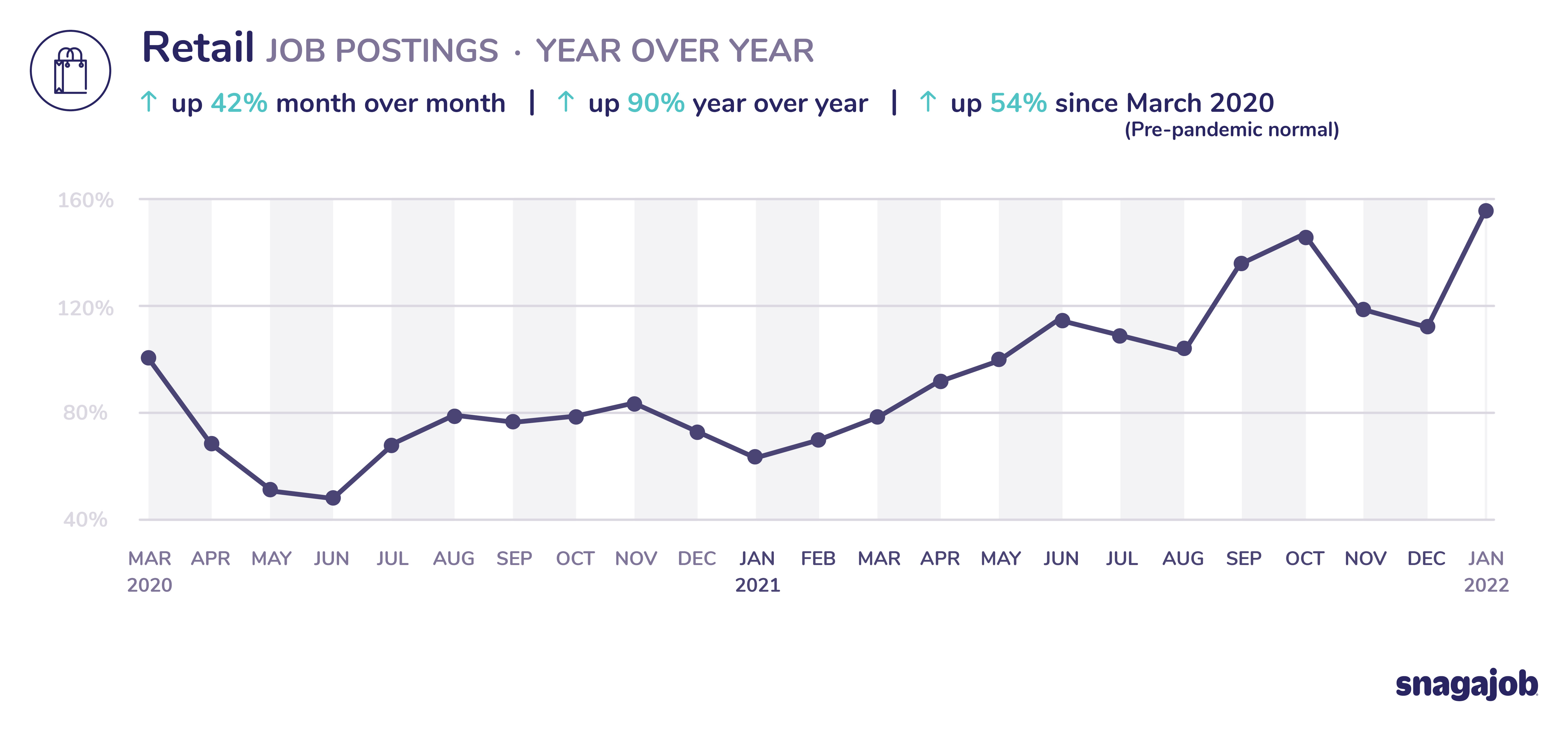

Retail jobs are up 54% compared to pre-pandemic norms, seeing a 42% month-over-month growth, and 90% year-over-year growth.

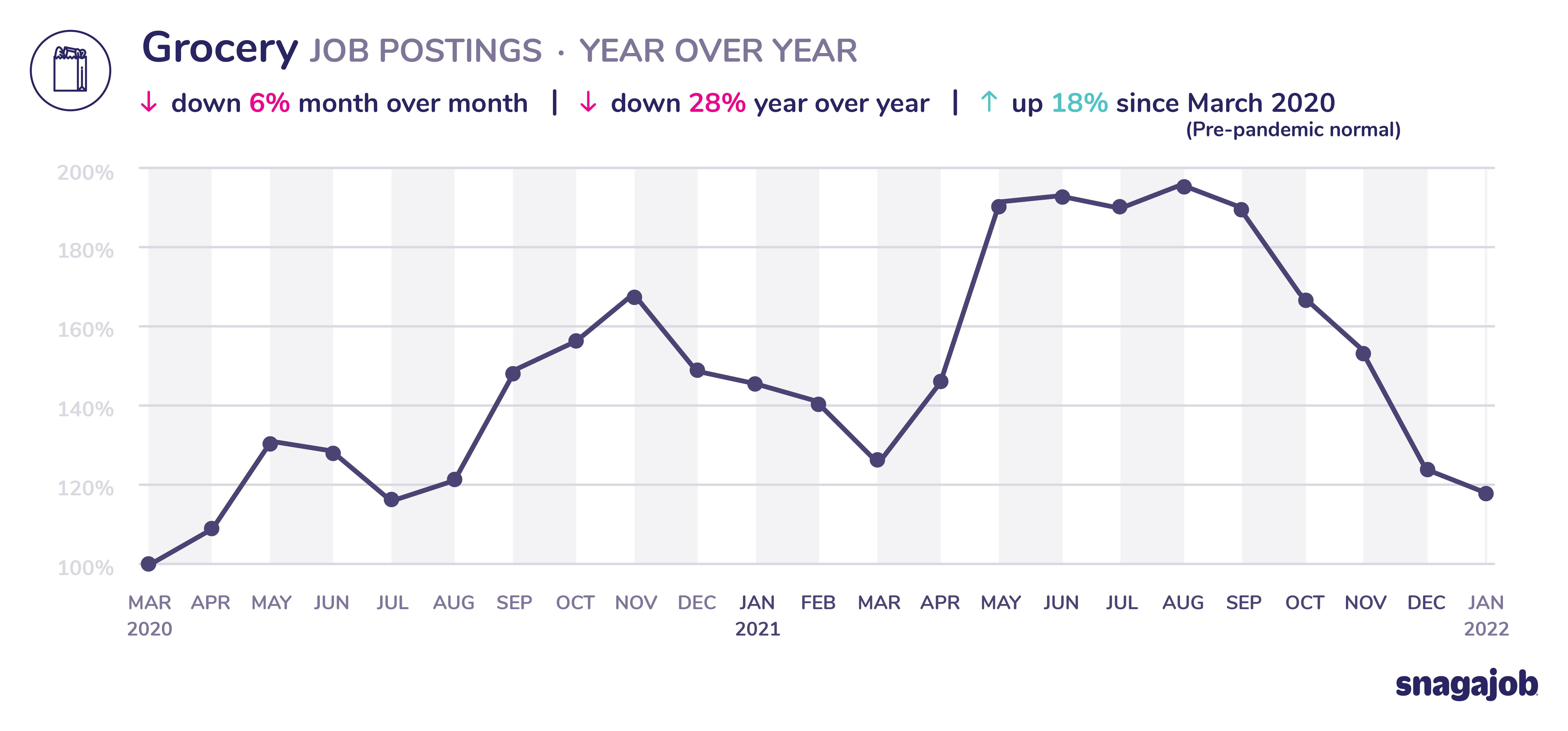

Grocery jobs are up 18% compared to pre-pandemic norms, seeing a 6% month-over-month decline, and a 28% year-over-year decline.

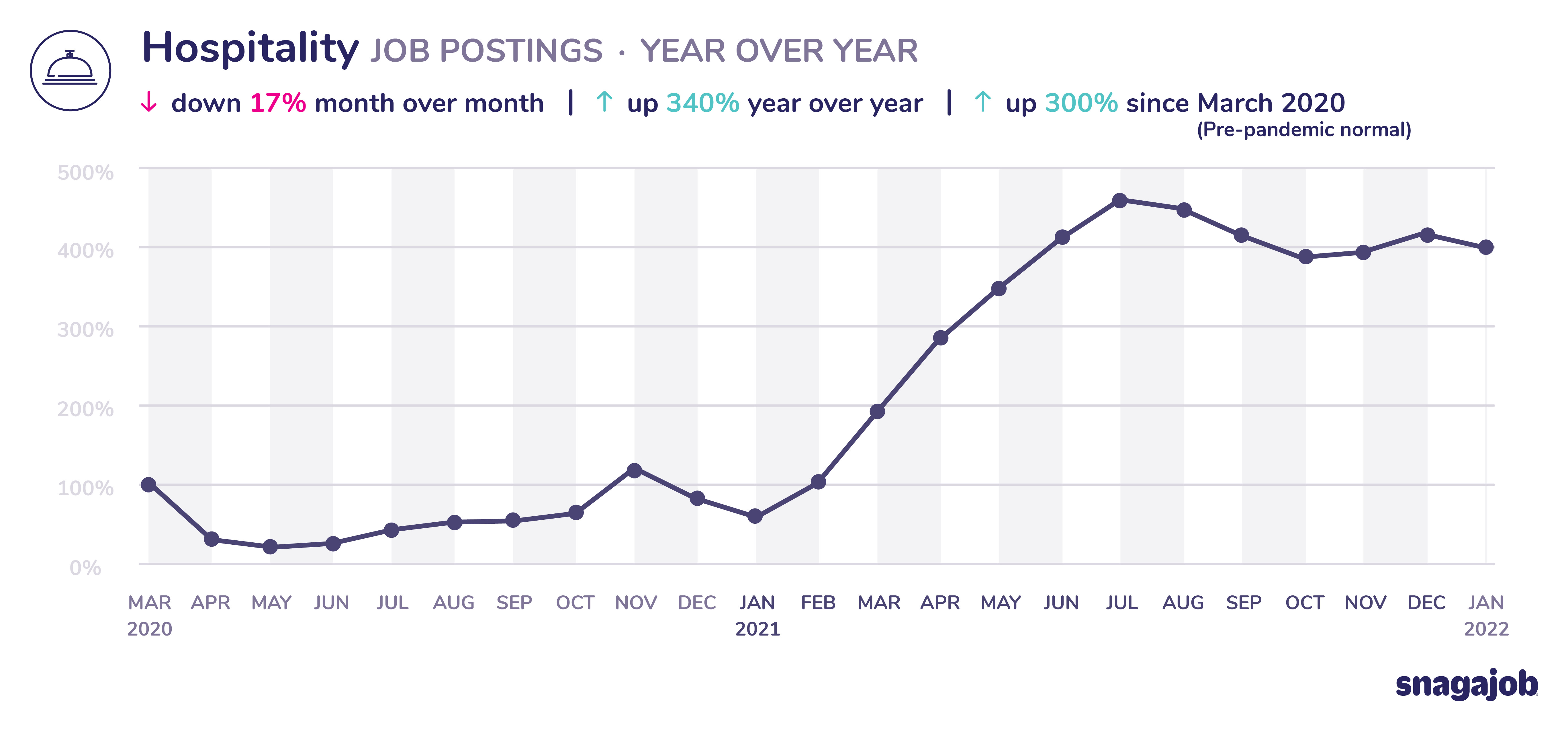

Hospitality jobs are up 300% compared to pre-pandemic norms, seeing a 17% month-over-month decline, and 340% year-over-year growth.

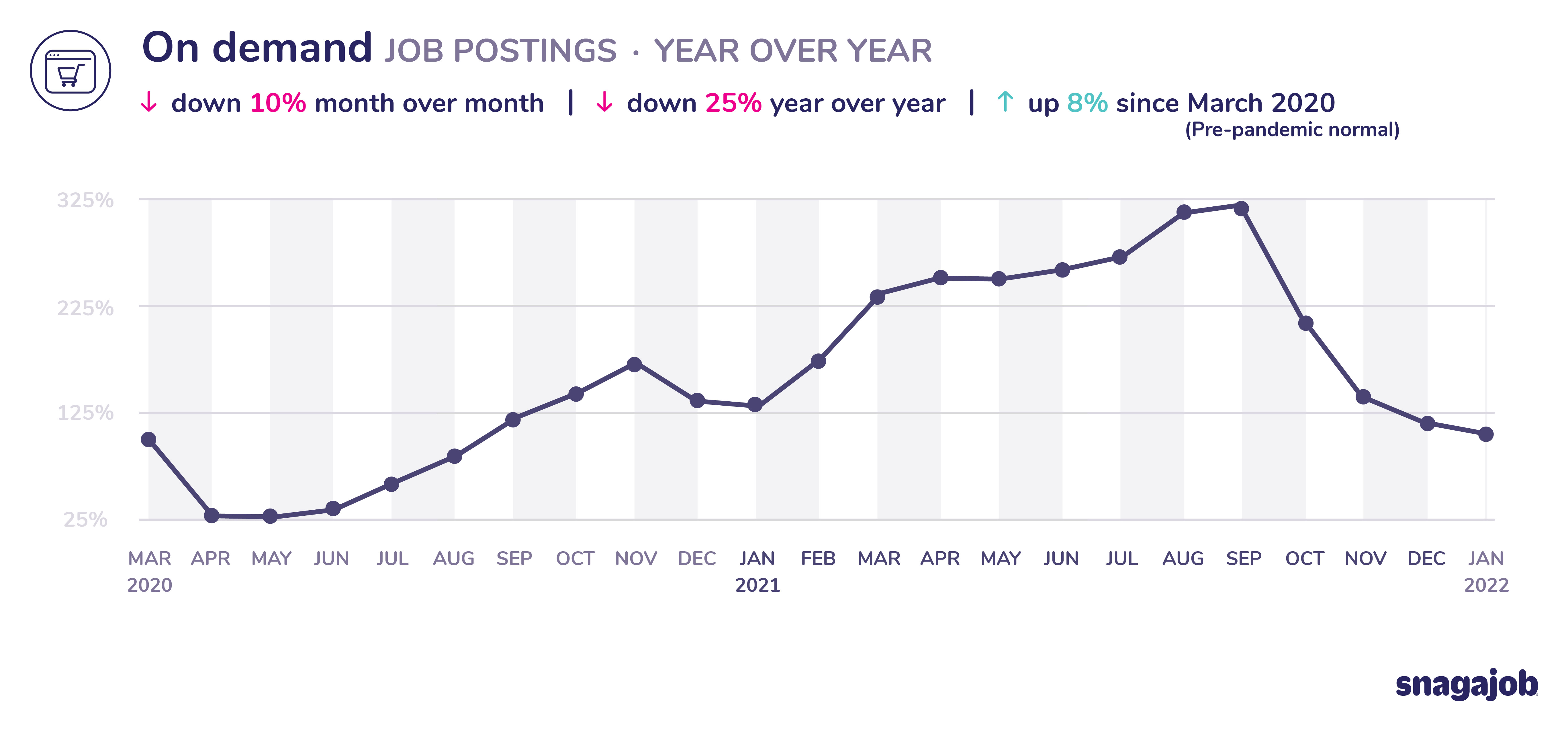

On-demand jobs are up 8% compared to pre-pandemic norms, seeing a 10% month-over-month decline, and a 25% year-over-year decline.

Convenience store jobs are down 11% compared to pre-pandemic norms, seeing a 7% month-over-month decline, and a 15% year-over-year growth.

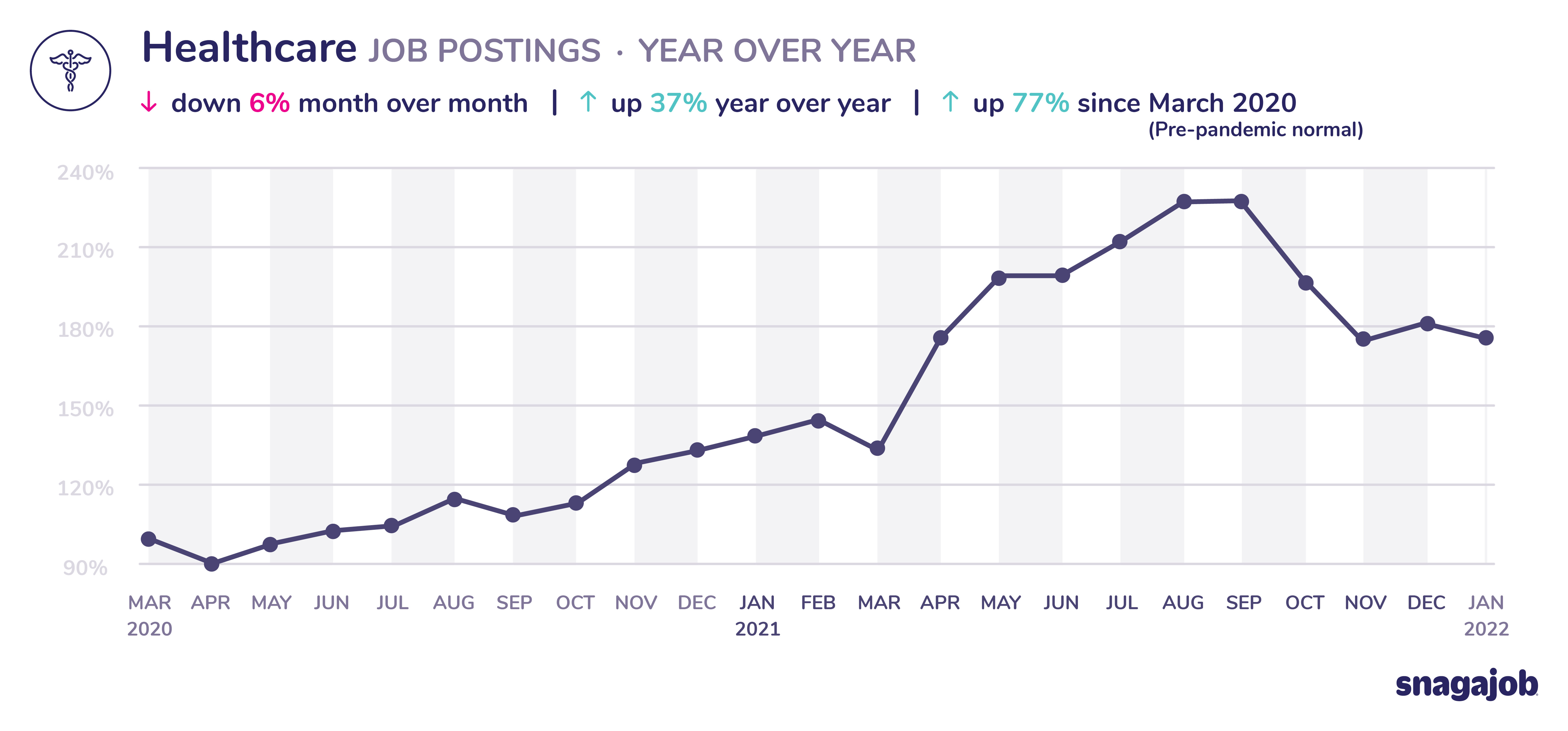

Healthcare jobs are up 77% compared to pre-pandemic norms, seeing a 6% month-over-month decline, and 37% year-over-year growth.

Workers

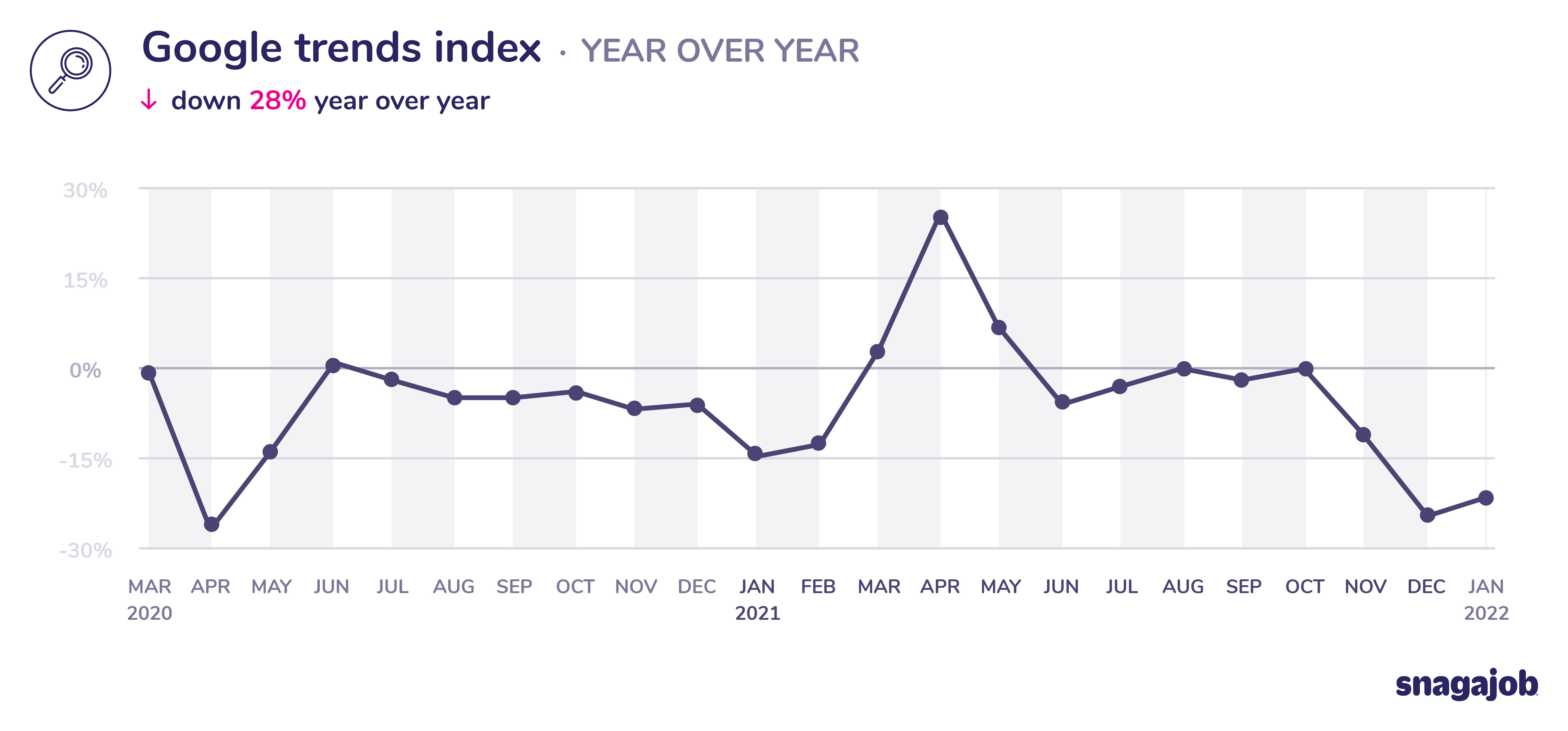

Google searches for hourly jobs are down 23% year over year.

The bottom line

We’ll continue to be your best resource for hourly job market insights as we collectively navigate towards our new normal and beyond.