Weekly Hourly Hiring Report 3/30/2021

How COVID-19 is affecting hourly work

Weekly Hourly Hiring Report 3/30/21

Highlights

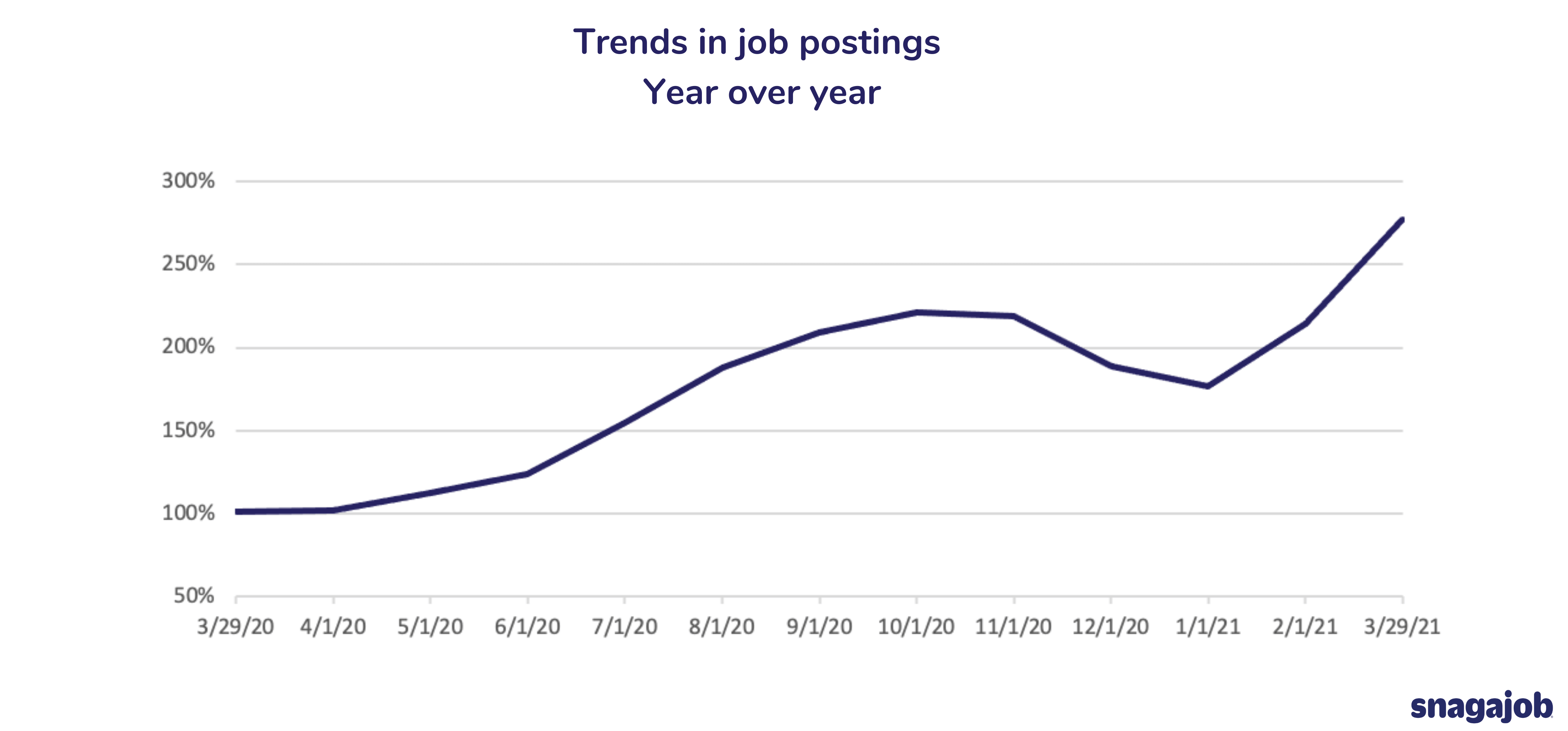

Overall jobs are up 63% month over month and up 188% year over year.

We are seeing high demand and low supply in the workforce right now. Businesses are eager to operate at full capacity and accommodate as many customers as possible but are challenged to find and hire enough staff.

The struggle to find employees is counterintuitive in a recession and catching many businesses by surprise. A combination of factors are at play. Many workers aren’t comfortable working without a vaccine, while others are getting by with stimulus checks, unemployment benefits and tax refunds.

Employers are getting creative to attract and retain good talent. In a recent Snagajob survey, many employers reported offering a range of employee benefits to stay competitive. Here are the top three:

Flexible hours and scheduling (89%)

Employee discounts (76%)

Job skills development and training (54%)

Other trends among hourly employers include signing bonuses, increased pay and vaccination incentives.

Jobs

Here are the latest job numbers by industry:

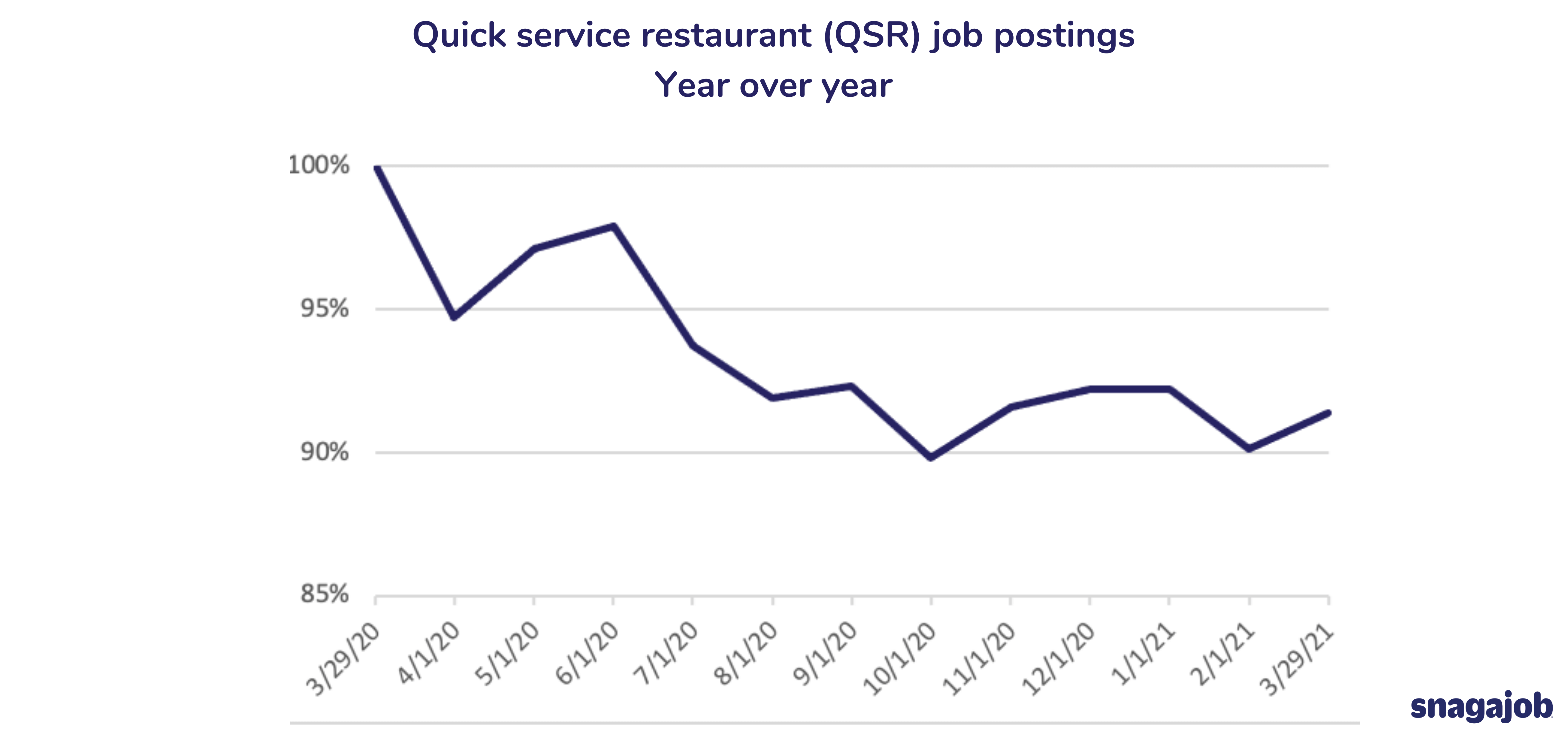

Quick service restaurant (QSR) jobs are up 1% month over month and down 7% year over year.

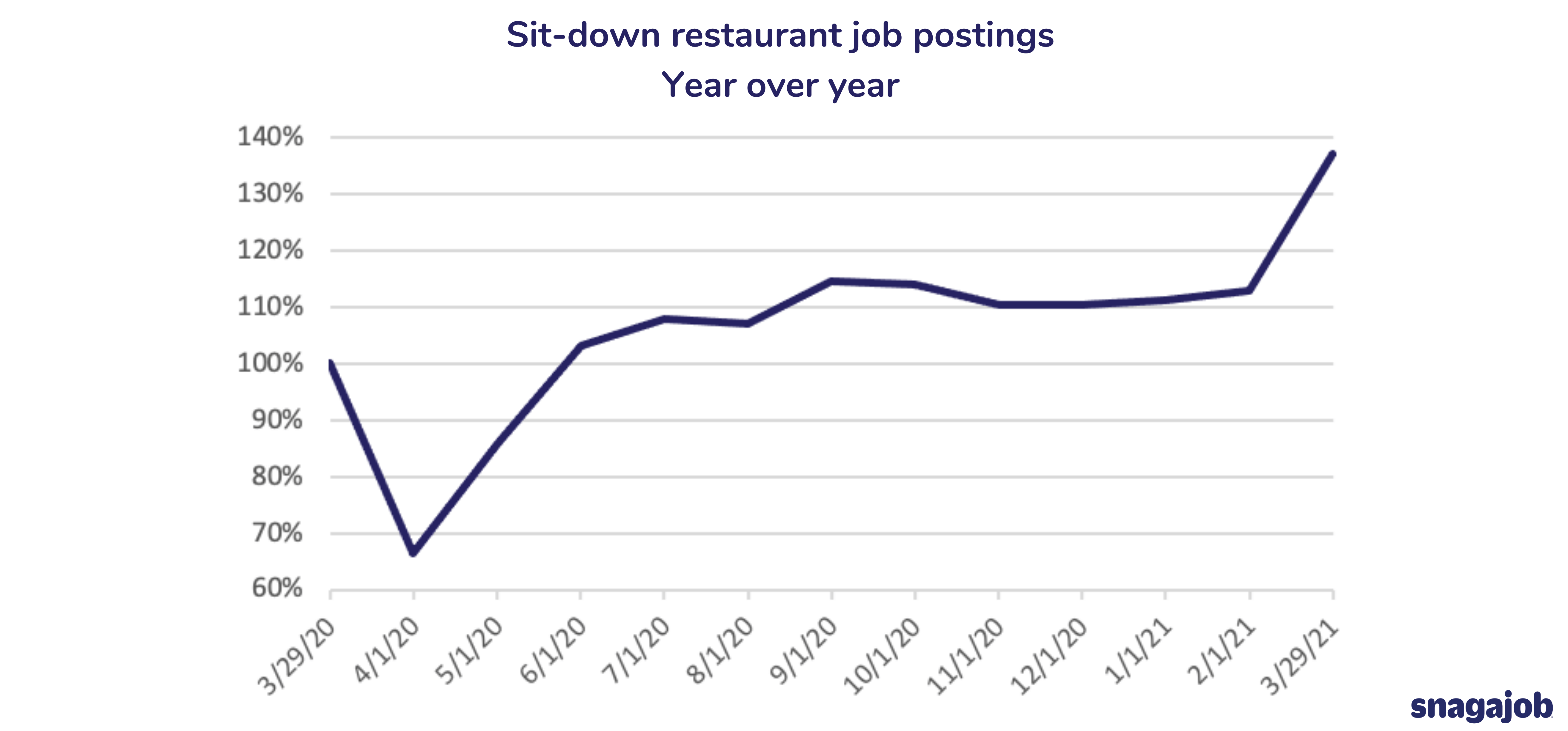

Sit-down restaurant jobs are up 24% month over month and up 37% year over year.

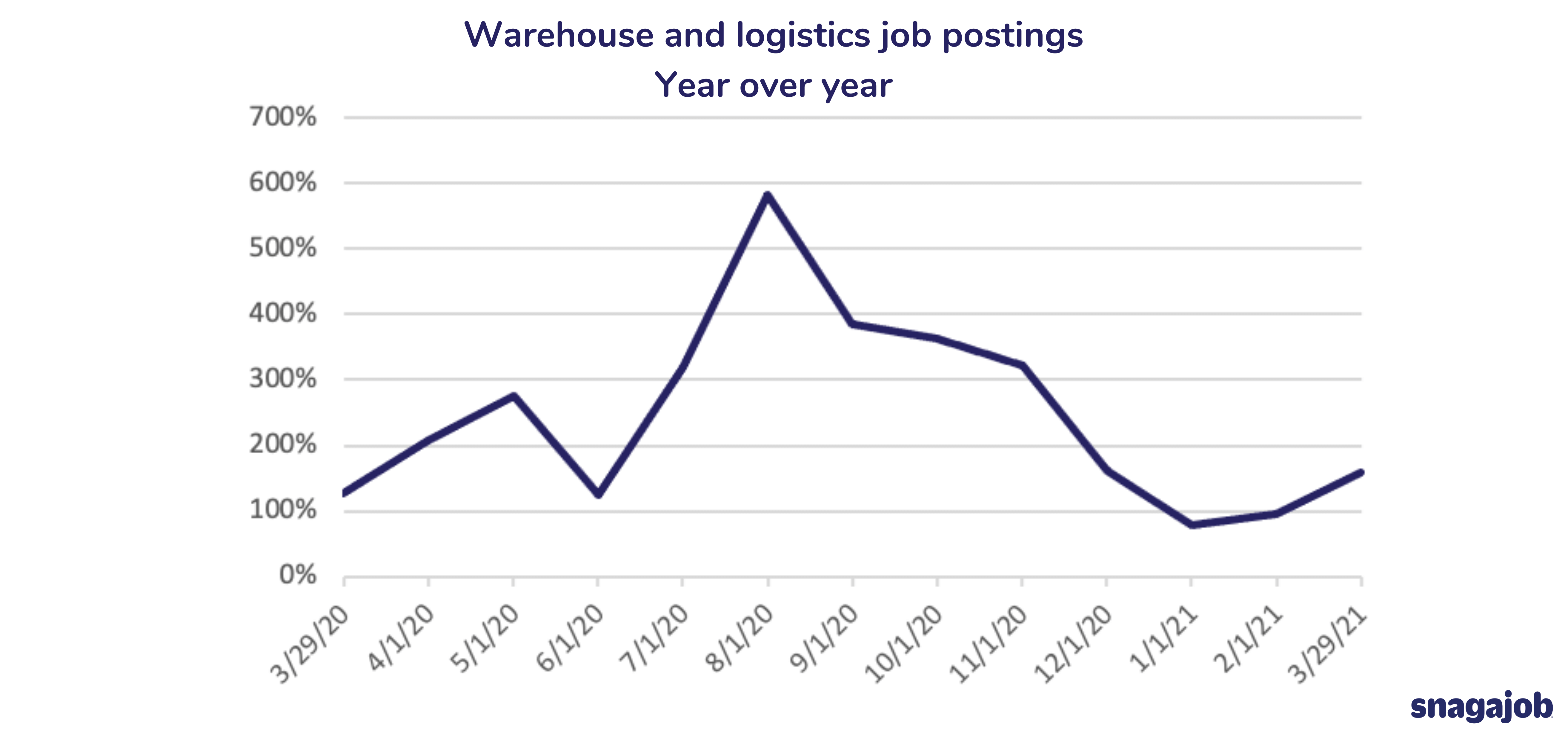

Warehouse and logistics jobs are up 64% month over month and up 140% year over year.

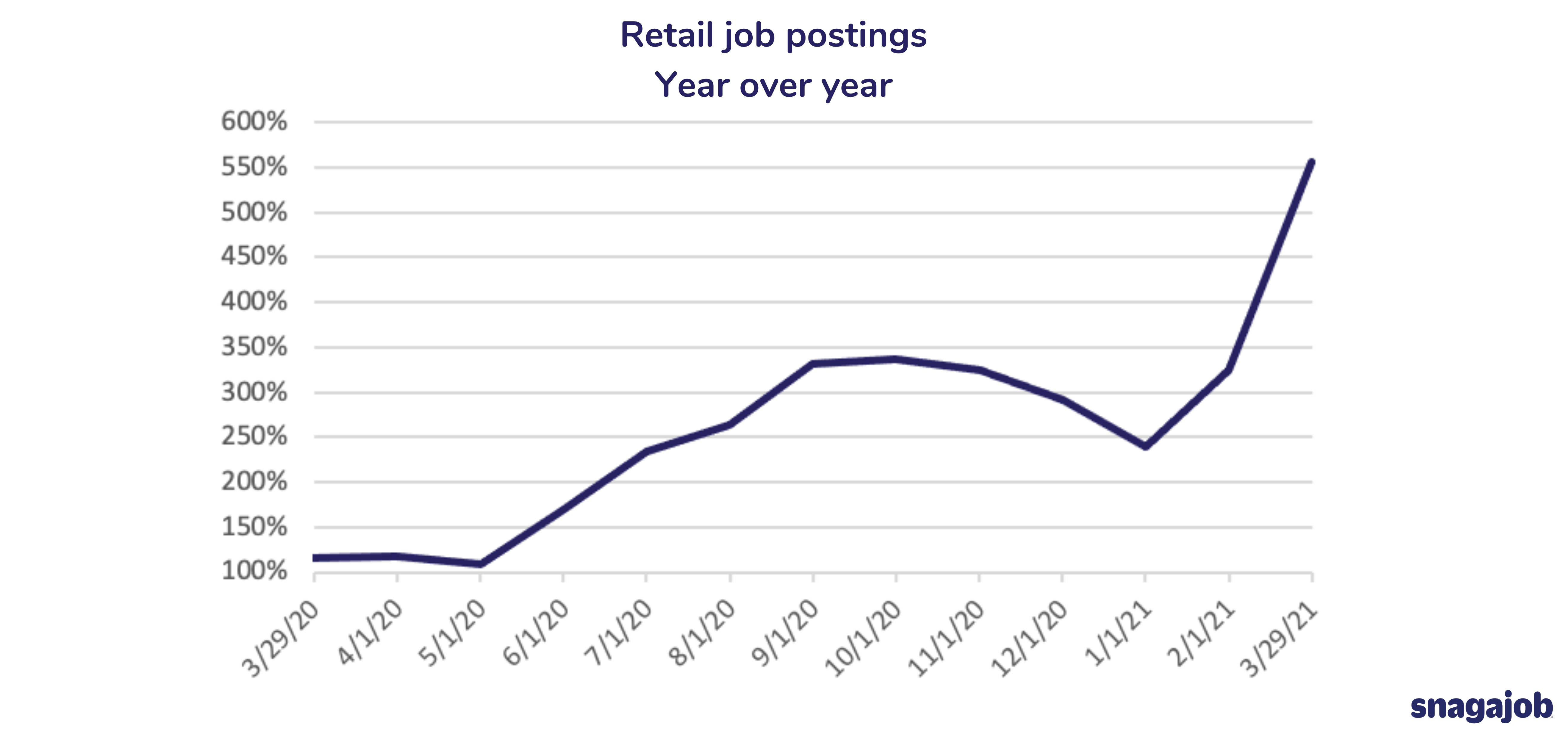

Retail jobs are up 231% month over month and up 518% year over year.

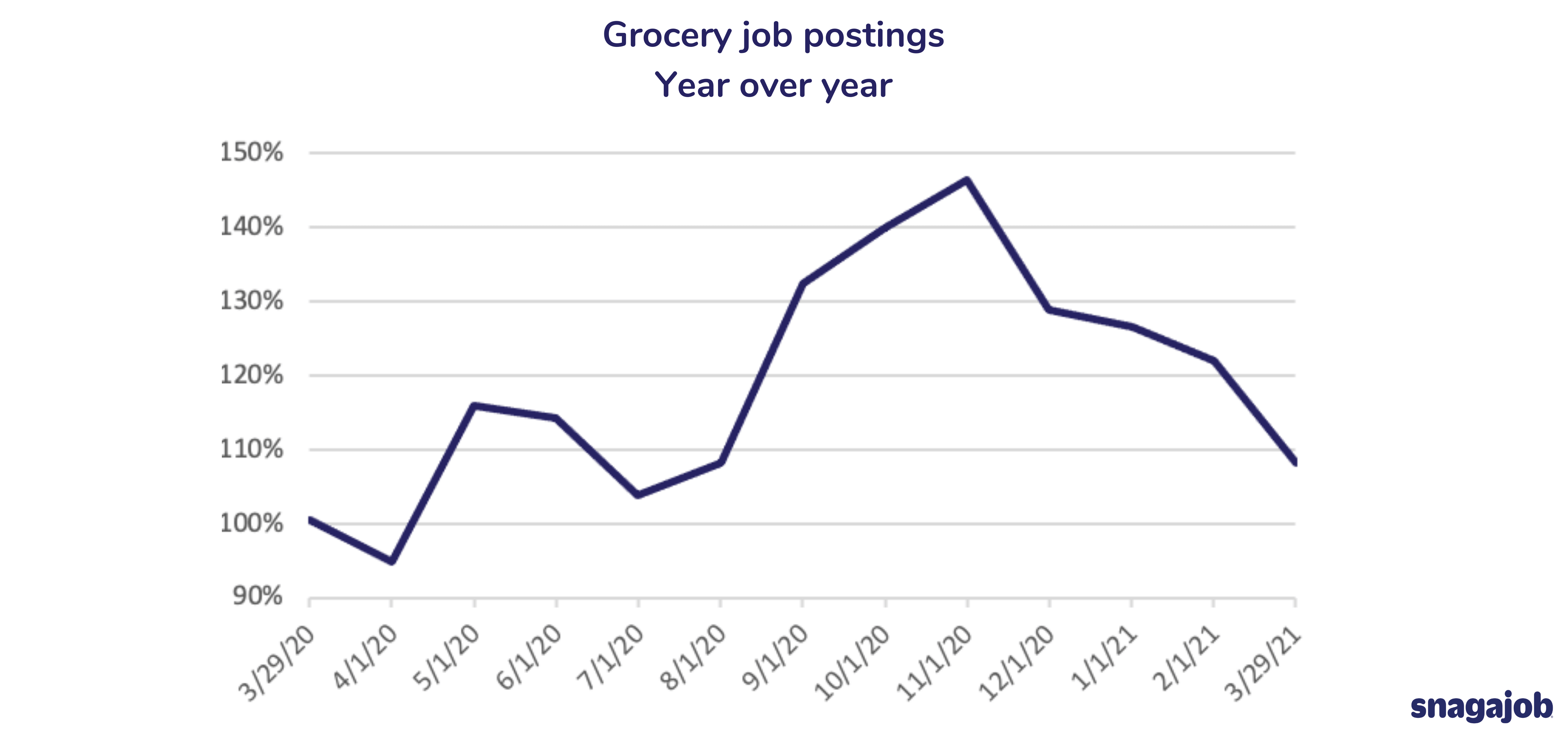

Grocery jobs are down 14% month over month and up 12% year over year.

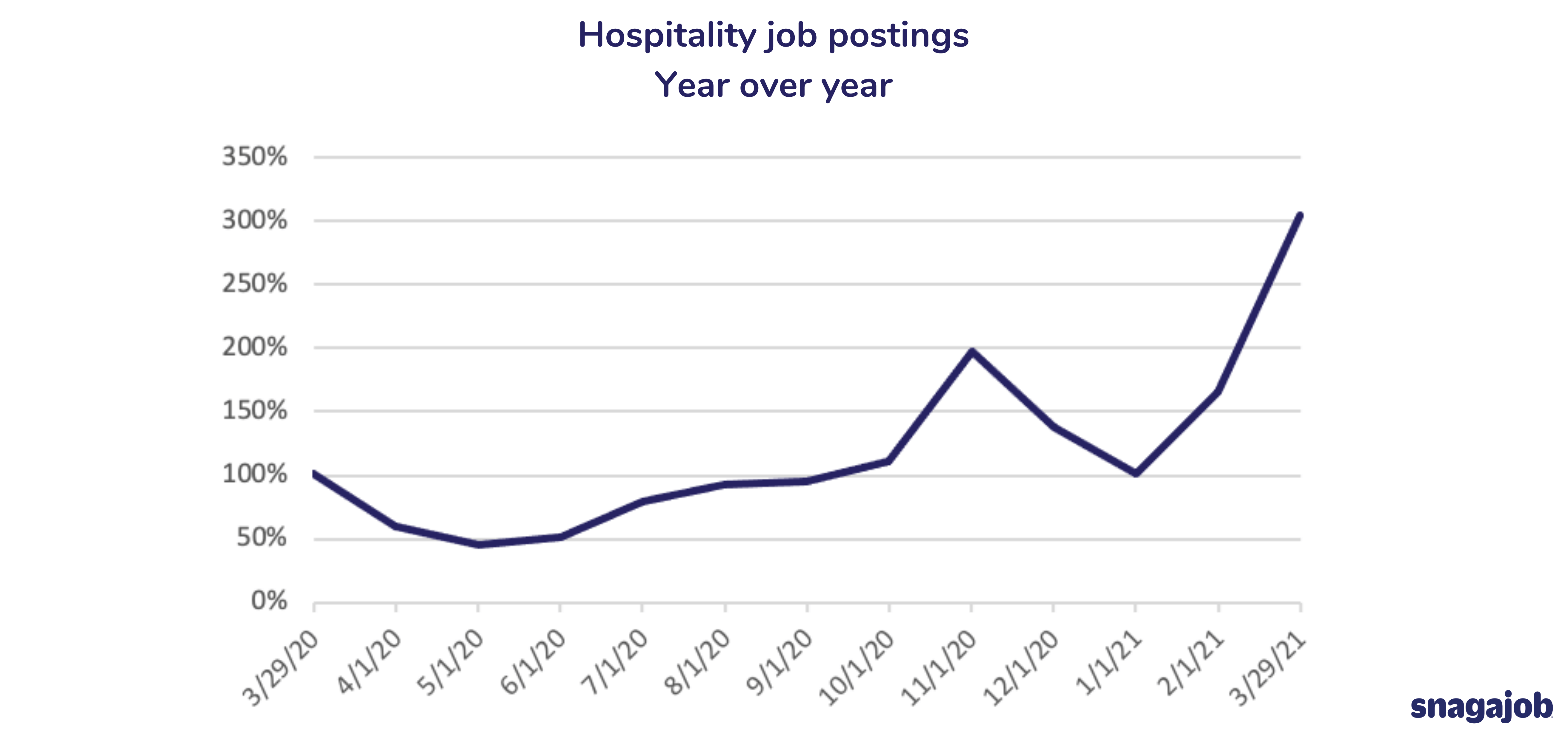

Hospitality jobs are up 139% month over month and up 399% year over year.

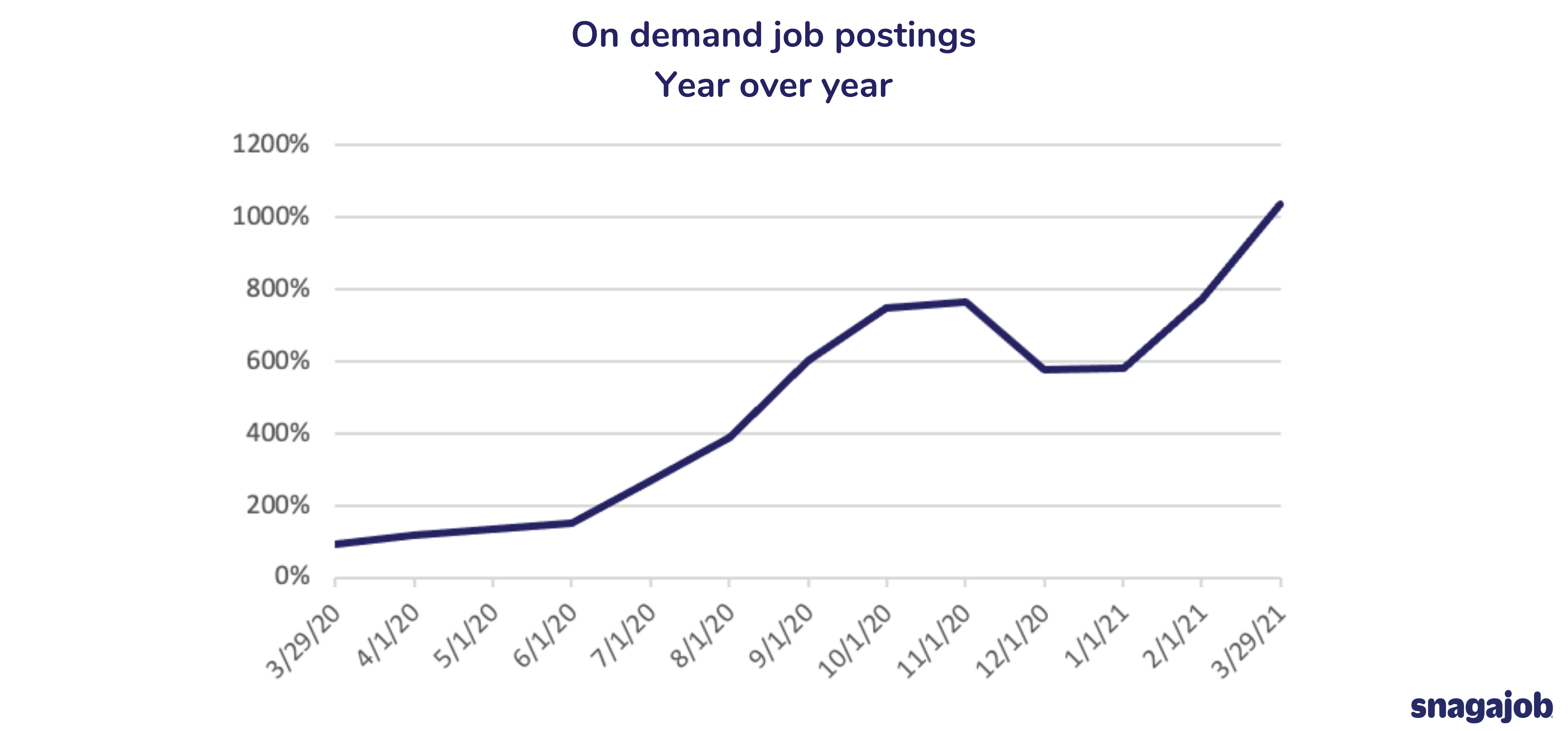

On demand jobs are up 265% month over month and up 988% year over year.

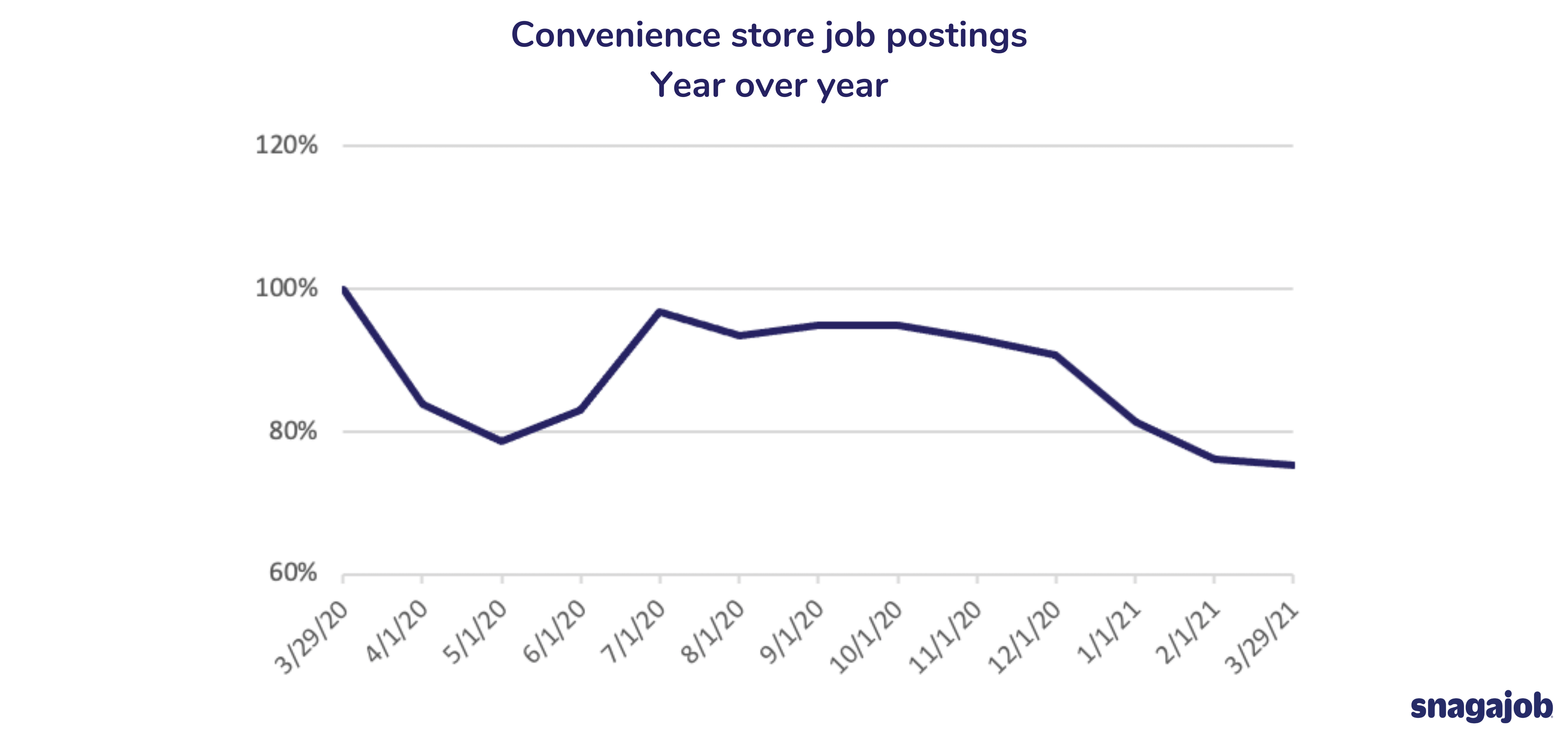

Convenience store jobs are down 1% month over month and down 21% year over year.

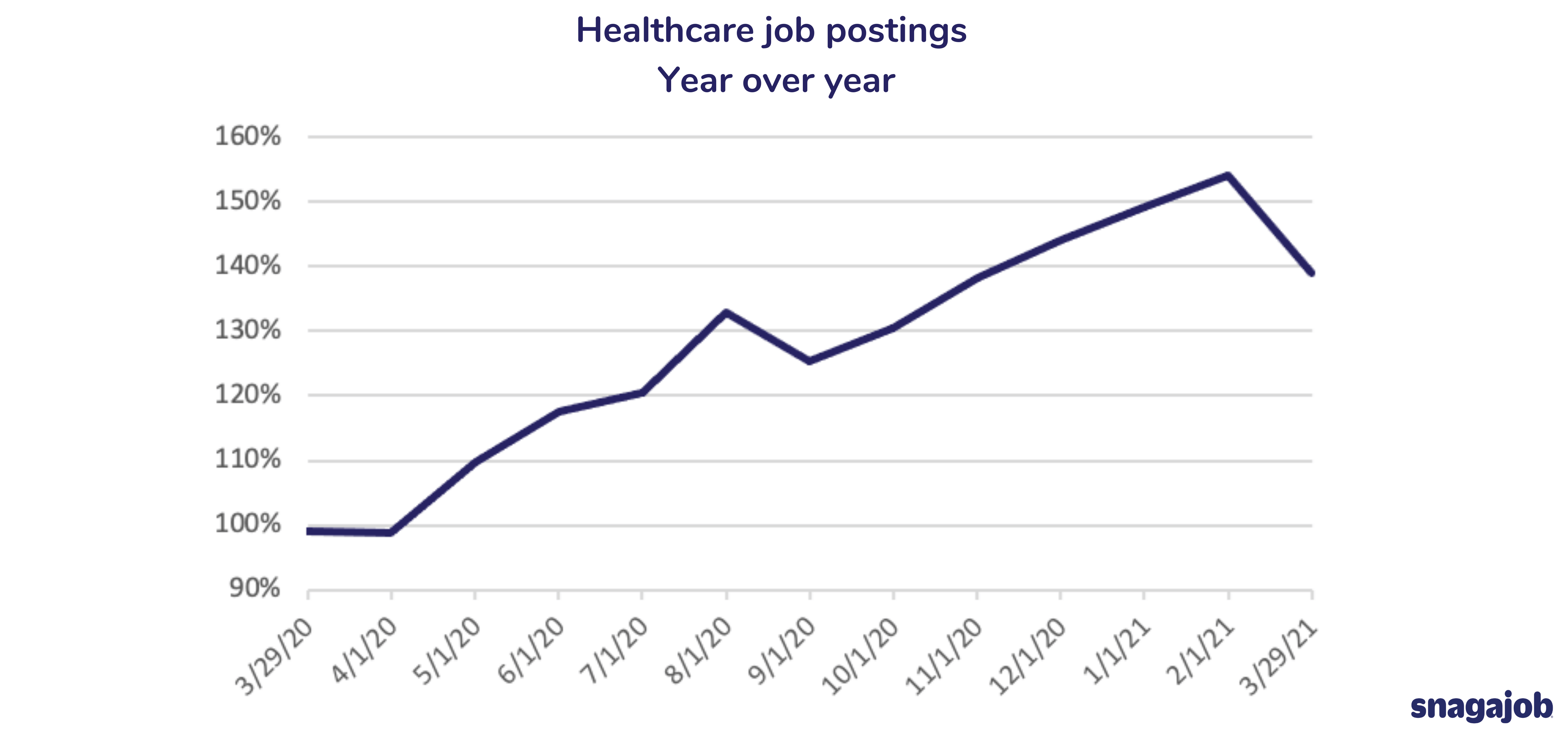

Healthcare jobs are down 15% month over month and up 29% year over year.

Workers

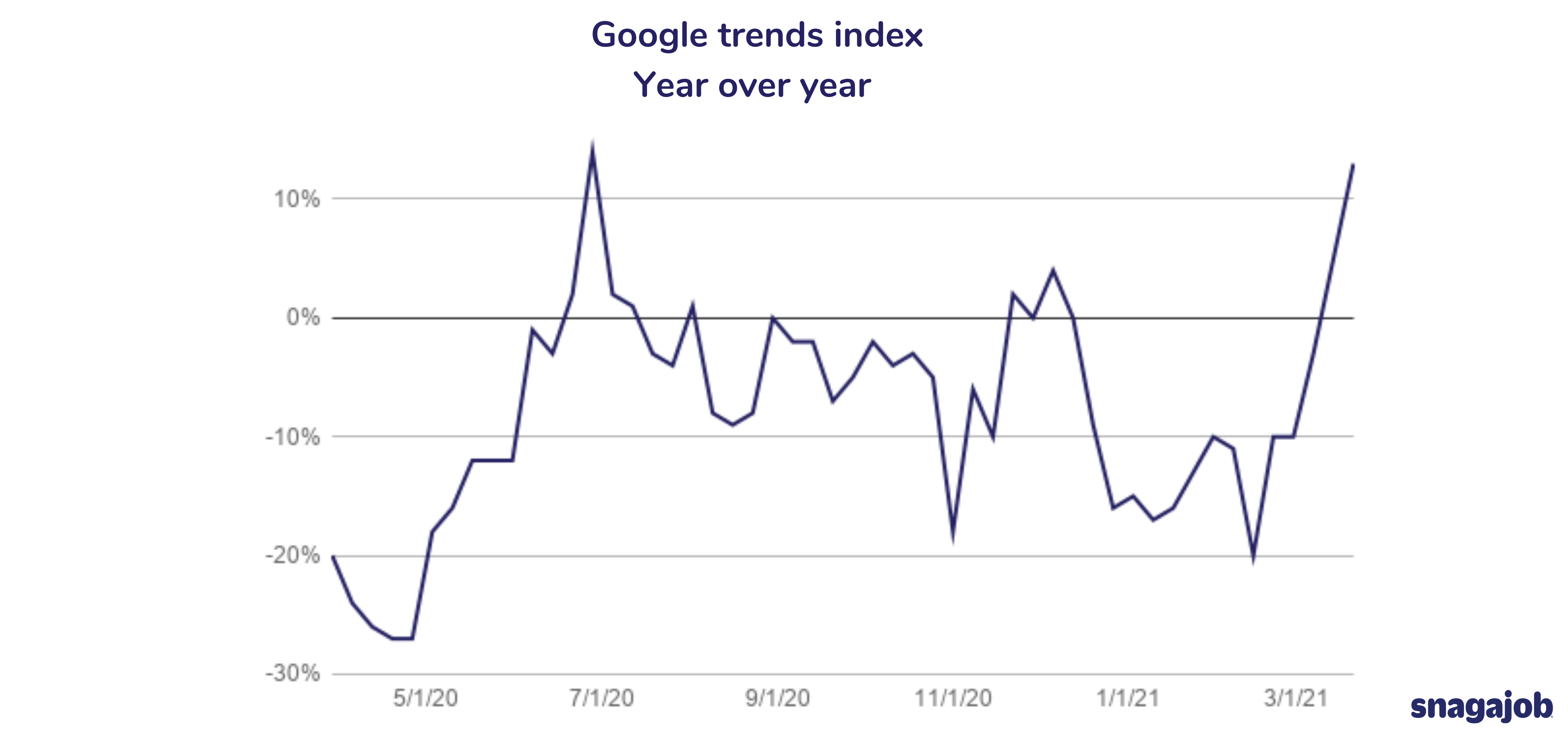

Google searches for hourly jobs are up 13% year over year.

The bottom line

We’ll continue to be your best resource for hourly job market insights as we collectively navigate towards our new normal and beyond.