Weekly Hourly Hiring Report 8/10/21

How COVID-19 is affecting hourly work

Weekly Hourly Hiring Report 8/10/21

Highlights

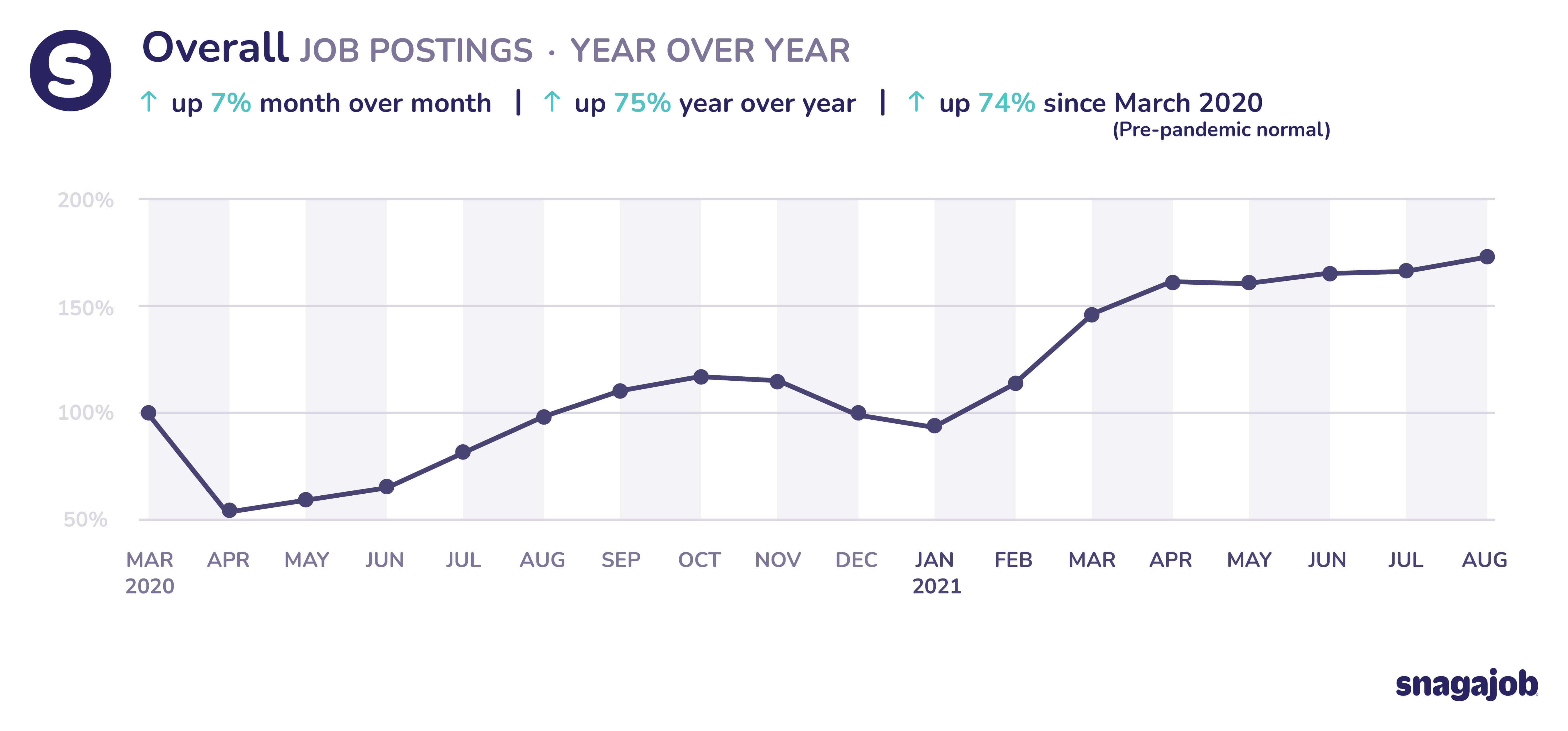

Overall jobs are up 74% compared to pre-pandemic norms, with 7% month over month growth and 75% year over year growth. Google searches for hourly jobs are down 6% year over year.

For the first time in decades, the American hourly worker has the upper hand in wage conversations, and millions are asking themselves if they’re satisfied with their current job.

The U.S. added 943,000 jobs in July, the best growth since August 2020, and there were 5.7 million fewer jobs than there were in February 2020 according to Labor Department data.

The number of jobs available outnumbers Americans looking for work but the percentage of adults working or looking for a job is slowly increasing—up by 1.5% since April 2020.

The number of people who voluntarily left their jobs increased to 3.9 million in the month, and the quits rate rose to 2.7%.

In response, employers are doing more than ever to stay competitive in the most challenging labor market in recorded history.

Kroger Co., Chipotle Mexican Grill Inc. and Under Armour Inc. are increasing hourly wages to retain employees. Starbucks and Drury Hotels are offering hiring bonuses to entry-level applicants. CVS is no longer requiring job seekers to have high school diplomas. And small businesses across the country are luring workers from other local businesses with offers of better hours and higher pay.

In COVID-19 news, the Delta variant looms.

Thirty-eight states now have transmission levels considered high by the CDC. With cases rising, it's falling on hourly workers across the country to enforce vaccine and mask requirements.

Support for mandates is ramping up. The Defense Department announced it will require all U.S. troops to be vaccinated by Sept. 15.

Jobs

All industry data is from 3/2/20-8/9/21

Here are the latest job numbers by industry:

Quick service restaurant (QSR) jobs are down 21% compared to pre-pandemic norms, seeing 1% month over month growth and 7% year over year growth.

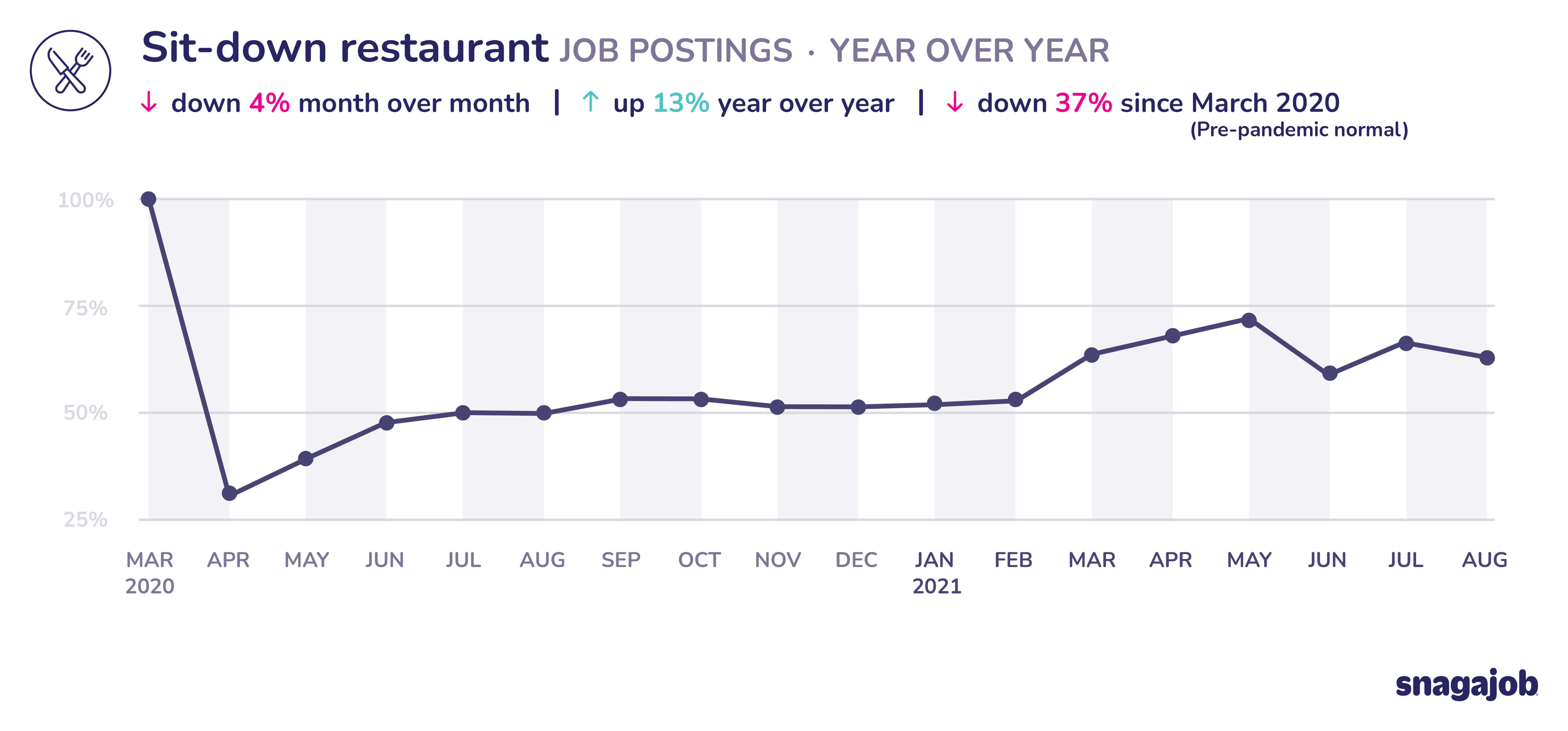

Sit-down restaurant jobs are down 37% compared to pre-pandemic norms, seeing a 4% month over month decline and 13% year over year growth.

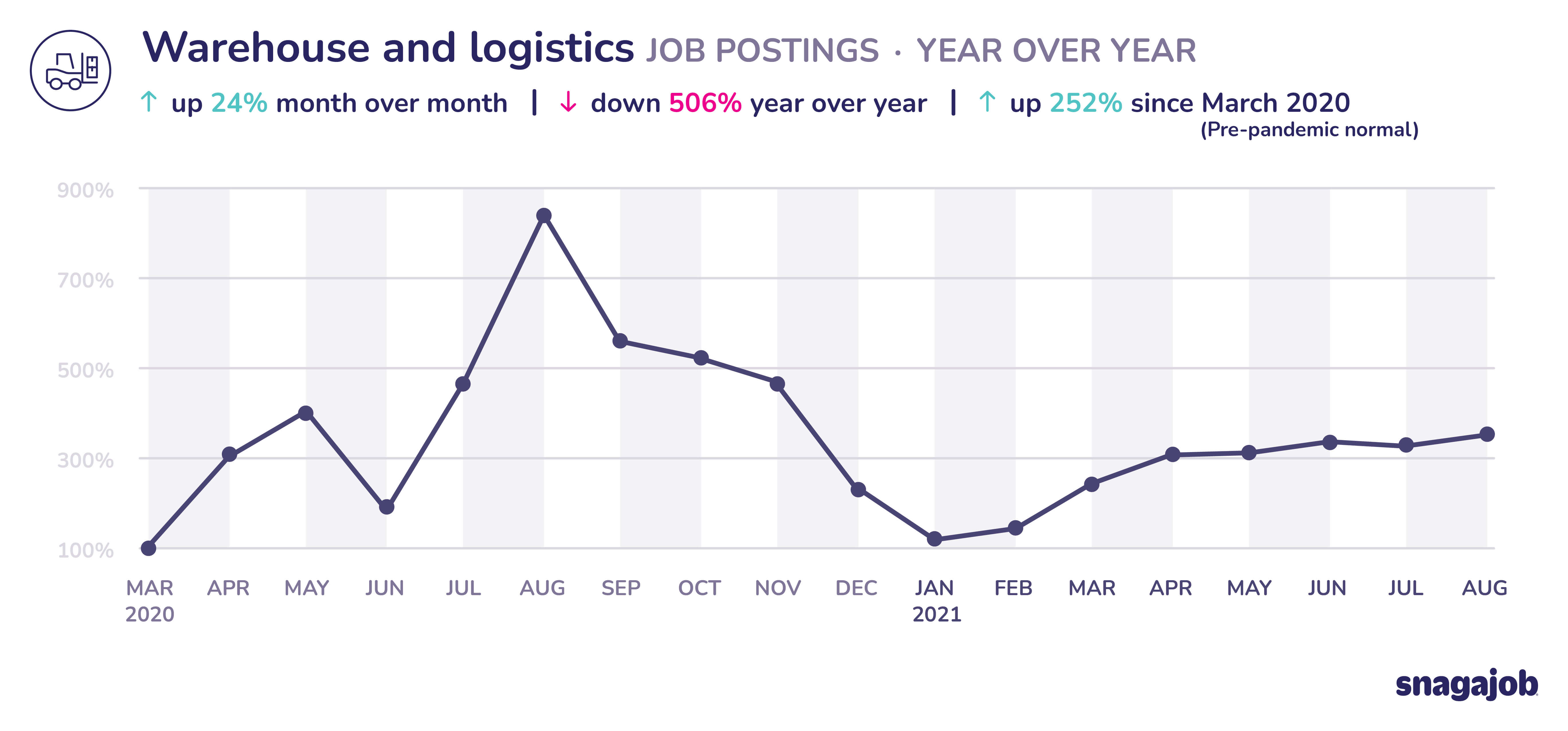

Warehouse and logistics jobs are up 278% compared to pre-pandemic norms, seeing 51% month over month growth and a 480% year over year decline.

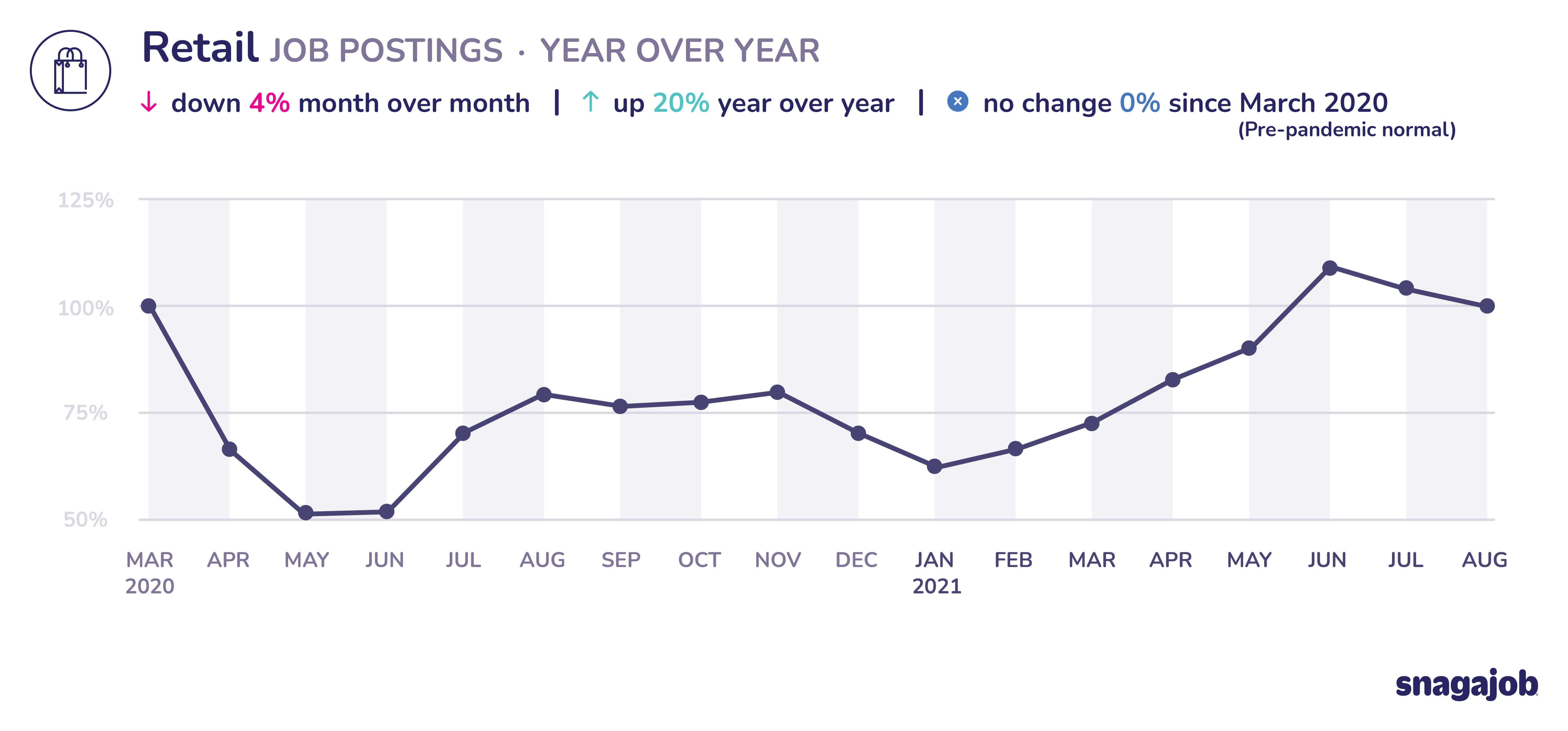

Retail jobs are flat compared to pre-pandemic norms, seeing a 4% month over month decline and 20% year over year growth.

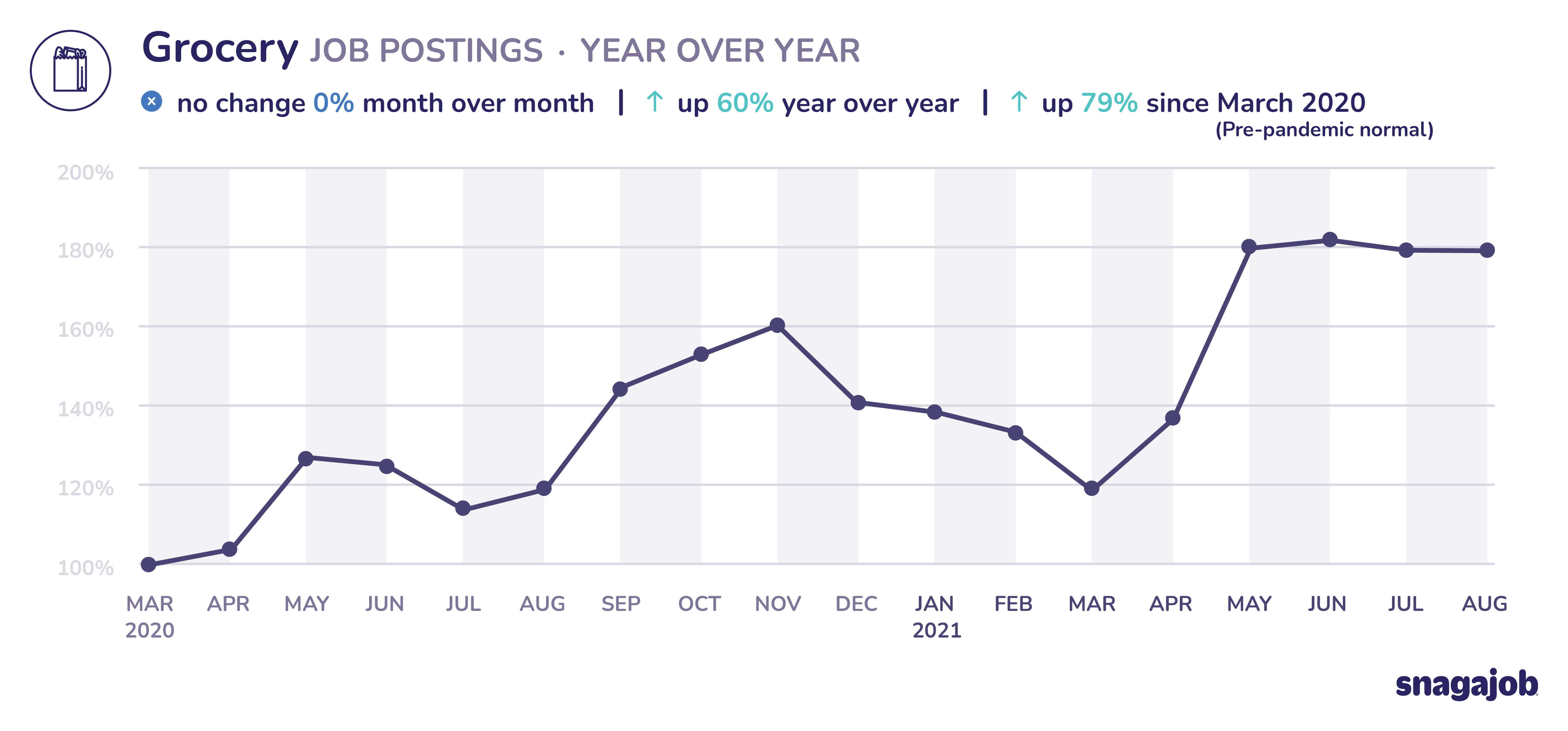

Grocery jobs are up 79% compared to pre-pandemic norms, flat month over month decline and 60% year over year growth.

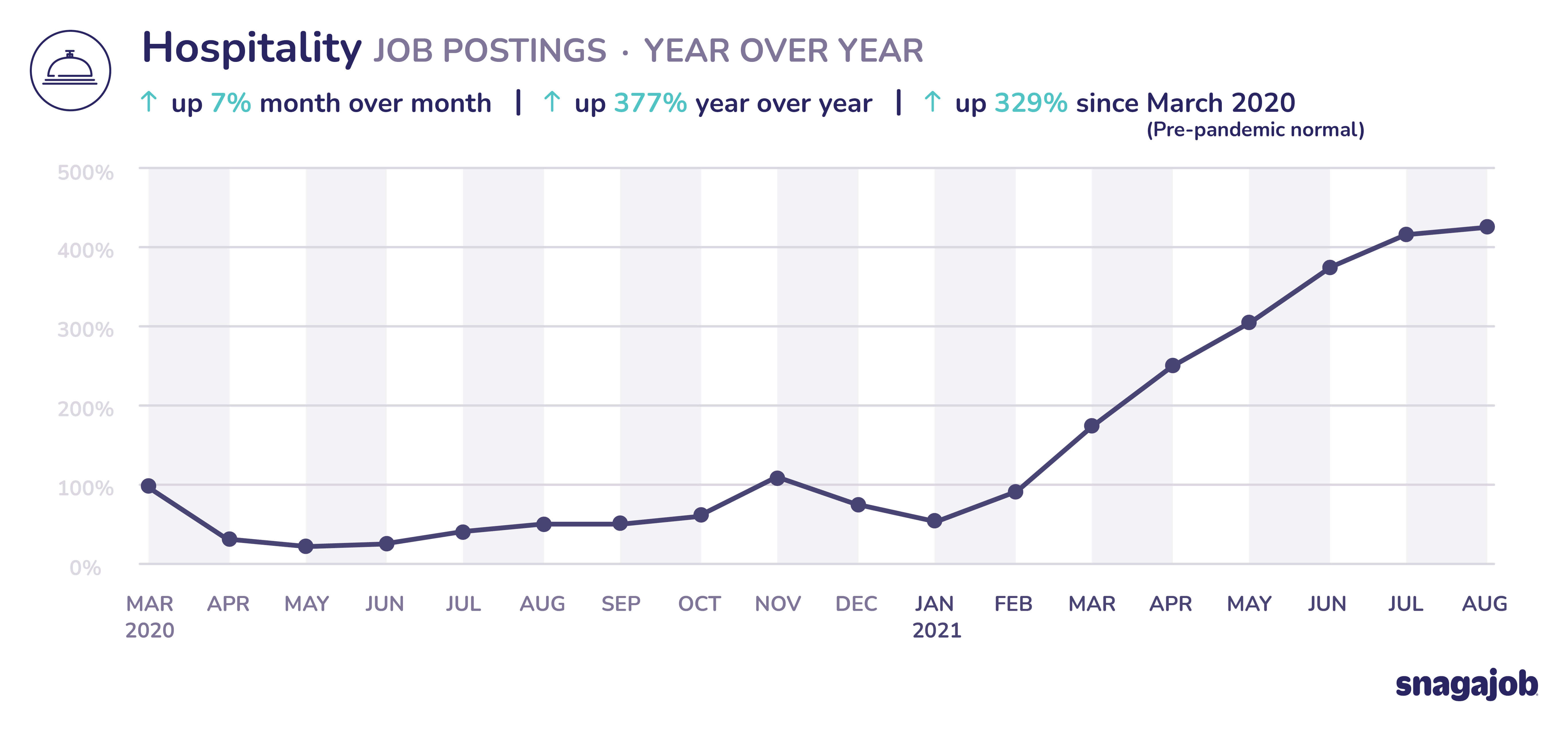

Hospitality jobs are up 329% compared to pre-pandemic norms, seeing 7% month over month growth and 377% year over year growth.

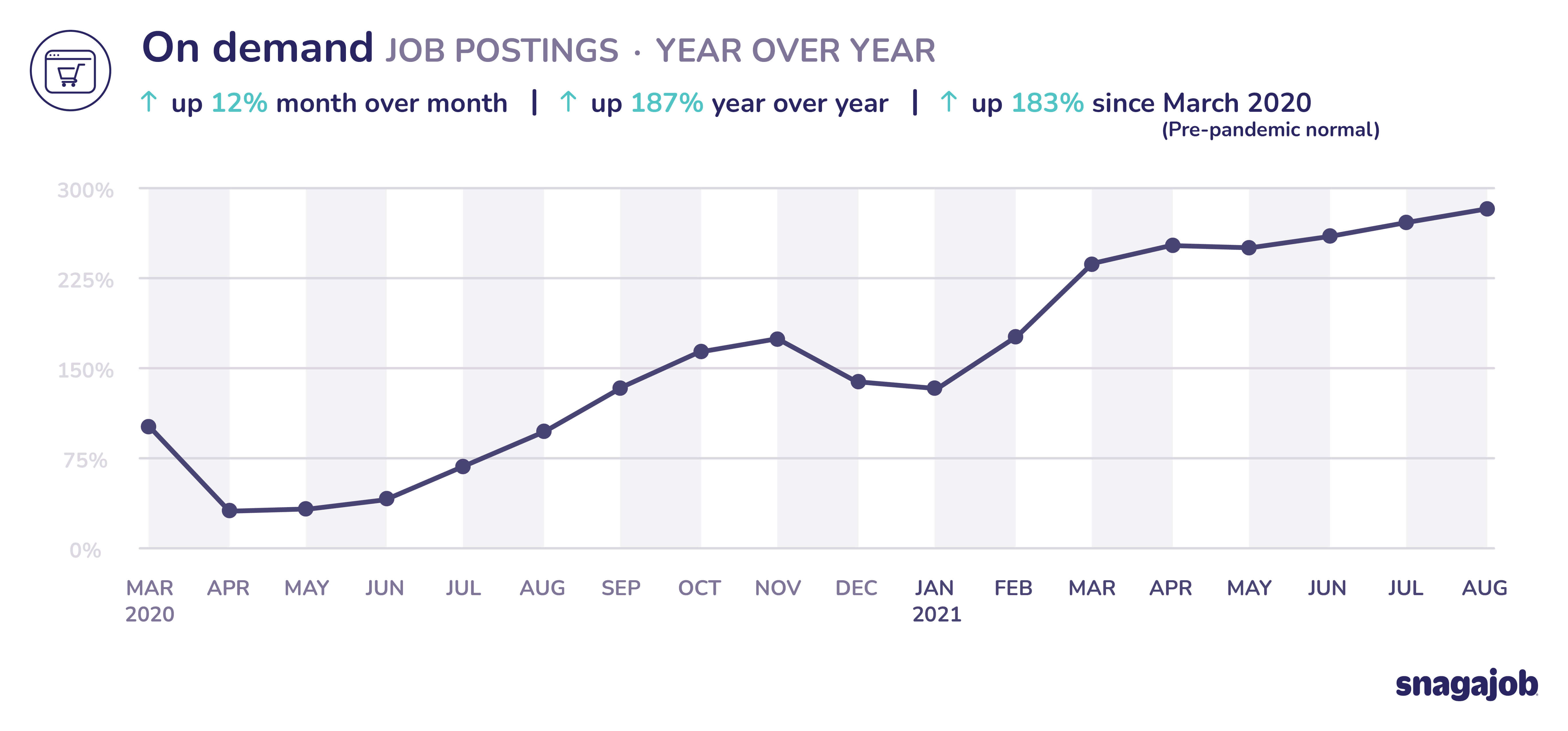

On demand jobs are up 183% compared to pre-pandemic norms, seeing 12% month over month growth and 187% year over year growth.

Convenience store jobs are down 7% compared to pre-pandemic norms, seeing 7% month over month growth and 8% year over year growth.

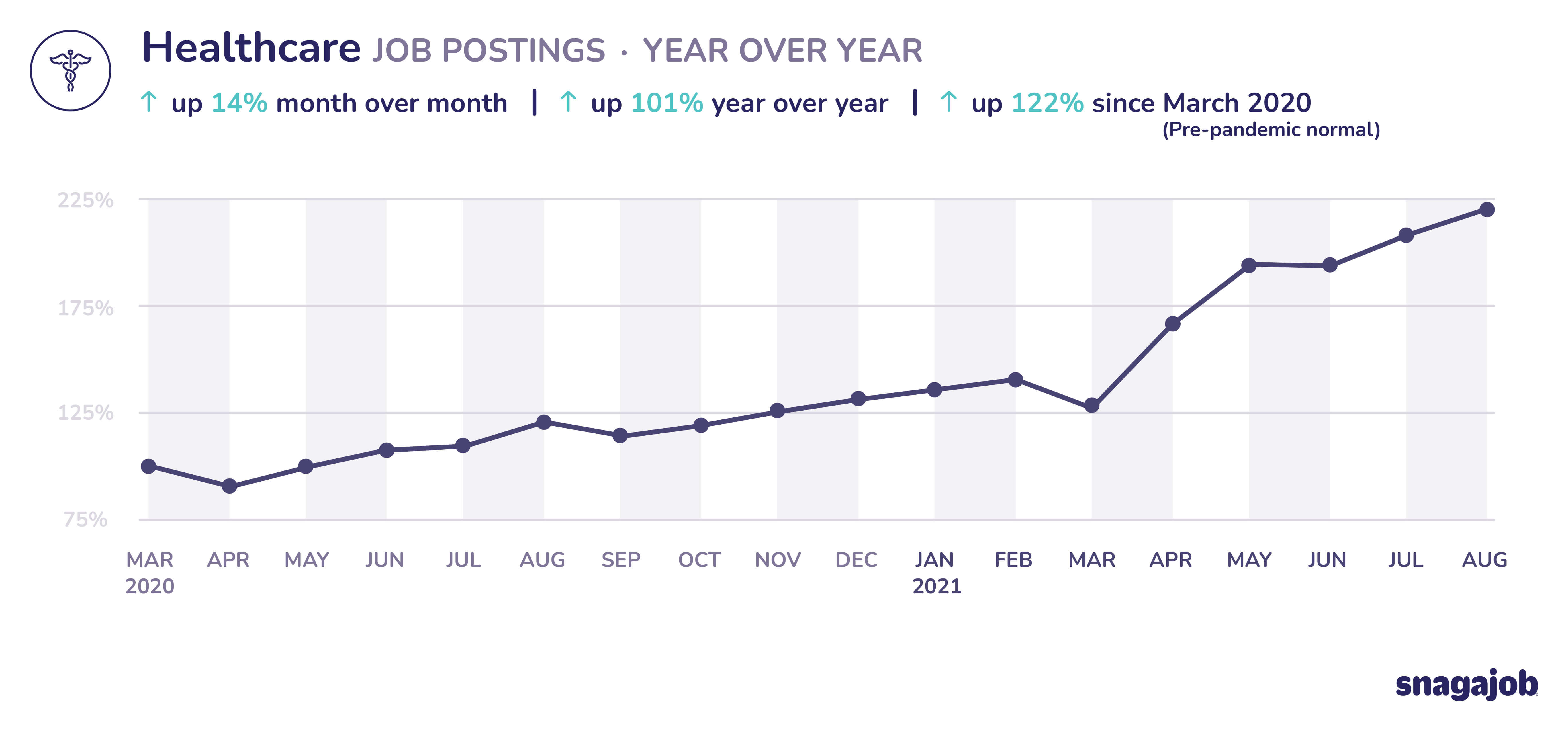

Healthcare jobs are up 122% compared to pre-pandemic norms, 14% month over month growth and 101% year over year growth.

Workers

Google searches for hourly jobs are down 6% year over year.

The bottom line

We’ll continue to be your best resource for hourly job market insights as we collectively navigate towards our new normal and beyond.